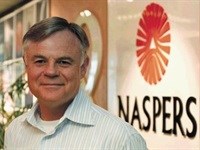

Questions have been raised after nonexecutive Naspers (NPN) chairman Koos Bekker sold 70% of his shareholding in the company without notifying the market...

Image via BDLive

Bekker retired as CEO of the high-flying Naspers last year after a 17-year stint. He was appointed nonexecutive chairman this year.

Naspers is trading at a high price: earnings ratio valuation of 100, mainly based on the group's 34% investment in Chinese internet group Tencent.

"Technically, it was not obligatory to disclose the selling of his shares, but it would have been helpful," said Momentum SP Reid analyst Stephen Meintjes.

He said Bekker had resigned from the Naspers board at the time of the sale and was on sabbatical. "He built up the company over the years and was certainly entitled to take some money off the table," he said.

Bekker's reduced shareholding was disclosed in Naspers's latest annual report, stating that at end-June 2015 he owned 4.69-million shares in the company. In the previous comparable report he held an interest of 16.38-million shares.

This means he sold 11.69-million shares over the 12-month period for between of R1,277 per share in June 2014 to R1,967 per share in June this year, netting a profit of about R20bn.

JSE rules require directors to disclose all share dealings on the stock exchange news service SENS.

According to sources, Bekker bought a top-of-the-range Tuscan wine farm in Italy. Naspers did not want to confirm this, saying the company does not comment on private matters.

Naspers has been one of the best performing shares on the JSE in the past five years. It crossed the R2,000 level on 15 April, losing about 10% of its value in recent market volatility in China.

It is unclear how the sale of Bekker's shares will affect market sentiment towards the group.

Barclays Research has an annual target for Naspers this year of R2,650 per share.

Naspers head of investor relations Meloy Horn said Bekker was taxed on the raised cash on his share options at the full marginal rate of 41%. "That is the case with any gains made on share options."

That means Bekker could have paid up to R6bn in tax.

Source: BDpro