Top stories

ESG & Sustainability#BudgetSpeech2026: SRD grant unchanged, other Sassa social grants see hike

11 hours

More news

ESG & Sustainability

South Africa’s carbon tax should stay: climate scientists explain why

While data for the market is scant, industry players estimate that back-to-school sales generate revenues of more than R1bn annually. The figure does not include sales of school items during the normal course of the year, or school fees.

In the US, where the segment is tracked, sales are expected to grow 2.6% in 2016 to $828.81bn. Deloitte US estimates that parents spend an average of $375 pre-term on supplies — just more than R5,000.

Back-to-school retailing locally is dominated by brand-conscious buying. A Euromonitor report says Bic dominates the stationery category, "driven by the fact that the brand has been present in SA for quite some time, and consumers can easily relate to the brand".

It says parents are unwilling to compromise on stationery quality, and prefer to stick to tried-and-tested brands instead of trying cheaper options.

Students Schoolwear & Sports owner Linda Evans, who has been in the business for 35 years, says this holds true in apparel, but parents are now feeling the squeeze of the slowdown in the economy.

"A trend in the past two years is that parents are buying far less school uniforms now because of the downturn of the economy. But they want very high-quality uniforms that last longer, and are made in SA."

Local shoppers differ from their US counterparts in this regard. The Deloitte US report found purchase decisions were influenced by the item being bought. In clothing, parents valued sales and promotions above quality and brand loyalty, while for school supplies, value was most important.

Evans says the local back-to-school space is competitive, but seasonal. The summer peak season is December 15-January 20, while the winter peak season is April 20-May 5.

"In the time between seasons, there is no business. We might as well go home, but we can’t, because we have full-time staff, monthly rental, and all the other regular monthly overheads. Whatever turnover is done in the two peak seasons of just eight weeks has to carry the business through 10 months of dead season," Evans says.

Smaller players are in a battle against retail giants such as Pep, Game, Woolworths, Waltons, Makro, and Pick n Pay. Pep is SA’s largest schoolwear retailer, with a market share of more than 50%.

Larger retailers are able to compete more effectively on pricing, often pushing out independent players. More and more retailers are offering stationery, which has given the consumer a wider variety and choice, but has decreased the size of the pie for sellers.

Marc Swiel, the MD of School & Leisure, says the start of a new term is always the busiest time. Although many feet have come through the door in July, unit sales are down compared with the year-earlier period, he says. Swiel says revenue earned during peak seasons surpasses revenue made during the rest of the year.

Nationally, back-to-school buying probably pushed up retail sales in May.

Statistics SA data show that retail sales increased 4.5% year on year on May. Growth was driven by general dealers and retailers in textiles, clothing, footwear and leather goods.

Euromonitor expects volume and value growth in the sector to remain muted. With household income expenditure at recessionary lows, retailers have had to resort to promotions to boost sales. The market research firm says manufacturers are reluctant to invest much in innovation due to limited returns in a slow economy.

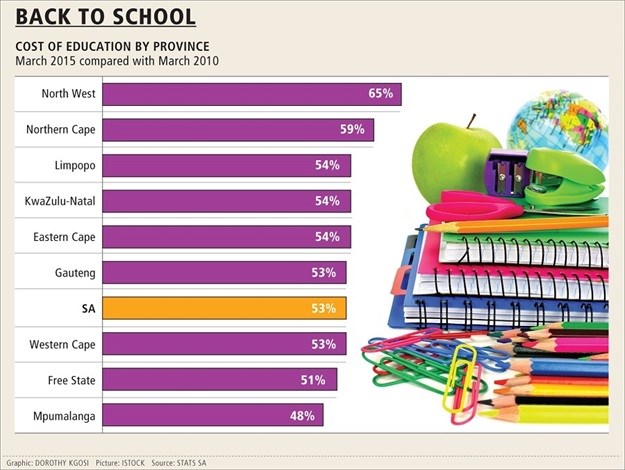

Outside of school supplies, the cost of education is on the rise. Stats SA’s general household survey for 2015 showed education costs increased 53% from March 2010-March 2015. Gauteng and the Western Cape were in line with the average while costs in the North West surged 65%. Mpumalanga had the lowest growth at 48%.

For more than two decades, I-Net Bridge has been one of South Africa’s preferred electronic providers of innovative solutions, data of the highest calibre, reliable platforms and excellent supporting systems. Our products include workstations, web applications and data feeds packaged with in-depth news and powerful analytical tools empowering clients to make meaningful decisions.

We pride ourselves on our wide variety of in-house skills, encompassing multiple platforms and applications. These skills enable us to not only function as a first class facility, but also design, implement and support all our client needs at a level that confirms I-Net Bridge a leader in its field.

Go to: http://www.inet.co.za