Last year's five consecutive repo rate cuts, which dropped the prime lending rate to a record low of 7%, has resulted in an increase in buyer activity in the property market, especially among first-home buyers. "While the going is good at the moment, it is worth remembering that property is a long game and there are practical steps to consider when investing," says Carl Coetzee, CEO of BetterBond.

1. Pay off existing debt

Property is currently more affordable than it was this time last year, when the prime lending rate was 9.75%, but your credit score and debt will affect your chances of securing a bond, says Coetzee: “Banks look at how you handle your financial commitments when deciding whether to lend you money for a home loan.” Impulse buys and purchases on credit cards and store accounts could be detrimental to your credit score if that debt is not serviced regularly.

2. Save towards a deposit

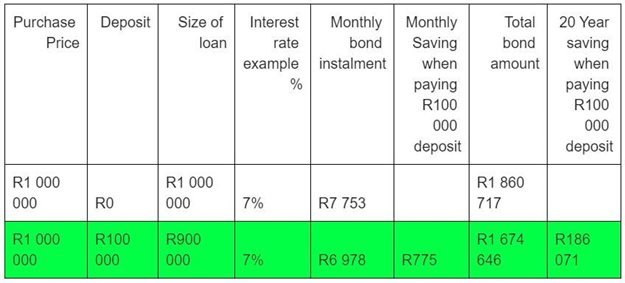

If your budget allows, saving a deposit for a property purchase is one of the best moves you could make, says Coetzee. “It demonstrates to sellers and banks that you are a serious buyer, it brings down the amount to borrow, and it ultimately means you could get a better interest rate from the banks. Taken over a typical loan term of 20 years, even a small difference in interest rate could mean hundreds of thousands in savings, as the table below shows. On a R1m bond, a 10% deposit at the current prime lending rate of 7% will save close to R200,000 over 20 years and will shave almost R800 off your monthly bond payment.

3. Check affordability

Find out how much you can buy for by getting pre-approved for a home loan. “Once you know what you can afford, you can focus your search on properties that are within your budget and you will stand a better chance of getting the deal when you find a place you love,” says Coetzee.

4.Get the best bond

Shop around when applying for a bond, to make sure you get the best deal.

5. Budget for all costs

Remember to take all the costs of property ownership into account - not only your monthly bond repayments. Include rates and taxes, levies (if you're buying sectional title property), insurance, and utilities like water and electricity in your budget. Adds Coetzee: “Working from home has become much more common, so you should also budget for connectivity costs like fibre internet.”

6. Be a good landlord

Once you’ve bought your investment property, know your role and rights as a landlord, and those of your tenant/s. Get good legal advice upfront and use a water-tight rental agreement that covers both parties. Check out prospective tenants by contacting their references and doing a credit check before signing. Coetzee adds that being a landlord also involves maintenance and repairs, so have a list of reputable service providers like plumbers, electricians and carpenters on hand, and make sure you can cover maintenance and repairs to keep the property in good condition. “It’s all part of taking care of your investment and ensuring your asset grows over time,” he concludes.