Hands up, who misses going to the mall? If you are female, live in Gauteng and are between the ages of 25-36 years, you will probably be among the first to put up your hands or even admit that you regard shopping as one of your favourite pastimes!

Image supplied

Shoppers have had various shopping behaviours that guide the way they shop, from leisure shopping to bargain hunting, top-up to bulk grocery shopping. Whether it is just window shopping or meeting friends for a cup of coffee or having a meal at a restaurant and seeing a movie, shopping malls have been an integral part of people’s lives.

People’s chosen or preferred mall has been guided by two factors, convenience versus destination shopping. Convenience being your quick in and out, grab your essentials and top-up shopping versus a destination mall for lifestyle and leisure shopping, as well as bulk shopping.

The Covid-19 global lockdown has forced overnight shifts in this consumer shopper behaviour. The question is, how will this new enforced shopper behaviour impact malls in 2020 and beyond? With the trend towards convenience shopping or e-commerce for luxury and bulk shopping, this is going to impact on malls, in particular with their retail mixes.

Whatever the reality, mall owners will have to fine tune the way they configure their retail space and tenant mix and further understand the size and characteristics of their shopper population within their trading areas.

SA’ current mall reality

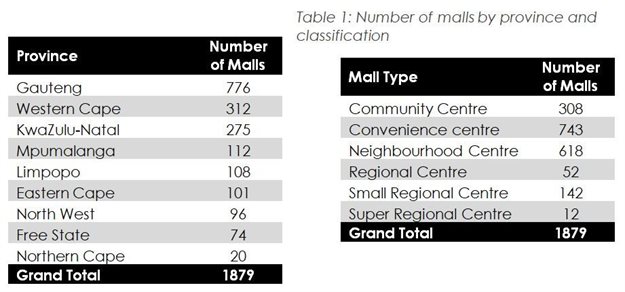

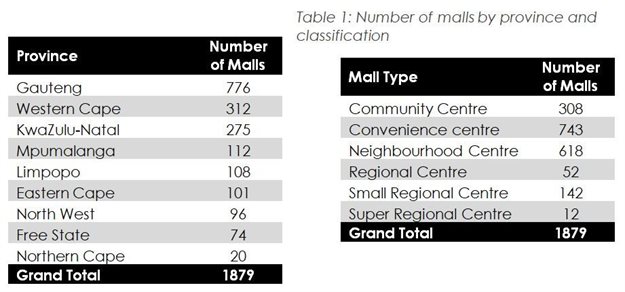

South Africa has approximately 2,000 malls, with Gauteng alone having over 750 malls with a total GLA of close of 10 million metres squared. That is a lot of malls and trading space, which is under huge trading and financial pressure from the Level 5 Covid-19 total lockdown as well as the extended Level 4 lockdown. Level 3 has opened up the retail sector but foot count is low.

Non-essential retailers were forced to close, resulting in revenue streams for both the retailer and the landlords drying up due to government restrictions on the sale of non-essential items, waning foot traffic and tenants struggling to pay rent, respectively.

Prior to the lockdown, mall owners were starting to feel the pinch because of the stagnant economy, dwindling foot traffic and consumer spend, growing competition and cannibalisation by new shopping malls. The Moody’s downgrade of SA sovereignty status just before the lockdown has placed added pressure on the economy.

We have already seen the demise of Edgars, Jet and Dion Wired that will not be re-opening their doors. Economists are predicting the closure of many small independent retailers which will have further impact on malls. Even the larger retailers will be impacted and will constrain their trade in the immediate future.

A small silver lining was introduced at the end April in the form of a relief package by a newly formed alliance of property owners, now known as the Property Industry Group. It is offering relief in the form of rental discounts of between 15% and 100%, as well as interest-free rental deferrals for April and May to help mitigate the impact on retail businesses that are not allowed to trade during the lockdown. The primary focus of this relief package is on SMMEs across all sectors, but the group has also included providing support to large retailers such as The Foschini Group (TFG), Pepkor and KFC.

Covid-19 will force malls and retailers to re-examine their trading environment and to do this they will require detailed information.

