The third Crop Estimates Committee (CEC) maize production forecast published on 25 April 2019 puts South Africa's expected total maize output at 10.66 million tonnes for 2019, i.e. 5.29 million tonnes white maize and 5.37 million tonnes yellow maize.

The latest forecast for the 2018/19 total maize output is 0.9% higher compared to the previous forecast but still, 14.8% (or 1.85 million tonnes) lower compared to the 2018 output of 12.51 million tonnes.

The country’s total maize consumption is estimated at around 10.8 million tonnes annually. The expected 10.66 million tonnes and the 3.0 million tonnes of carryover stocks (a total of 13.66 million tons) should cover domestic consumption. However, this is too optimistic given that late plantings of over a month during the optimal planting period for summer crops is likely to have a huge impact on the final 2018/19 season maize output.

The maize output and price are major drivers of food prices as maize (yellow maize in particular) is also used as a major ingredient in animal feed. Therefore, given concerns that maize supplies could be limited for the 2018/19 production season, leading to increases in prices with a possible strong increase in feed costs used in intensive production of poultry, pork and beef, amongst others. Feed prices are largely determined by the cost of yellow maize which is in turn determined by available supply.

Should there be reduced supplies of especially the yellow maize as predicted by the CEC, the livestock industry which relies on cheaper animal feed to remain profitable would be negatively affected.

Livestock prices are already under pressure following the outbreak of foot-and-mouth disease (FMD) and higher feed costs are likely to further put pressure on the meat industry. Beef exports were suspended after the FMD outbreak, which led to additional red meat supplies in the domestic market. As a result, beef carcass prices, weaner calf prices and lamb prices experienced downward pressure.

Higher feed costs will thus put livestock farmers’ margins under pressure and lead to reduced profits. In addition, the prices of grain-based products are likely to increase which will see increases in meat and food inflation in 2019. As maize prices increase, production volumes from intensive livestock units decrease putting upward pressure on meat prices.

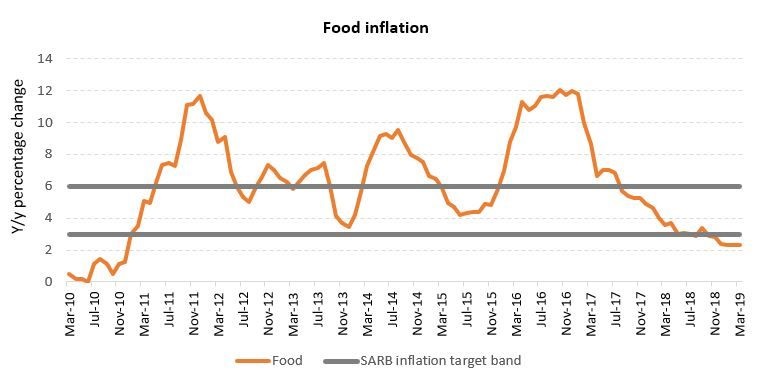

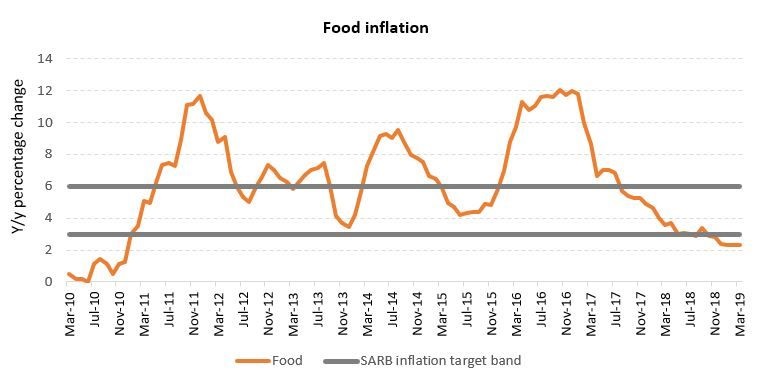

Food inflation has been coming down since January 2017 (9.2%) reaching 2.3% in March 2019 influenced mainly by lower grain and meat prices (see Figure below).

Source: Stats SA

However, this picture is likely to change due to limited supplies of maize. Furthermore, meat inflation is expected to accelerate as the meat industry normalises and meat exports resume. As such, we expect food inflation to increase to around 5% in 2019.