Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

TNS Research Surveys, South Africa's leading marketing and social insights company, has released the results of a survey to ascertain what South Africans feel about our new president, President Jacob Zuma. The study was conducted amongst a sample of 2 000 SA adults from the seven major metropolitan areas of South Africa, interviewing them face-to-face in their homes, with a margin of error of under 2.5%. Interviewing was in the last two weeks of June, 2009.

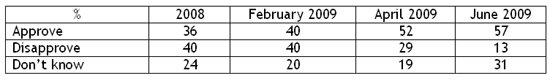

By late June, 57% of the adult metro population felt that President Zuma was doing a good job as president. This represents a rise from the 52% who felt he would do a good job as president when they were interviewed in an identical study over the election period in April and a substantial rise from the 40% who felt he would do a good job as president when interviewed in February 2009 and from the 36% in a November 2008 study.

In addition, last year, TNS Research Surveys measured how people felt about Mr Zuma as President of the ANC. In February and April, he achieved a 36% approval rating, this barely shifting to 37% mid year.

Hence, for all of 2008, his approval rating essentially remained the same at 36%. It began to rise in February and has continued this rise unabated since then.

By comparison, Mr Mbeki's approval ratings were in the mid to low 30s from 1999 to 2002, only beginning to rise in 2003 before hitting a high of 66% in both 2004 and 2005. He ended his term on a rating of 34%.

The latest study shows that, whilst only 13% of people feel he is NOT doing a good job, 31% gave a “don't know” response. This compares with 29% giving a negative response over the election period and 19% giving a “don't know” response. Hence, many people have moved from a negative stance to either a positive or a “don't know” response.

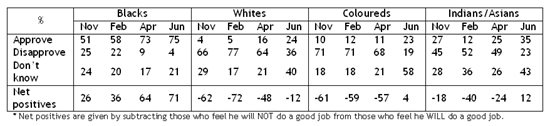

Unfortunately, political views in South Africa tend to have a strong correlation with race. This is best illustrated in the following table:

From these results, it is clear that President Zuma is achieving high approval ratings very early into his administration. For all race groups except blacks, however, there is a strong “wait and see” sentiment.

There are usually strong regional differences in such ratings. These are outlined below:

The low figure in Cape Town should be no surprise given the election results.

Whilst trends by wealth are confounded with race to some extent, it is interesting to note that, amongst blacks, the very poorest people give lower approval ratings that do even more slightly wealthy blacks. Further, amongst blacks, whilst 80% of those whose home language is isiZulu, this drops to 65% for those whose home language is isiXhosa, falling into the mid-70s for the other language groups.

Partly in line also with race, younger people are much more positive about the President (63% of those under 34 years approve of the way the President is doing his job), this dropping to 38% for those aged 60 years and more.

This question was posed to people in the April study. At that time, 44% felt that the dropping of charges was the correct thing to do whilst 41% disagreed with 15% giving a “don't know” response. As usual, there were strong differences by race:

It is clear that views are sharper here but are very divided.

The President has seen a marked rise in approval levels with many formerly negative people either becoming positive or adopting a wait-and-see attitude. His ratings amongst blacks are very high and there have been remarkable swings in his favour in the minority groups - although it is here that many people are undecided.

It remains to be seen whether President Zuma's ratings will drop with the honeymoon period expiring or whether the momentum he has already achieved will continue. Given the recent spate of service delivery protests, it may be that expectations are high. The fact that the very poorest people are less positive is also telling. However, there is no doubt that there is a more positive sentiment than ever at present in favour of the President.

All the studies were conducted amongst 2 000 adults (1260 blacks, 385 whites, 240 coloureds and 115 Indians/Asians) in the seven major metropolitan areas: it has a margin of error of under 2.5% for the results found for the total sample. The studies were conducted by TNS Research Surveys (Pty) Ltd as part of their ongoing research into current social and political issues and were funded by TNS Research Surveys. For more details, please contact Neil Higgs on 011-778-7500 or 082-376-6312. www.tnsresearchsurveys.co.za

TNS, who recently merged with Research International, is the world's largest custom research agency delivering actionable insights and research-based business advice to its clients so they can make more effective business decisions. TNS offers comprehensive industry knowledge within the Consumer, Technology, Finance, Automotive and Political & Social sectors, supported by a unique product offering that stretches across the entire range of marketing and business issues, specialising in product development & innovation, brand & communication, stakeholder management, retail and shopper, and qualitative research. Delivering best-in-class service across more than 70 countries, TNS is part of Kantar, the world's largest research, insight and consultancy network. Please visit www.tnsglobal.com for more information.

The Kantar Group is one of the world's largest research, insight and consultancy networks. By uniting the diverse talents of more than 20 specialist companies - including the recently-acquired TNS - the group aims to become the pre-eminent provider of compelling and actionable insights for the global business community. Its 26,500 employees work across 80 countries and across the whole spectrum of research and consultancy disciplines, enabling the group to offer clients business insights at each and every point of the consumer cycle. The group's services are employed by over half of the Fortune Top 500 companies. The Kantar Group is a wholly-owned subsidiary of WPP Group plc. For further information, please visit www.kantargrouptns.com.