Image supplied

Understanding SA’s mall landscape

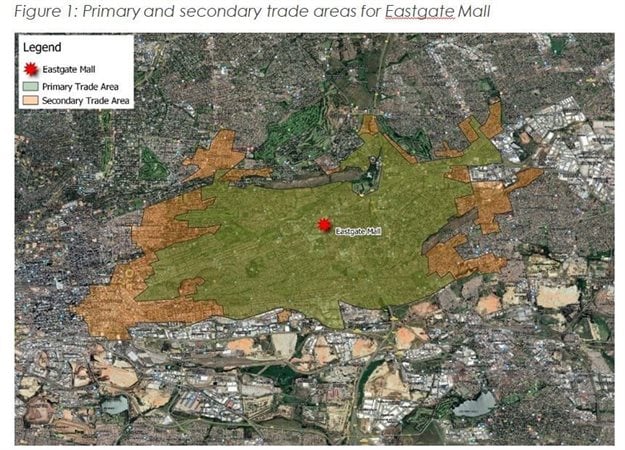

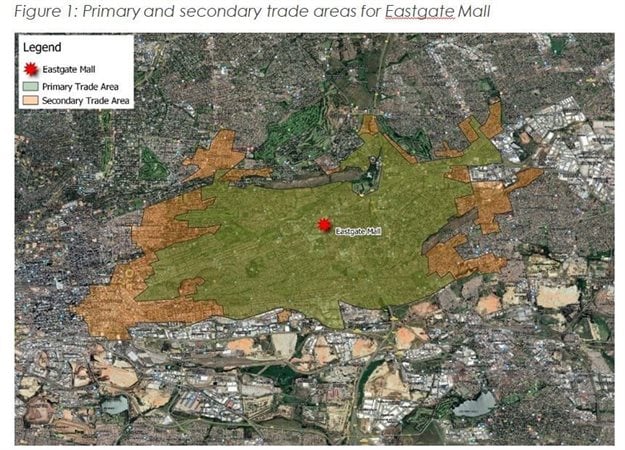

Understanding a malls primary trading area is going to be key to the success of malls trading their way out of the Covid-19 lockdown. Understanding a mall's trade area size, consumers demographic profiles, available income, and spending habits, is going to be critical. International research has shown that the primary trade area is normally the minimum capacity required for a mall to be financially viable, while the secondary trade area is the marginal increase in the target market needed to ensure the profitability of malls.

A comprehensive geospatial database has been developed that maps all the malls in South Africa and detailed information associated with them, including their classification, GLA and contact details has been collected. More importantly, the primary trade area (i.e. where approximately 60% of shoppers come from) for each mall in SA has been defined using travel time and capacity parameters provided by the SA Council of Shopping Centres (SACSC). The primary trade area is the minimum area required for a mall to be financially sustainable. Table 1 below shows how many malls across South Africa's nine provinces and of different classification types need to survive.

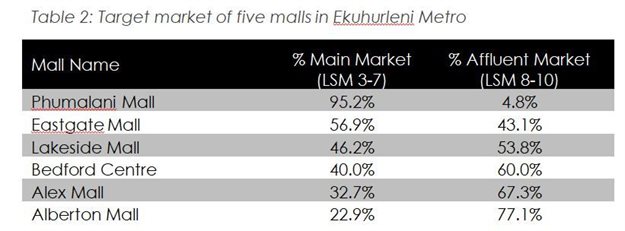

Focusing on Ekurhuleni Metro in the east of Gauteng as an example, the variable rich shopping mall database shows a total of 170 malls ranging from 64 small convenience malls, which accounts for 38% of the malls in Ekurhuleni Metro, to one large super regional centre – Eastgate Mall. The data shows this metro is home to predominately the affluent LSM consumer (LSM 8-10) with 76.5% of the malls showing a skew towards this target market (Table 2). That said, this metro is also home to malls that target the mass market (LSM 3-7), such as Lakeside Mall and Phumalani Mall. These two malls attract 95.2% and 46.2% of their shoppers from LSM 3-7, respectively. As with most large super regional malls, Eastgate Mall, due to its extensive and varied tenant mix, attracts shoppers equally from both the mass and affluent markets.

Mall trade area information needed to balance retailer/landlord agreements

The impasse that is beginning to develop between retailers and mall owners on the paying of rent during lockdown because of a decline in foot traffic and changes in consumer profile, is an example of why information on the trade area of malls is so important.

