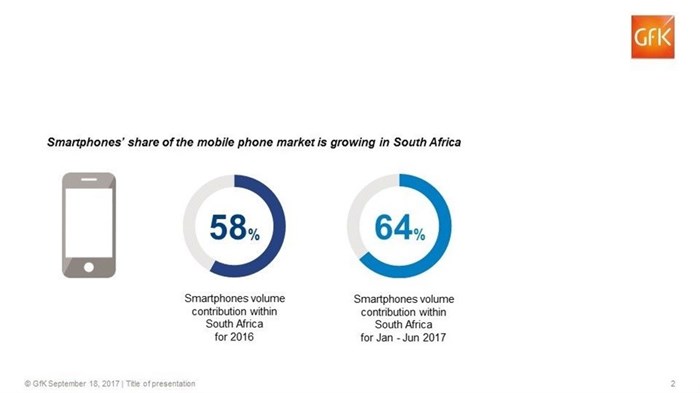

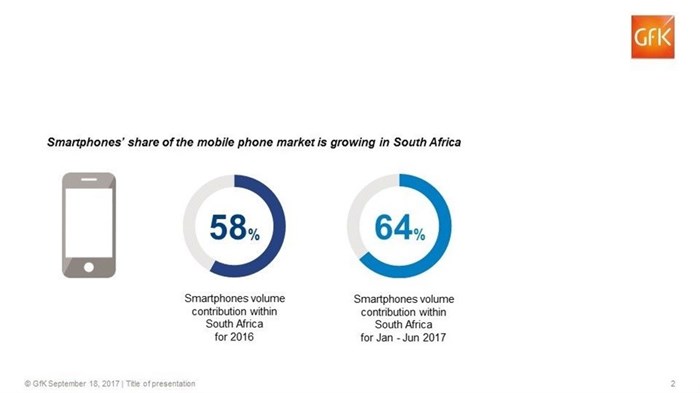

GfK South Africa’s data shows that mobile phone sales have decreased by 23% for January to June 2017, compared to the same period in 2016. Smartphone unit sales has increased 17% in the same timeframe. Smartphones accounted for 64% of mobile devices sold in the first half of 2017, while feature phones comprised the balance. By comparison, the split was 58% smartphones and 42% feature phones in the 2016 calendar year.

Smartphones’ share of the mobile phone market is growing in South Africa

Notebooks experienced flat growth for the first half of 2017, with around 295,000 units sold through retail during the period. This follows a decline of more than 20%, from 360,000 units sold through in January to June 2015 to about 295,000 units in January to June 2016. Tablet computer retail sales, meanwhile, have dropped from 862,000 units in the first half of 2016 to around 540,000 for January to June 2017.

Smartphones buoyant in a flat market

Says Nicolet Pienaar, Business Group Manager: IT and Telecoms at GfK South Africa: “Growth in South Africa’s consumer computing devices market has flattened in recent years, partly because of economic conditions, partly because the weak rand has pushed prices up, and partly because of high penetration of these devices into the segments of the market that can afford them. The smartphone market, however, remains buoyant as consumers migrate from feature phones.

"We are also seeing cellular networks, manufacturers and retailers come up with innovative ways to drive sales volumes. For example, some smartphone and PC makers continue to focus on laybys and store credit to make notebooks, tablets and smartphones more affordable to the first-time buyer. Some vendors are also seeking to increase the value of the units they sell—such as notebook manufacturers who have opened new markets such as the premium R40,000-plus gaming notebook.”

Adds Berno Mare, Product Manager: IT, Office and Photo at GfK South Africa: “Growth in South Africa’s mobile phone market is predominantly driven by the introduction of extremely low cost smartphones. This is fuelling the transition from traditional mobile phones to smartphones. Another trend sees consumers enthusiastically adopt larger screen sizes of five inches and above.

