Top stories

HR & ManagementLeadership in crisis: Why trust and empathy are critical to employee engagement

Tim Cordon 2 days

RetailDiageo sells East African Breweries stake to Asahi for $2.3bn

Duncan Miriri and Emma Rumney 36 minutes

More news

South Africa has an established formal retail market and is one of the most economically advanced nations on the continent. The wealthy upper class and large middle class, continuously improving internet penetration and a nascent affinity to shopping online, all present a potentially lucrative new customer base for Amazon.

In addition, South Africa remains a good launchpad for trading in the rest of Africa, one of the last untapped markets globally for e-commerce retailers.

Despite the Covid-induced boost, the local e-commerce retail market is still in its infancy, with approximately 5% of sales done online. Whether South Africa will attain the same level as the global leaders (i.e. China, Indonesia, UK and South Korea), where e-commerce accounts for over 30% of retail sales, is unknown.

What is certain is that the efficiency of shopping online for consumers will see e-commerce gain an increasingly larger share of retail sales in South Africa in future.

Before we discuss the likelihood of Amazon’s success in the South African market, it is worth understanding the characteristics of their business model, which have enabled them to become one of the largest retailers in the world.

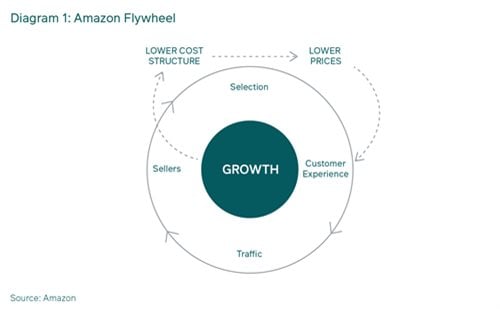

Nick Sleep, co-founder of the Nomad Investment Partnership and an early investor in Amazon, describes Amazon’s competitive advantage as being one of Scale Economics Shared (SES).

SES is a model where the benefits from “economies of scale” are shared with customers, typically through lower prices, which incentivises customers to buy more and attracts more customers.

This additional volume affords a company better buying power, lowering unit costs, and hence enables lower prices. Once this flywheel is spinning, it’s difficult to compete with.

Importantly, it’s a model where the company’s moat (i.e. competitive advantage) deepens as the company grows. Diagram 1 illustrates this model.

Another core advantage Amazon has over many of its competitors is a negative cash conversion cycle (CCC). A negative CCC means Amazon receives payment from customers before they have to pay their suppliers.

Effectively borrowing from suppliers, interest-free, to fund their operations and enabling positive cash generation despite having a relatively low net margin. Amazon’s scale and diverse supplier base provide the negotiating power to extract better payment terms than competitors attain.

Amazon is a multi-faceted behemoth which constantly evolves, making it difficult to categorise its business.

At its core, it encompasses the following:

Some 60% of Amazon’s sales comes from these third-party sellers. This marketplace model enables sellers to reach a broad audience at a substantially lower cost than building out an equivalent store network. It’s also changed consumers expectations such that they now expect a wider selection, competitive prices and convenient delivery options.

Amazon’s presence has irrevocably reshaped the retail landscape by shifting customer expectations to wanting larger product selections, competitive pricing, convenient delivery options and a seamless online experience. Traditional retailers have had to adapt by launching online offerings, but struggle to provide an equitable product given the capital-intensive nature and the requirement to deliver decent shareholder returns over a shorter period than Amazon typically targets.

Founder Jeff Bezos wrote in the 1997 shareholder letter: “The stronger our market leadership, the more powerful our economic model.”

Today, the focus remains to take significant market share, so they have the scale to deliver the best value to customers in the categories they operate in. To achieve this Amazon enters new territories in a measured and phased approach, the aim being to execute flawlessly while they tailor the functionality to local conditions and establish the supply chain required to roll out its complete offering. Once established, the business is scaled up.

One of the most recent examples has been the company’s entry into Australia five years ago. At first Amazon underwhelmed the local market, only entering with 7.5 million products available and keeping pricing relatively rational. Hence, the impact on established local retailers was muted.

However, in late 2022 they began expanding aggressively. Distribution capacity was doubled to 330,000m2, its product range was expanded by 60% (having grown to 125 million by 2021 and then to over 200 million in 2022), and free one-day delivery for Prime members was launched at the same time.

According to ecommercedb.com, Amazon Australia’s 2022 gross merchandise value (GMV) was A$9 billion, 20% larger than the second largest e-commerce player, eBay Australia, a business which launched in 1999 (18 years earlier than Amazon).

While the short-term impact of Amazon’s arrival in SA may be muted, the local established retailers need to be actively transforming their businesses to compete with this global behemoth over the medium term.

Over the last decade, the local retail category has become increasingly more competitive, driven by three factors.

First was the launch of Takealot in 2011 (100% owned by Naspers) and the arrival of some international retailers like Cotton on and Zara the same year, H&M in 2015 and more recently Shein in 2020.

