Related

Top stories

Marketing & MediaWarner Bros. was “nice to have” but not at any price, says Netflix

Karabo Ledwaba 1 day

Logistics & TransportMaersk reroutes sailings around Africa amid Red Sea constraints

Louise Rasmussen 17 hours

More news

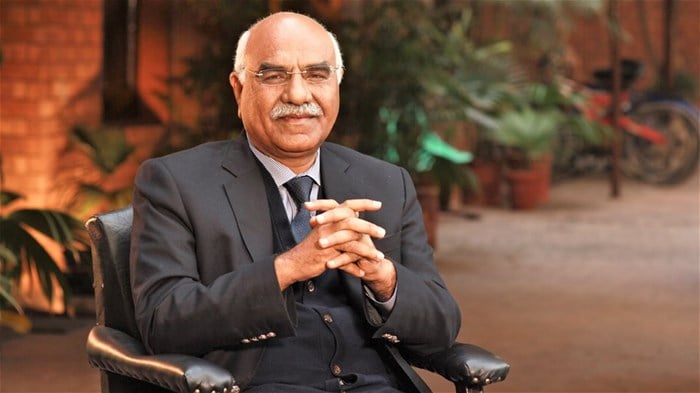

This was the gist of the message by Nobel Peace Prize Nominee, Dr Amjad Saqib, during a webinar hosted by Regent Business School.

Dr Saqib reflected on his role as the founder and director of the largest Pakistan-based interest-free micro-finance organisation, Akhuwat.

He said micro-financing is important as it provides financial assistance to the unemployed or low-income individuals who have no other access to financial services.

“There are too many financial institutions that want to enrich those who are rich and have security. What about the poor people who have no security or collateral? Who will provide banking for the unbanked?”

“There are many people who do not want to steal or beg because they want to keep their dignity intact. Where will they get a loan from?”

“Our form of micro-financing can best be described as a benevolent loan. We offer people interest-free loans. We create a pool of money from rich people and act as custodian of funds used to lend to the poor.”

He said people in South Africa borrow money from friends and family without interest. Banks should do the same.

“Why should underprivileged people face high interest fees when they already have the burden of being deprived in the country?”

“Poverty is a multi-dimensional concept: social, political and educational. It is anybody who does not have self-respect; anybody who does not enjoy equal political rights; and anybody who does not have a roof over his or her head.”

Dr Saqib said development programmes should focus on the traditions and the culture of society. They must not be divorced from the local history, local institutions and local culture of the people.

“The micro-financing blueprint of another country must not be adopted wholly. Countries must adapt a micro-financing model best suited to the local environment,” Dr Saqib said.