“Brand loyalty and design are the main drivers in the premium market. Features are secondary in consumer purchasing decisions because most premium phones have excellent spec levels and similar functionality. In the credit-driven sector, the smartphone is a critical status symbol and screen size is a major factor in smartphone purchasing decisions.”

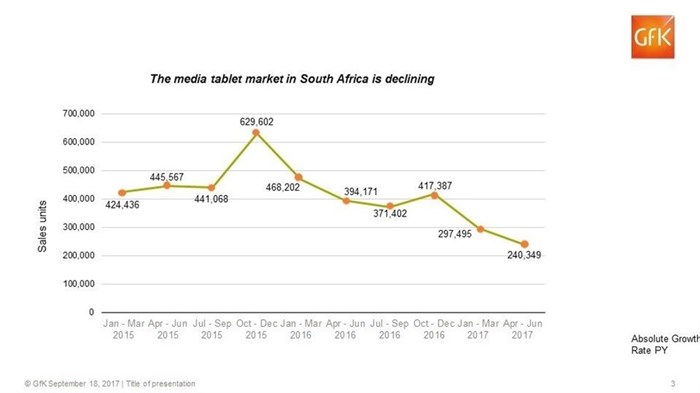

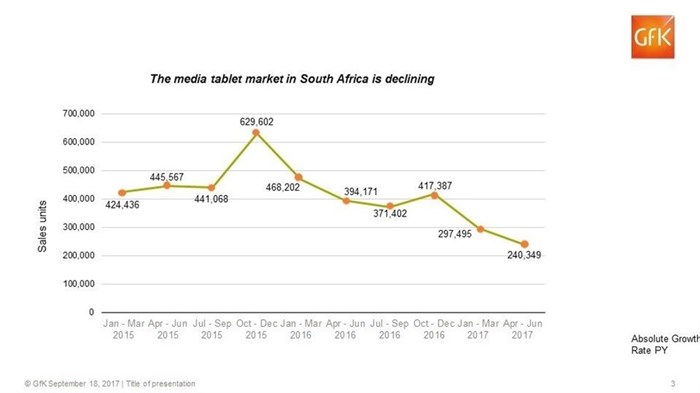

Tablets feel the pressure

Commenting on the tablet market, Pienaar says that tablets are seen as a secondary support device, used to consume media rather than to create content. As a result, this category is feeling the pressure of a tight economy more than mobile computers and smartphones, which many consumers regard as essentials.

The media tablet market in South Africa is declining

Says Pienaar: “A trend we have noted in Europe is that people prefer to use their smartphones to hail an Uber or take notes in a meeting because their handsets are right at hand – they don’t want to take out a tablet or hybrid. The same trend is taking place, here, too.”

There is fierce competition in the entry-level tablet market, thanks to a growing choice of brands as well as telecoms networks offering contract deals. However, the professional segment – including slate and hybrid form factors – is struggling because prices are too high for mass market appeal.

In the notebook market, a volatile exchange rate and higher component prices are making it difficult for manufacturers to keep price points low for entry-level devices. The industry is focusing on combining spec configurations that allow for aggressive pricing. As a result, there is a little innovation in the low-end of the market, with some devices leveraging older processors. In the premium market, thin form factors, SSD and other innovative features are driving growth.

Spurred by innovations, such as virtual reality, artificial intelligence, smart home functionality, mobile payments and mobile health, smartphones are going to gain further relevance for consumers in premium segments in the next year to two. Meanwhile, low-cost smartphones will continue to grow as users migrate from feature phones, especially younger people who see connectivity as a life essential.

GfK

GfK is the trusted source of relevant market and consumer information that enables its clients to make smarter decisions. More than 13,000 market research experts combine their passion with GfK’s long-standing data science experience. This allows GfK to deliver vital global insights matched with local market intelligence from more than 100 countries. By using innovative technologies and data sciences, GfK turns big data into smart data, enabling its clients to improve their competitive edge and enrich consumers’ experiences and choices. www.gfk.com/en-za/