The philosophical doctrine of 'change being the only constant', is wholly applicable to the South African fast food industry as stakeholders are forced to constantly craft competitive responses to capriciously fluid market dynamics. These innovative strategies have fueled phenomenal domestic growth over the past five years.

Insight Survey's latest Fast Food Industry Landscape Report comprises extensive primary research (including in-depth interviews with leading industry experts) in order to provide insight into the crucial role of product differentiation strategies within South Africa's ever-evolving market environment.

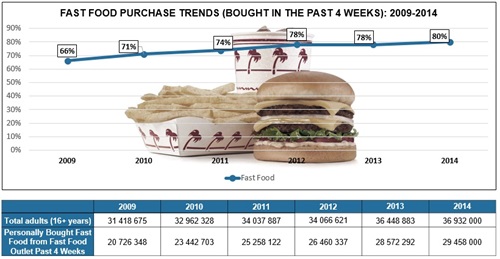

As the graph below indicates, we are witnessing an exponential growth increase in the demand for fast food in South Africa: The percentage of fast food consumers has increased from 66% in 2009 to 80% in 2014. However, whilst on face-value this can ostensibly be construed as cause for optimism, it belies the fact that the market has since become increasingly competitive and saturated; hence the need for reactive product differentiation strategies as a fundamental means of carving out market share.

Source: AMPS: Graphics by Insight Survey click to enlargeOne means of attempting to cut a swathe through the market is through the diversification and strategic tailoring of menus. During one of our primary interviews with Natalie Ruwers, Marketing Manager at King Pie, she explained that within their LSM target market, consumers are currently extremely price sensitive and are exhibiting a burgeoning tendency towards buying 'combo-meals' which offer greater value for money. As such they have strategically re-adjusted, ''changing all the menu boards to increase combo's based on this research''.

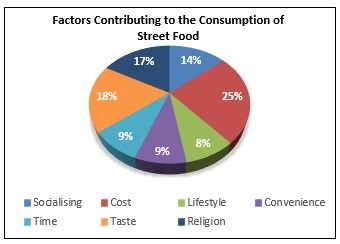

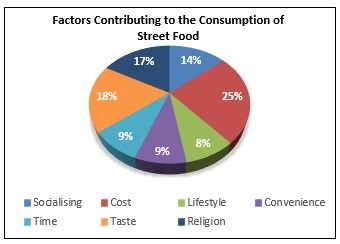

We are also witnessing revolutionary differentiation strategies, involving the re-conceptualisation of certain products to appeal to a broader LSM spectrum. For example a recent survey amongst lower LSM consumers indicated that 80% chose to eat 'street food' over Fast Food. Their rationale was based primarily on cost, but also included aspects of taste and conviviality. Chesa Nyama strategically capitalised on this gap in the market, formalising the quintessential 'street food' product from a franchise perspective, in so doing both maintaining its socio-cultural heritage, whilst simultaneously marketing it as a ''Local is Lekker'' experience to higher LSM's.

Ernest Moshide, Chesa Nyama's Marketing Manager, confirmed this by stating "I noticed that the grilled meat market was very informal and the fast food industry didn't cater towards the niche market of proper flame-grilled meat - it was burgers, pizza or chicken. I knew from experience that the concept would work across wide LSM markets".

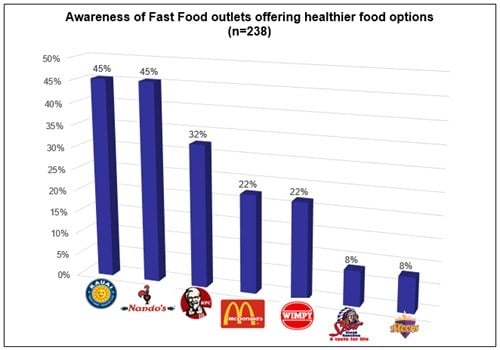

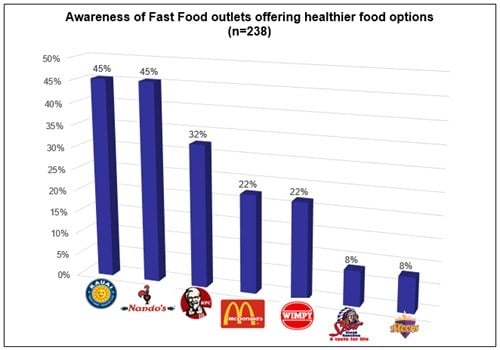

The trend towards healthy eating (see graphs below) is another factor which is forcing stakeholders in the fast food industry to make reactive product differentiation strategies. This hypothesis was ratified during our many interviews with key industry stakeholders and leading academics who claimed that health trends in higher LSM markets were forcing the crafting of competitive product responses. For instance, such responses have manifested in McDonalds' recent partnership with Weight Watchers, KFC launching muesli breakfast cups, and Wimpy adding a selection of low-fat salads to their menus.

Source: Gopaul: Graphics by Insight Survey click to enlargeThus, it is evident from our in-depth nuanced analysis that the doctrine of 'change being the only constant' is an accurate lens through which to view the fluid market dynamics of the South African fast food industry.

The Fast Food Industry Landscape Report (122 pages) provides a dynamic synthesis of primary and secondary research, including extensive interviews with relevant stakeholders and industry experts across the value chain: from retail franchises, to independent outlets, street food traders, consumers, and leading academics.

Some key questions the report will help you to answer:

- What are the key factors that are driving the growth of the local and global markets?

- What are the local and global industry challenges currently restraining market growth?

- What are the competitive strategies currently being implemented on a local level?

- What were the relevant GMNCF/RF's overall financial performances for 2014?

- How are 'street food'/independent traders able to compete for market share with GMNCF/RF's?

- What are the future prospects for local retailers in 2015?

- What are the local consumption trends between 2009-2014 in the fast food industry?

- What factors have contributed to the exponential increase in local consumption?

- What consumer trends are forcing reactive product differentiation strategies?

Please note that the 114-page PowerPoint report is available for purchase for R25,000 (excluding VAT). Alternatively, individual sections can be purchased for R7,500 (excluding VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (0)21 045-0202.

For a full brochure please go to: 2015 Fast Food Industry Landscape Report Brochure

About Insight Survey:

Insight Survey is a South African B2B market research company with almost 10 years of heritage, focusing on business-to business (B2B) market research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B market research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business's competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za. Alternatively, contact +27 (0)21 045-0202.