Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

Unit trusts remain a popular choice with investors. The industry experienced a staggering amount of net flows during Q3 (R51.1bn), more than double that of Q1 and Q2 (R23.1bn and R23.7bn respectively). These numbers include flows into institutional unit trust funds, retail unit trust funds and funds of funds.

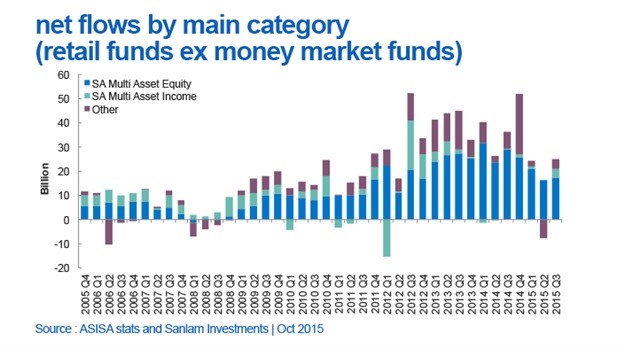

Excluding money market retail funds, it is noticeable that the SA Multi Asset Low Equity category has recorded the biggest net flows in Q3, coinciding with a relative slowing of the net flows into the SA Multi Asset High Equity category.

But one swallow does not make a summer. We would need to wait for at least a few more quarters of ASISA statistics to see whether investors' move towards funds with lower equity exposure and associated market volatility is indeed a 'de-risking' trend.

The preference for multi asset funds, in general, has been the trend for a few years now and Q3 2015 was no different. Combined, the SA Multi Asset High Equity, Medium Equity, Low Equity and Flexible categories attracted more than the rest of the categories combined.

The chart below shows the net retail fund flows into the main ASISA categories over time.

More than 30% of the unit trust industry's retail fund assets are invested in the SA Multi Asset High Equity category. The majority of the funds in this category are regulation 28-compliant and popular among investors who invest towards retirement and want to enjoy the maximum equity exposure which is currently allowed by the Pension Funds Act.

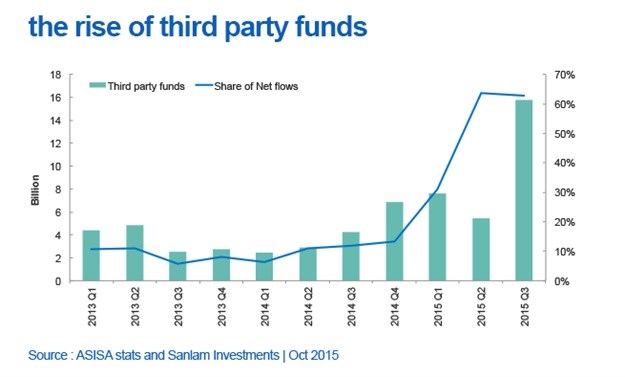

Another trend that we're spotting is the increasing significance of boutique managers. In the two years to the end of Q3 2015 the assets managed by key boutique managers have grown by more than 50%, with these managers now managing a sizeable share of industry assets. (Our view is informed by a subset of the managers flagged as 'third party managers' within the ASISA quarterly statistics.)

The chart below illustrates how these third party managers (and within this grouping, the boutique managers) have slowly been increasing their share of the net flows, accelerating their percentage flows over the past year and a bit, in particular.

We are encouraged to see that, despite the perceived lowering of risk appetite we are witnessing in net flows, investors continue to save in this challenging economic environment.