Warc has announced the details of their Global Advertising Trends report: Ad Investment 2021/22 - The Rate of Recovery. Following an analysis of adspend across 100 markets, the annual forecast has been updated according to the strong rebound global ad markets saw from the Covid-19 downturn last year.

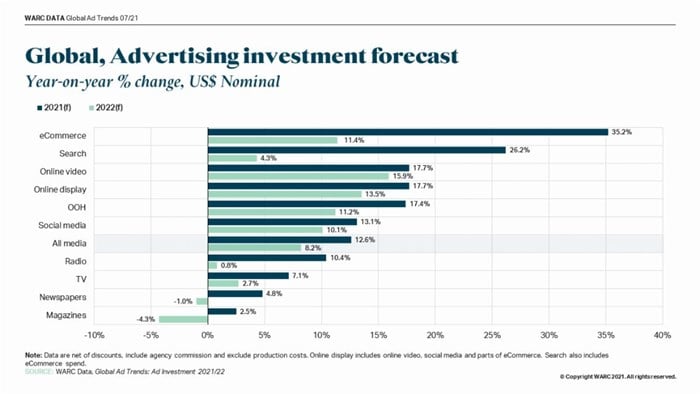

The report has found global advertising spend is on course for 12.6% growth this year to reach $665bn, an upgrade from the 6.7% initially projected. Further growth of 8.2% is forecast for 2022, by which time the global advertising market will be worth more than $700bn.

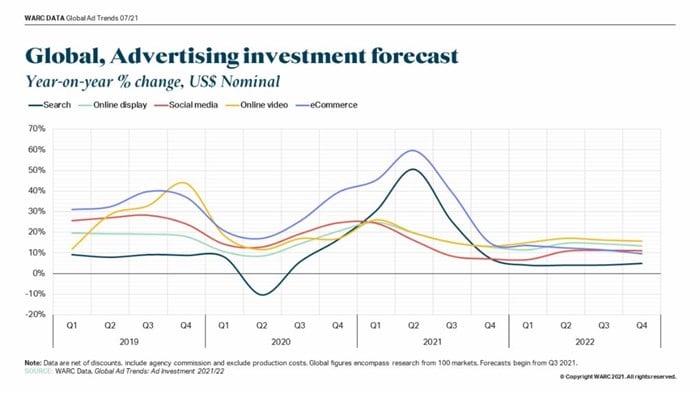

Advertising spend in Q2 2021 rose 23.6% to a total of $157.6bn - a new high for a second-quarter period and the strongest rise in over a decade.

Growth in the second quarter was driven mostly by online formats, which collectively saw spend rise by 31.2% versus the previous year. E-commerce (+59.5%) and search (+50.6%) were star performers, though offline media - most notably linear TV (+11.5%) - also fared well.

The second-quarter rise in global ad trade followed on from 12.5% growth in the first quarter; consequently, at $311.5bn, global ad investment was 17.8% higher during the first six months of the year than during the same period in 2020.

Covid-19 accelerated a digital shift in marketing

While total spend fell by 5.4% - approximately half the rate initially estimated - spend on offline media such as print, radio, TV, and cinema fell by a fifth, or $63bn, equating to the worst downturn for this sector in Warc's 40 years of market monitoring.

Online spending, however, rose by 9.4% ($29.2bn) last year, buoyed by rising e-commerce (+27.4%), social media (+18.3%) and online video (+15.9%) investment.

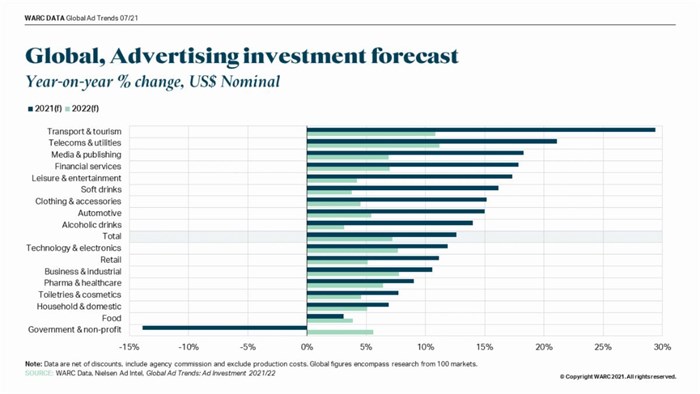

Online media gained 10 percentage points in budget allocation last year in the automotive and financial categories, a rate of increase that was double the pre-pandemic average. All product sectors are allocating more of their ad budget to online formats than before the pandemic.