Before the lockdown, malls were able to draw customers from much further afield. By doing a proper customer trade area analysis, the malls would have been able to define their primary (where 60% of customers actually come from) and secondary trade area (where 80% of customers come from). Information on the number and character of their target market would have been available. This would have provided a benchmark to monitor changes in the profile of customers falling into the malls' trade areas before the Covid-19 lockdown.

The new trade area of malls is going to be quite different as it may be significantly constrained by travel regulations and a more circumspect consumer. The new trade area of the mall will be those areas within the immediate proximity that will have sufficient numbers of people from their target market to enable the mall to remain financially viable. Under these circumstances, the profile of mall visitors will change, and the foot traffic may be significantly less. Figure 1 below shows as an example, the primary and secondary trade areas for Eastgate Mall.

Some retailers that draw their customer base from suburbs immediately surrounding the mall may benefit. Others that drew their customers from further afield may be disadvantaged. Consequently, a new balance will need to be established in lease agreements between retailers and mall owners that reflect this change in consumer numbers and profile, so that business can continue. The reality is that if such a balance is not achieved, that all parties – retailers, mall owners and consumers – will lose out.

A deeper dive into the Ekurhuleni Metro’s shopper landscape

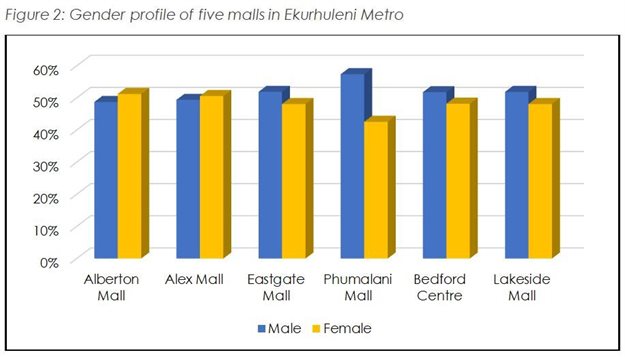

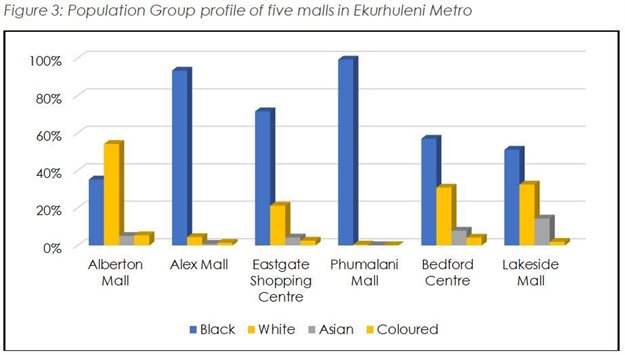

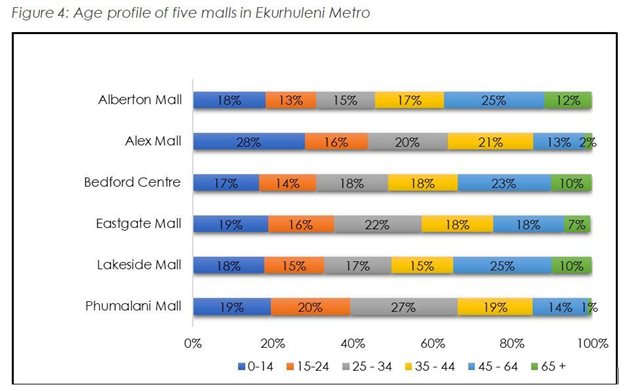

Focusing on five malls in the Ekurhuleni Metro that typically would be considered quite different from each other, based on perception, location, size, and / or tenant mix, the below charts tell an interesting story.

Figure 2 (Gender) shows a slight skew towards the male shopper with the exception of Alberton Mall and Alex Mall. There is a need even now to start understanding the lay of the land since the doors opened with the Level 3 lockdown. From the gender split below, there are skews towards male shoppers in certain malls and therefore, in order to attract more female shoppers, mall owners need to understand the needs of female shoppers and what will happen with changes in shopping behaviour, especially with convenience and access becoming much more considered factors.

