Top stories

Marketing & MediaAds are coming to AI. Does that really have to be such a bad thing?

Ilayaraja Subramanian 11 hours

More news

There are signs of pressure in the retail property space prevalent mainly due to cannibalisation and strong market competition. Gauteng, in particular, has had new regional and super-regional malls opening or undergoing massive expansion. This has put pressure on neighbouring centres' trading densities, exacerbated by the slowdown in the economy where retail spending has been strained in the past year. The very same centres are competing for the same struggling and debt-ridden customers. In 2016 alone, two new centres were added in the market - the 90,000m² Mall of the South and the 131,000m² Mall of Africa. Menlyn Shopping Centre and Fourways Mall are also undergoing major expansion to super-regional centres. Menlyn Mall is expected to be the largest shopping centre in Africa with 170,000m² of retail space.

Customers are spoilt for choice; the bigger the centre, the more choices available. In turn, this means the smaller centres will be forced to specialise, much like Nicolway and Morningside shopping centres which offer restaurant facilities. Competition is prevalent in the retail space, however from 2017 onwards, should the economy not improve, real estate institutional investors will be forced to scale back and diversify into other segments of property.

The past two years have seen the resilience of the #Feesmustfall movement which became more violent in 2016. One of the many results from the protests is students fearing being on campuses due to the unrest, encouraging more students to find accommodation off campus. Further to this, the student population has been on the rise in South Africa, with a number of students looking for safe, secure and affordable accommodation. There has been an increasing demand in students looking for accommodation of which current campuses’ housing stock cannot meet. Property developers are starting to consider increasing investment in this important sector of the economy as the demand continues to rise.

We are likely to see various funds diversifying to cater for student housing demand in 2017. This is one real estate sector that developers have ignored for a long time as much of the investment has been allocated to industrial, office and retail development which is evidently becoming saturated. According to the minister of the Department of Higher Education, Dr Blade Nzimande, student accommodation supply caters for only 100,000 out of the 530,000 students. The ministry estimates that by 2030, an additional 400,000 beds would be required as various old universities are housing students in derelict buildings, old hotels and office converted buildings in the inner cities. For various property developers, the opportunity is ripe for penetration and will alleviate the social challenges faced by the future employees and employers of this economy.

Planned new Gautrain stations are expected to create more space for commercial activity. Although still too early to tell, the approval of the next phase of Gautrain lines is expected to create more real estate demand, particularly around the stations, be it for commercial property, rental stock or more residential sectional titles. The Bus Rapid Transport (BRT) system is also likely to influence acquisition decisions. All major municipalities have or are implementing the BRT system, which is aimed at improving access to safe public transport. With this investment in mind, it could revive some of the nodes that are under strain, particularly where infrastructure is developed along busy commercial secondary nodes.

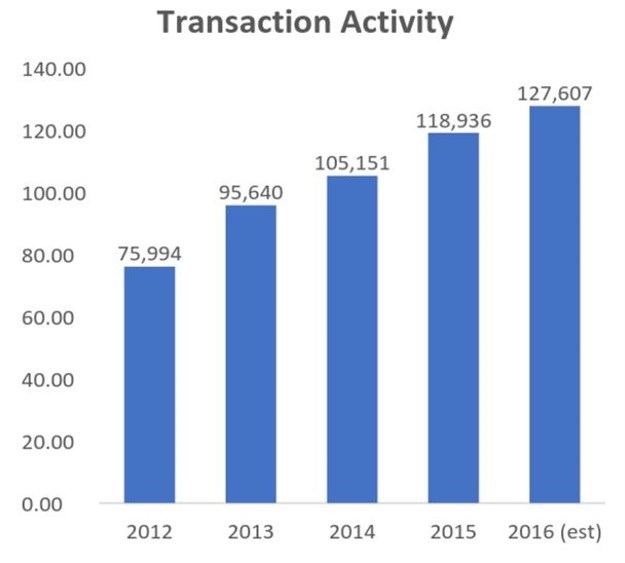

Commercial transaction activity has again this year shown no signs of slowing down and is estimated to reach R127bn in 2016 up from R118.9bn in 2015. Although this is an improvement, it is only a 7.3% increase from 2015 and a slight drop from the 13.1% increase seen in 2015.

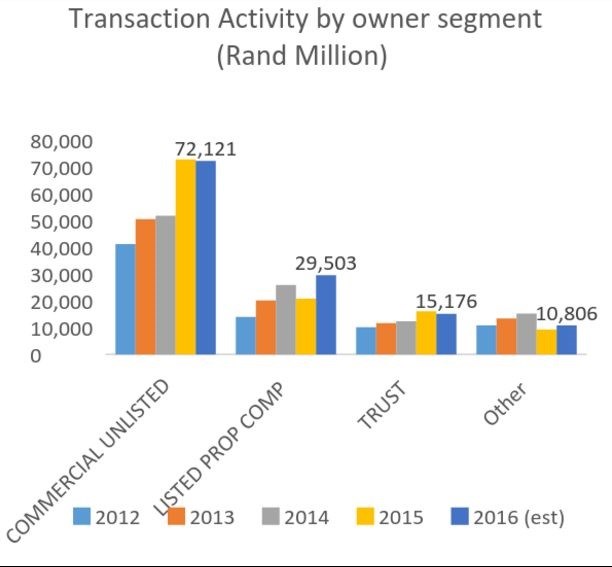

The listed sector is dominating this time with transaction purchases increasing by 42% from the previous year. This is because funds are looking for valuable assets and land for development to cater for future demand. In 2017, we are likely to see even more purchases as various funds diversify from traditional sectors to residential and student accommodation.