Related

Top stories

HR & ManagementNational minimum wage 2026: What workers (and employers) need to know

Danelle Plaatjies and Ludwig Frahm-Arp 13 hours

More news

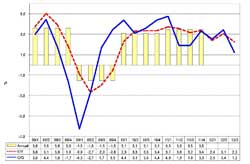

This means that the South African economy has narrowly avoided a recession following a -0.6% decrease in the first quarter of 2014.

Briefing reporters, Executive Manager for National Accounts at Stats SA, Gerhardt Bouwer, said that the largest contributors to the quarter-on-quarter increase of 0.6% were general government services and the transport, storage and communication industry which each contributed 0.4% of a percentage point.

The finance, real estate and business services contributed 0.3% of a percentage point to growth.

According to the data, the growth in the finance, real estate and business services was due to increases in banking activities.

Mining and quarrying and the manufacturing industry were among the industries that contributed negatively to GPD (having contributed -0.4% percentage point and -0.3% percentage point).

Economic activity in the manufacturing sector reflected negative growth because of lower production in food, beverages and tobacco and petroleum among others," noted the report by Stats SA.

Growth was inhibited by the sustained mining industry strike in the platinum sector.

"Most people's eyes were on the platinum [sector] but I think this negative growth was more an overall poor performance of the mining industry. It was not only platinum. There was poor performance in the gold and other mining activities. There are a lot of reasons for that [like] safety stoppages, strikes and so forth," said Bouwer.

In the second quarter of 2014, nominal GDP was estimated at R891bn which is R17bn more than in the first quarter. The agriculture, forestry and fishing sectors expanded by R19bn to R34bn while general government services expanded by R6bn to R140bn.

According to data electricity, gas and water expanded by R5bn to R27bn, while manufacturing and mining and quarrying both contracted by R1bn to R90bn and R66bn respectively.

In the second quarter the largest industries were the finance, real estate and business services at 21.2% followed by general government services at 17.2%, while the wholesale, retail and motor trade, catering and accommodation sectors accounted for 16.1% and the manufacturing industry was at 11.1%.

The data means that the South African economy has avoided a recession following first quarter GDP data that showed a seasonally adjusted GDP at market prices slumped at an annualised rate of 0.6% for the first quarter of 2014.

The Reserve Bank in its June Monetary Policy Review (MPR) said that while the domestic economy has suffered several adverse supply shocks as a result of strike action and electricity shortages which led to negative first quarter growth, it was unlikely that the country would fall into a recession.

This decrease in growth - the worst since the second quarter of 2009 when the world's economy dipped as a result of the global recession - comes after the GDP grew by an annualised rate of 3.8% in the fourth quarter of last year.

Analysts had expected the economy to show moderate growth in the second quarter.

"Real GDP expanded by a seasonally adjusted annualised 0.6% quarter-on-quarter. Although better than the contraction of 0.6% recorded in the first quarter, it is still slower than the 0.9% quarter-on-quarter expected on average by the markets and our own forecast of a 1.4% improvement," said Nedbank's economists.

According to the economists the outlook for the economy remains murky.

"Recent economic indicators suggest that the weakness continued into the third quarter, with the motor industry strike disrupting manufacturing output throughout July. Consumers are generally expected to remain under pressure as a result of household income, rising debt service costs and a deteriorating job market.

"Although South Africa avoided recession, underlying conditions remain weak and confidence is fragile. The risk to the growth outlook therefore remains firmly on the downside," said Nedbank.

Earlier today, Standard Bank said it expected GDP to expand by 0.6% which was weaker than market expectation of a year-on-year growth of 1.2% and a quarter-on-quarter growth of 0.9%.

SAnews.gov.za is a South African government news service, published by the Government Communication and Information System (GCIS). SAnews.gov.za (formerly BuaNews) was established to provide quick and easy access to articles and feature stories aimed at keeping the public informed about the implementation of government mandates.

Go to: http://www.sanews.gov.za