Top stories

LifestyleWhen to stop Googling and call the vet: Expert advice on pet allergies from dotsure.co.za

dotsure.co.za 2 days

More news

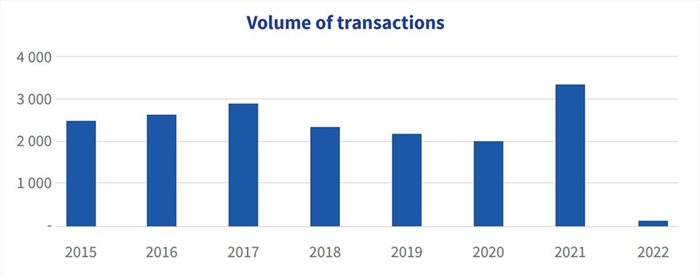

People have been seeking a quieter life, leaving cities and larger towns. Hayley Ivins-Downes, head of digital at Lightstone, said property transactions jumped more than 30% in 12 months, from 1,982 in 2020 to 3,355 in 2021.

The West Coast stretches from Yzerfontein in the south to Velddrif in the north and inland as far as Darlington and Hopefield.

Ivins-Downes said that unlike in many towns, freehold transfers still dominate, although estate living is on the rise as the graph below shows. The next graph shows development of freehold properties far outstrips estate and sectional title.

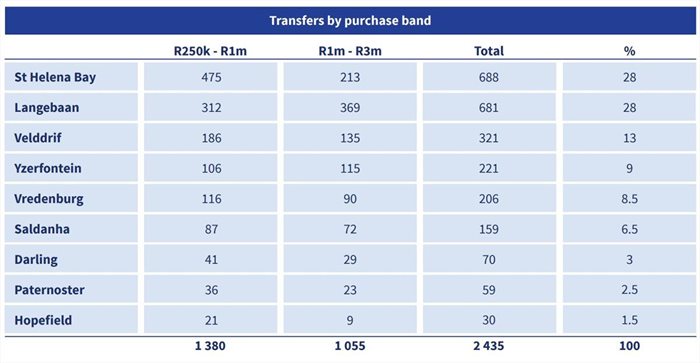

West Coast towns are predominantly attracting buyers in the R250k-R1m and R1m-R3m value bands. Buyers in the R250k-R1m band nearly doubled in numbers from 736 in 2020 to 1,380 in 2021, while the R1m-R3m band jumped from 587 to 1,055.

The R250k-R1m and R1m-R3m property bands accounted for 73% of all transfers in 2021. St Helena Bay, a fishing town, and Langebaan, internationally acclaimed for its wetland and tidal mud flats of the lagoon, together accounted for 56% of the transfers in these bands (R250k–R3m) in 2021.

In St Helena Bay, transfers were predominately in the R250k-R1m band, while Langebaan’s transfers were most evenly split.

Velddrif was the best of the rest at 13%, followed by Yzerfontein and Vredenburg. The more iconic town brands of Darling, part of the Cape Floral Region, and Paternoster, one of the region’s oldest fishing villages, accounted for just 5.5% of transfers between them.

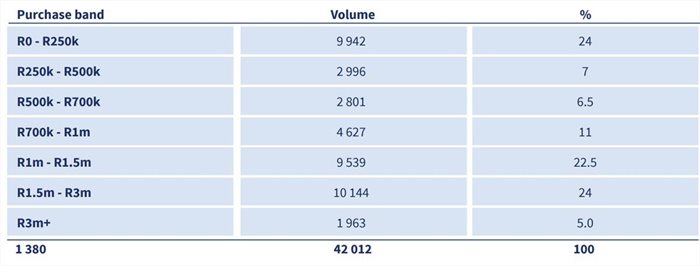

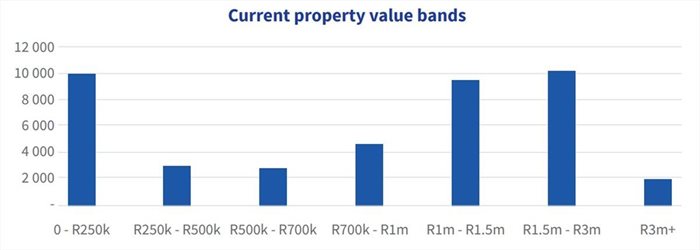

There were 42,012 properties registered (see table and graph below) in the towns reviewed, i.e., Saldanha, Paternoster, Vredenburg, Velddrif, St Helena Bay, Langebaan, Hopefield, Darling and Yzerfontein as at February 2022, of which 24% were valued at between R0-R250k, R250k-R1m accounted for 24.5%, R1m-R3m for 46.5%, with properties over R3m accounting for 5%.

The number of first-time buyers and repeat buyers has remained consistent from 2015 to 2021, but in 2022, first-time buyers accounted for 32% as opposed to the previous norm of around 20%. Ivins-Downes said it will be interesting to see if the early activity in 2022 holds true for the balance of the year.

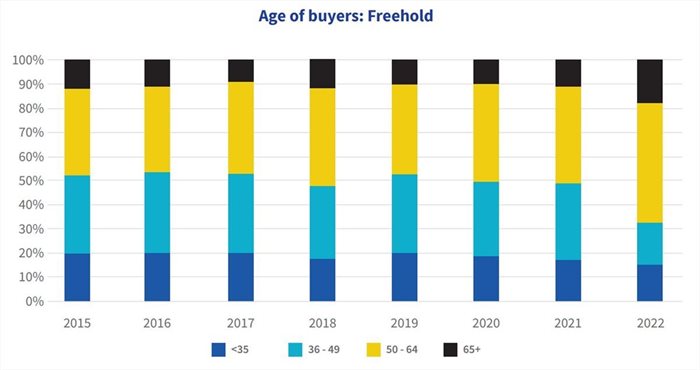

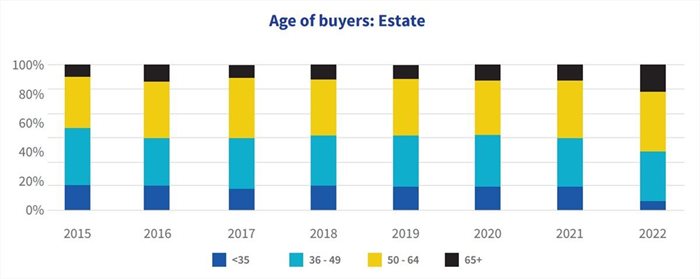

The age of buyers across the three property types reveals the 50-64 and 65+ categories prefer freehold, with estate buyers being more evenly split to include all categories, although dominated by 36-49 and 50-64, while the <35 age group has been buying less sectional title properties over the years.