Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

Insight Survey’s latest South African Cannabis/CBD Industry Landscape Report 2022 (152 pages) provides a dynamic synthesis of industry research, examining the local and global cannabis industry (including the impact of Covid-19) from a uniquely holistic perspective, with detailed insights into the entire value chain – key global and South African market trends, innovation and technology, drivers, and challenges, as well as manufacturer, distributor, retail, and pricing analysis.

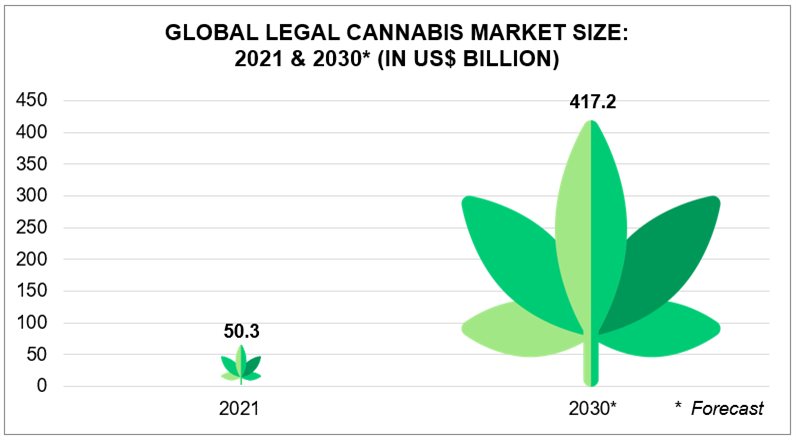

Globally, the legal cannabis market has witnessed significant growth over the past few years and was estimated to be worth approximately $50.3bn in 2021. Furthermore, as per the graph below, the global legal cannabis market value is forecast to increase by a massive compound annual growth rate (CAGR) of 26.5%, to reach $417.2bn by 2030.

Within the South African context, the cannabis industry has also experienced positive performance. In terms of cannabidiol (CBD), the market increased significantly in terms of retail value RSP, between 2019 and 2021. Additionally, the market is expected to continue to grow at CAGR of approximately 28.4% between 2022 and 2026. This growth in the CBD market, the economic potential of cannabis, as well as cannabis becoming legal for personal use, has led to more South Africans viewing cannabis and CBD products in a more favourable light.

This is reflective of global trends, which have witnessed an increase in cannabis research, more consumers seeking out information about cannabis online, as well as celebrity endorsements of both cannabis and CBD products. In addition, cannabis products are becoming easier to safely access. This is, in part, due to technologies such as Cultiva Wellness’ Wellness Pantry and QwikLeaf’s click-and-collect pick-up lockers, which have made it easier than ever to conveniently access cannabis products through legitimate means.

This focus on legitimisation is also seen in the South African market, which legalised the personalised use of cannabis in 2018. This has led to an increase in access to reliable information and knowledge regarding cannabis. This includes access to educational resources through organisations such as the Cannabis Development Council of South Africa (CDCSA), as well as through educational institutions, such as The Cannabis Institute and The Cheeba Cannabis Academy.

Moreover, many South Africans are turning to online communities and resources to safely grow their own cannabis for personal consumptions, rather than purchasing cannabis with unknown origins from dubious sources. Resources available to South Africans looking to grow their own cannabis include growing information, such as growth calendars, as well as access to the equipment needed to grow cannabis at home, including specialised growing kits, tailored to one’s experience level.

This increased acceptance and legitimisation around cannabis has also been seen among cannabidiol (CBD) products. This includes the rise in luxury cannabis and CBD lifestyle products, such as those offered by cannabis brand KushKush. Furthermore, the rise in CBD products designed for children and pets is further cementing CBD and cannabis-based products as legitimate and safe, as more consumers are willing to not only use these themselves but give them to their children and animals.

The South African Cannabis/CBD Industry Landscape Report 2022 (151 pages) provides a dynamic synthesis of industry research, examining the local and global cannabis industry from a uniquely holistic perspective , with detailed insights into the entire value chain – market size, industry trends, innovation and technology, industry drivers and challenges, manufacturer/distributor overview, and pricing analysis.

Please note that the 151-page full report is available for purchase for R30,000.00 (excluding VAT). Alternatively, individual sections can be purchased. For more information, please email az.oc.yevrusthgisni@ofni or call our Cape Town office on (021) 045-0202 or Johannesburg office on (010) 140- 5756.

For more details and a full brochure: South African Cannabis Landscape Brochure 2022

Insight Survey is a South African B2B market research company with more than 15 years of heritage, focusing on business-to-business (B2B) market research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B and industry research solutions, to help you to successfully improve or expand your business, enter new markets, launch new products, or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment, through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.