Figure 3 (Population group) shows that Alberton Mall has predominantly white shoppers at 54%, while Alex Mall and Phumalani Mall have predominantly black shoppers at 93% and 99%, respectively. Of the five featured malls, Lakeside Mall has the most Asian shoppers at 14%.

Figure 4 (Age) shows Alberton Mall has the highest percentage of consumers 45 years and older, which is an indication that the profile of shoppers living in its primary trade area, is of a more mature population. This compared to Phumalani Mall and Alex Mall that both have over 60% of their consumers being under the age of 34 years. This is vital data if one looks at the strategy of re-purposing mall trading space to a more e-commerce environment versus considering introducing government community services, such as a social grant collection point.

Web mapping - where innovation and location meets opportunity for strategic mall development

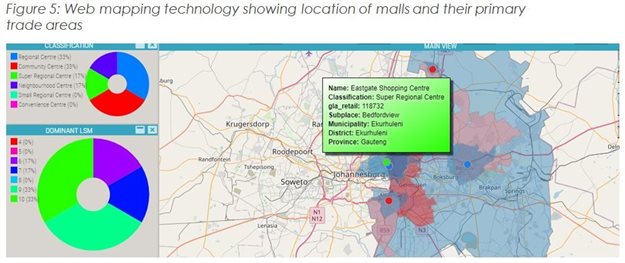

Web mapping technology brings this big shopping mall database to life on a platform that allows users to filter and analyse all variables associated with both the malls and their primary trade areas. Figure 5 below shows the five featured malls and gives a visual representation of their unique primary trade areas. Each mall’s primary trade area gives the user detailed information on the demographics, income and LSMs.

For more information, visit the AfriScope shopping mall demo site here.

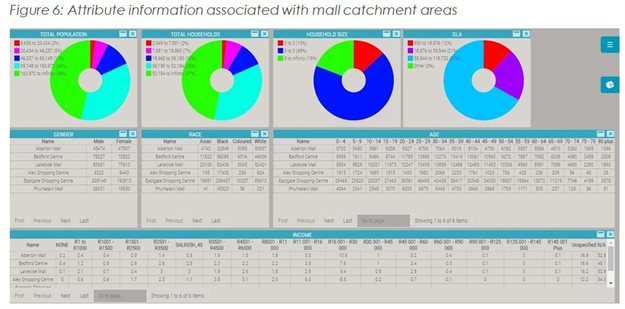

The real power of the database lies in the layered and detailed information associated with the mall’s primary trade areas as is shown in Figure 6 below. Some of the key insights common to the five featured malls are:

- 68% have a household size of three;

- 47% have more than 52,000 households in their primary catchment areas;

- 67% have a GLA larger than 50,000m2;

- Eastgate Mall has a total of 209,148 male shoppers and 193,813 female shoppers, compared to the smallest of the five malls, Phumalani Mall which has 26,331 male shoppers and 19,530 female shoppers.

Malls need to be data driven post Covid-19 lockdown

By all accounts, South Africa will face a new paradigm once the lockdown has passed. How significant the change? Only time will tell. A question that many property developers and retailers will be thinking is – what will retail look like post Level 3? Many will be thinking, we will see how the land lies and start developing our strategic approaches then. But that may be too late already.

There is a need to start understanding the lie of the retail land now before the pandemic has passed, especially with convenience and access becoming much more considered factors.

Malls will need access to detailed information on the size of their existing trading area and what the characteristics of the population are that live there. This will empower them to start to formulate a strategic plan to bring about changes to their operating approaches and retail mixes.

The identification of new mall sites will have to be far more stringent and scientific. Gone are the days of doing simple feasibility studies. The future requires the use of more appropriate and sophisticated accessibility studies to identify viable sites and determine what types and mall sizes are possible, considering the primary trade area available. The movement of people from their place of residence or work to potential mall sites will be moderated by access to different modes of transport and their consumer behaviour.

The shopping mall trade area database described in this article is a powerful tool that will enable the marketers, retailers, mall and property owners, investment advisers and capital investment firms to make informed decisions about the future of their existing mall portfolios and decisions to invest in new malls in the country. Access to readily available information remains one of the pains that decision-makers have had to bear. But now, there is light at the end of the tunnel with web mapping technologies offering this to a broad audience of users.