Secondly, we have seen an increasingly challenging operating environment as consumers’ disposable incomes and hence expenditure have been constrained by stagnant employment growth and rising inflation. The costs of doing business also escalated considerably due to excessive property rates and tax increases, additional security costs and adapting to persistent load shedding.

And lastly, the sector has experienced the Covid-induced accelerated transition into omni-channel retailing, which comes with significant upfront capital spending to establish online sales functionality and distribution capabilities. The ongoing cost-to-serve each delivery is also higher than a store sale, due to the additional labour component and high rates of return.

All the above factors have put significant pressure on retailers’ margins and required substantial capital expenditure, negatively impacting companies’ free cash flow and lowering returns.

The entry of Amazon to SA enhances competitive pressure and is likely to stimulate an even more focused drive to improve the online offering by local retailers. This does not bode well for the free cash flow generation prospects of the retail sector.

This is especially true when we consider that for Amazon to achieve the level of scale they have in Australia, they have invested over A$5bn, equivalent to R66bn or the market cap of Mr. Price and Truworths combined.

While consumers benefit from these e-commerce businesses, they are yet to prove themselves as good investments for equity shareholders. Takealot.com provides some good insight into how challenging it is to generate a positive return.

Despite immense capital investment since launching in 2011 and being the local e-commerce market leader with an estimated GMV of over R25bn (including Takealot, Superbalist & MrD) in 2023, they most recently delivered an operating loss of R377m. That’s a far longer time than most equity investors are willing to wait for a positive return.

Most at risk in our view is Takealot.com, given the high overlap of their general merchandise product set. Takealot do, however, have established relationships with over 10,500 active sellers, according to Frederik Zietsman (Takealot.com CEO), over a decade of knowledge and insights into local consumers’ shopping behaviour and an established supply chain network with over 17,000 riders/drivers.

It will take time for Amazon to establish these, but longer term it’s difficult to see how Takealot can compete with Amazon’s deep pockets, immense buying power and unique service offering (e.g. Prime Video & Audio).

The apparel and food retailers are less at risk, especially in the short- to medium-term, for several reasons. Globally, Amazon has struggled to compete in apparel and grocery. In apparel, brand is a key component of the purchase decision and Amazon hasn’t built up the credibility required to compete as a fashion brand.

In food retail, Amazon wrestles with fresh produce’s perishability, seasonal variety and elusive online appeal, hindering its integration into its offerings. Their supply chain and pricing algorithms are optimized for ambient temperature and long-life products, so while they can compete in dry groceries, fresh has proved far harder. The purchase of US grocer Wholefoods in 2017 has enhanced their fresh skillset, but they are yet to develop a mass market grocery model which works.

Online sales remains a relatively small component of retailers’ total sales, at less than 5% for the listed companies’ SA operations. Approximately 95% of sales are still done in store, even after Covid and load shedding, which greatly accelerated the use of online shopping. Taking market share is difficult, developing a market is even harder.

Consumers still like to see, touch, and feel the products before they purchase, which can only be achieved in a store. Providing an exceptional in-store experience offers consumers value that Amazon currently cannot match. Two examples of great physical shopping experiences are Sportscene, owned by the Foschini Group, and Woolworths Food stores.

The large store networks have multiple benefits:

Most South African retailers have well-established loyalty schemes, offering substantial value to customers and providing retailers with a significant data advantage (on consumer behaviour). But further investment will be required to compete with the compelling value of Amazon’s Prime.

Lastly, a few South African retailers have very credible online offerings. For example, Checkers has their highly successful Sixty60 on-demand grocery business and The Foschini Group (TFG) has built their Bash marketplace platform, which enables shopping across all TFG brands in one app. Bash has also been designed to facilitate third-party sellers, like the Amazon model.

While the above list is not exhaustive, it does illustrate that it will not be a walk in the park for Amazon when they start trading.

As we expect Amazon’s entry to be considered and phased, there is likely to be a limited impact on the sales performance of locally listed retailers over the next few years. What does concern us, however, are questions around how much further investment will be required to build digital ecosystems that can compete with one of the world’s largest e-commerce retailers, and how quickly pressure on margins builds as Amazon’s range expands.

The impact on future shareholder returns is skewed to the downside. Janet Menzies, Amazon Australia country manager, explains capital allocation at Amazon as not based solely on financial returns, but how it could solve problems and improve the value proposition to customers.

Our portfolio exposure to retailers includes Spar and TFG. Both businesses are internationally diversified, executing on the multiple self-help levers, and are delivering current profitability levels well below our assessment of normal earnings power. From a valuation perspective, we are comfortable that their low forward price-earnings multiples provide a suitable margin of safety for the risk Amazon poses over our investment horizon. And positively, these stocks operate in categories where Amazon is yet to establish a competitive advantage.

How quickly Amazon will impact the local retailers is uncertain; however, as the Australia example above has indicated, local retailers need to be on their toes for the foreseeable future.