Top stories

More news

All is not in vain!

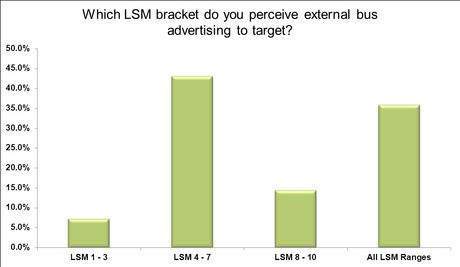

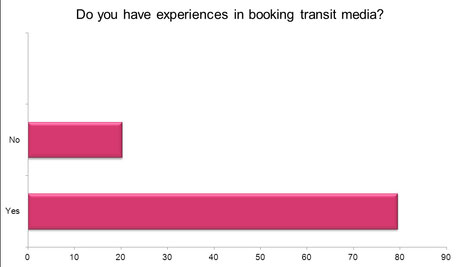

Tractor commissioned a survey that was targeted at both key buyers in the industry as well as direct clients. The focus of the survey was to determine whether or not there is a perception change taking place in the market regarding the value proposition of transit advertising on buses in order to explain the decline in bookings for the medium.

A statistically relevant number of responses were gathered over a three-week period that incorporated input from media planners, strategists, directors and marketing managers.

Whilst most respondents (75.8%) have a positive attitude towards bus advertising, the main negative viewpoints were the perception that buses are a potentially "dirty" medium and that the auditing of results is difficult or non-existent.

Although production rates for bus advertising are comparable across national markets which are generally perceived to be high for short term campaigns, media rental rates are perceived to be significantly different. The simple economics of supply and demand tell only a part of the story and one needs to look further at the maturity of the transit market in each geographical region and the expectations of the Bus companies themselves regarding revenue.

This has, to a large extent, lead to the geographical disparities between national bus media rates in the different markets.

Tractor has proactively started to address the issues at hand. New initiatives include the development and use of transit advertising related econometrics to determine what level of impact a campaign could have before its implemented.

To construct the econometrics, census information is utilised to determine the population dynamics and concentrations city wide. This information is overlaid with AMPS statistics and route breakdowns and there you have it, we can identify to some degree what level of impact can be achieved before the media contract is signed.

Tractor is constantly working with our landlords (bus operators) to implement operational systems for the branded vehicles to ensure that they are in the best condition when on the roads.

In order to reduce the upfront production cost for our clients which can be perceived in a negative light, Tractor is finalising a new offering that bundles the production costs with media rentals over the duration of a campaign.

A lot of work is still ahead for all transit media owners if we are to ever see the standard of transit and level of participation by clients in the medium as seen by our European counterparts.

Who knows, that future might be closer than we think.

To find out more about the results of the survey, please contact us.