Lightstone reveals how the service station industry offering continues to evolve in a demanding environment

Linda Reid, head of commercial property at Lightstone highlighted that the service stations not only provide consumers with the essentials of fuelling up their vehicles but also provide an array of additional retail benefits by partnering with fast food outlets, convenience stores and popular coffee brands. “This trend is nothing new and is fuelled by the South African consumers continued need for on-the-go convenience.”

Lightstone, a provider of comprehensive data, analytics and systems on property, and Tracker, a vehicle tracking company, have partnered to use data from telemetry devices covering half a million vehicles to gain insights on the movements and choices of people.

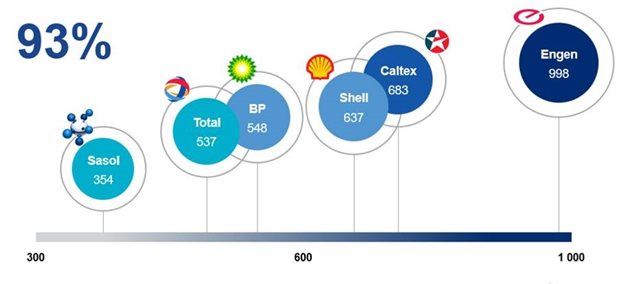

Lightstone has also captured locations of most of the services station landscape, around 4,027 service stations, which highlights that the South African service station landscape is dominated (93% of all outlets) by six brands.

SA's top service station brands

Some of the upcoming new brands include Puma with 114 outlets, Exel with 59 outlets and Ener-Gi with a network of 25 service stations across the country.

Service stations are clustered in the metro and dispersed in non-metro areas, which is intuitive as service stations are needed more where most people live. Although roughly 50% of the service stations are in non-metro areas, only 38% of the vehicles (aged between 0 and 15 years) ‘live’ in non-metro areas.

“This is likely to be because the role of service stations in non-metro areas is two-fold: partly to service the non-metro based cars, but they also need to be able to service the large bulk of metro-based cars as they travel through non-metro areas during long-distance travel,” says Reid.

Interestingly, this relationship doesn’t hold true for township areas. Overall, around 12% of the cars on the road (between 0 and 15 years old) are found in township areas, and the ratio of service stations to vehicles is equal in both non-metro and metro township areas.

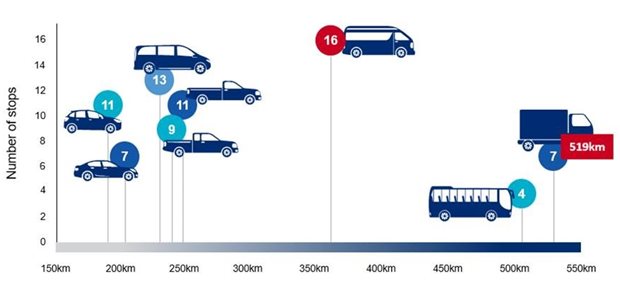

The average motorist stops at a service station approximately nine times per month, typically covering 220km between stops. “This tells us that consumers are stopping more often at stations than is required simply to refuel,” says Reid. Vehicles that stop the least number of times are the luxury passenger types, with an average of seven times a month and those that tend to stop the most times a month are taxis with up to 16 stops per month.

An infographic of the number of stops of different sized vehicles.

Brand loyalty

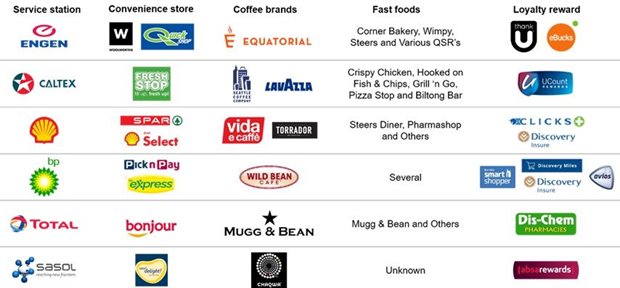

Consumer loyalty to service station brands has also played a big part in the last several years, partly due to the benefits they acquire from third parties.

“In polls conducted at all the Nedbank Franchise Roadshow events, the audiences consistently indicated that around a quarter of people chose which service station to stop at on the basis of the loyalty scheme partnerships present at that brand,” says Reid. “This is a substantial driver of choice that is being leveraged by the major fuel station brands”.

Additionally, brand loyalty also does not end with loyalty rewards, but branded grocery retailers also play a crucial role in the successful consumer conversion from one service station brand to another. ‘Conversion’ is the proportion of consumers accessible to the service station (that is, driving on the road segments next to the service station) that choose to turn in to that service station.

Looking at the conversion rates of service stations with or without branded grocery retailers, Lightstone evaluated two of the biggest players, namely BP and Engen. The markable results show that BPs that host a Pick n Pay convenience store have a conversion rate of 8,1% compared to 4,9% without. Engen service stations with a Woolworths offering have a 9% conversion rate in comparison to 5,3% for Engen service stations that do not have this retailer on their premises.

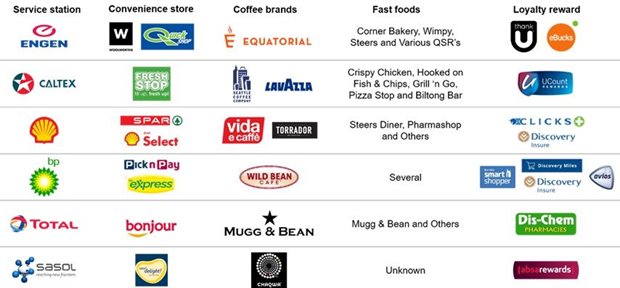

A view of the service stations and their various convenience and reward offerings

Increasingly, the franchising environment is playing a key role in the service station ecosystem. Although the main revenue stream for service station owner remains fuel, the partnerships with retailers, and loyalty schemes, play an important part in drawing customers in.

“As we continue to connect more customers and build on our vehicle base of over 1.1 million vehicles, the data we collect is proving how valuable connected behavioural data is in providing insight into consumers’ interaction with brand ecosystems.

The next exciting opportunity is how these connections help brands build the personalised convenience and services consumers are looking for,” says Michael Du Preez, executive product and Marketing at Tracker.

In a competitive environment, every extra customer conversion count towards the success of the service station and its ecosystem of retailers.