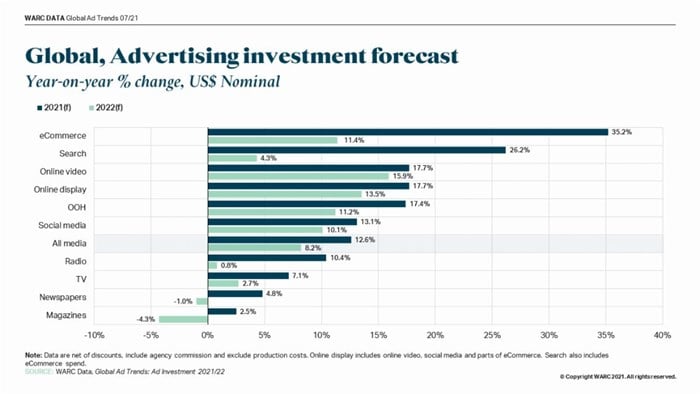

Online formats are also leading growth in 2021, with Warc forecasting spend on e-commerce advertising to rise 35.2% this year, mostly to the benefit of Amazon. Brand spend on search - where Google is the largest player - is set to rise by over a quarter (26.2%) this year, while online video spend is expected to be up by 17.7% and social media by 13.1% this year. All of these formats are expected to see record growth in 2022, too.

Global, Advertising investment forecast

Trends by media and format 2021/2022

Media formats focused on; linear TV, out of home, cinema, linear radio, newspapers, magazines, social media, online video, e-commerce, and paid search.

There is an expectation that growth in spending will be true across multiple media formats by 2022. On average, digital media mediums experienced significant growth due to the social distancing restrictions brought on by the Covid-19 pandemic. For example, brand spend on e-commerce saw a 24.7% growth last year as more shoppers migrated to online shopping.

There is also a projected overall increase in investment, with a few exceptions which have seen a decrease since 2019. Magazines specifically are projected to see a 2.5% investment increase before falling into a 4.3% decline next year.

Global, Advertising investment forecast by medium

Trends by region 2021/2022

Regions focused on; North America, Asia Pacific, Europe, Latin America, Middle East, and Africa.

Overall, adspend is expected to increase in all regions. North America, the largest region, is expected to see a 12.8% rise in adspend this year. Asia Pacific is projected to see a 12.8% increase in advertising investment this year, to top $200bn for the first time. Europe is expected to see a 12.1% rise in adspend and a 6.5% growth is expected for 2022. Latin America is projected to see a double-digit rise in advertising investment in both 2021 (16.9%) and 2022 (11.1%). In the Middle East, regional advertising growth will be 6.2% this year and accelerate to 15.1% in 2022 after a one-quarter decline in adspend last year. Africa adspend is projected to rise by 9.7% this year, with further growth of 7.3% expected for 2022.

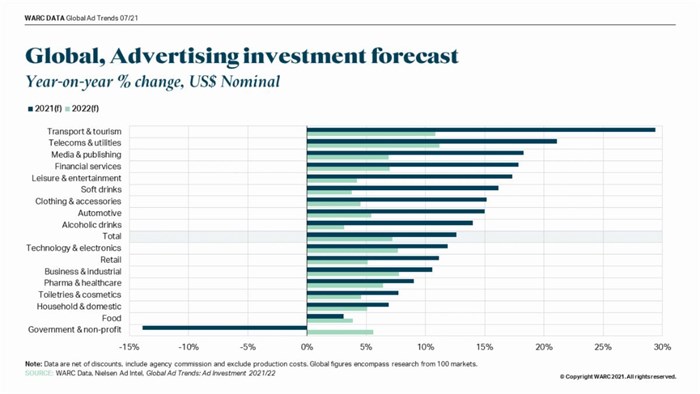

Global, Advertising investment forecast by product category

Trends by product category (five largest in 2022)

Product categories focused on; Telecoms and utilities, media and publishing, business and industrial, retail, and financial services.

Telecoms and utilities was the quickest growing category pre-pandemic and is showing no sign of slowing down. Adspend is expected to grow almost twice as quickly as the wider ad market. Overall, however, there is a predicted increase in adspend and advertising investment across product categories. Even though retail, for example, saw a cut in advertising budgets last year, an 11.1% investment increase is projected to happen.

For a sample report of Warc’s Global Advertising Trends: Ad Investment 2021/2022, go here. Warc data subscribers will have access to the full report.