Top stories

Marketing & MediaWarner Bros. was “nice to have” but not at any price, says Netflix

Karabo Ledwaba 5 hours

More news

The platform automatically matches businesses with any available funders according to their specific funding needs using its database of more than 300 funders and over 600 SMME finance products from the public and private sector funders in South Africa.

I chat to Wesgro chief executive officer, Tim Harris, to learn more about the Fund Matchmaking Portal and business funding landscape in South Africa.

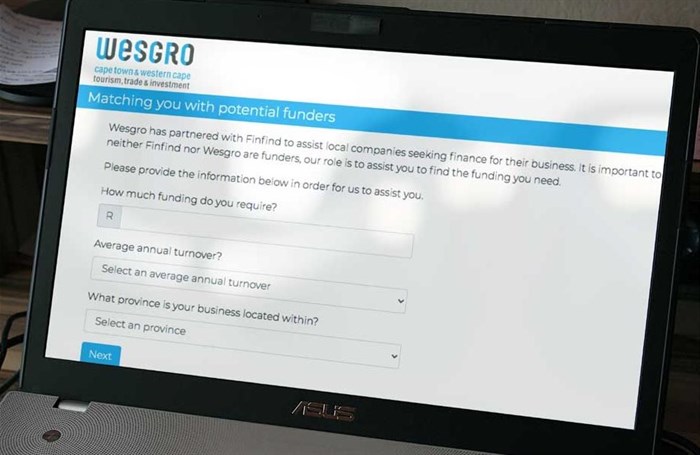

Wesgro’s Fund Matchmaking Portal is a funding platform developed by Finfind and is aimed at helping businesses develop a better understanding of the funding landscape. The concept was driven by a recognition of the need for businesses across the region to access funding.

The portal utilises information submitted by businesses and compares it against the funding mandates and qualifying criteria of more than 300 funders, and more than 600 finance products, to provide the best funder matches for the business. Wesgro does not provide the funding but links the business with the best funder for the business’ specific funding needs.

During the initial Covid-19 lockdown, Wesgro developed and launched the Covid-19 Support Finder Tool, which was designed to assist businesses in identifying viable support structures for their businesses. The uptake was strong, with more than 6,500 businesses utilising the tool during the lockdown.

Through implementing the Covid-19 Support Finder Tool and day-to-day interactions with local companies, the Wesgro Investment Promotion unit recognised that a knowledge gap existed among businesses in the region with regard to funding options for businesses in South Africa.

Many businesses that engage with Wesgro seeking funding have a limited understanding of funding options. Through an RFQ process, Wesgro partnered with Finfind, who customised their funding platform for Wesgro’s needs.

The funding options include all grant, equity and loan finance offerings available from any government or private sector funder in the country. The funder database currently includes 262 loan products, 228 equity finance products, 84 grants, 41 asset finance funds, 11 incentives and 47 invoice discounting and merchant cash advance products. The funders and finance product information is kept updated on a daily basis.

Each funder that is included in the funder database has their own qualifying criteria based on the type of finance product they offer. The requirements for funding products, like invoice financing, are less onerous than term loans, for example. Some finance offerings are sector specific, others have constraints related to the business’ annual turnover and trading period, for example. Funding requirements, the terms and the cost of finance is linked to a risk assessment.

SMMEs need finance to survive and grow, but many do not know what financial products are available that suit their financing needs and they don’t know what funders require from them. Publicly available information is difficult to find, or often out of date and uses jargon that is foreign to entrepreneurs.

Business owners waste a lot of time doing fruitless internet searches and applying for funding that they do not qualify for or for products that do not match their funding needs.

The Fund Matchmaker Platform solves this problem for them by doing the matching for them with the right funder and funding product, filtering out the ones that cannot assist them. It also notifies them about what they will need to have ready when they apply for the funding.

There is a significant need for startup funding in the country which is not currently being met. Development finance institutions, who are mandated to address this target market, are often applying the same strict qualifying criteria for funding as the banks do, locking out many early-stage businesses that need finance to survive and grow.

Banks are struggling to service the SMME market as they continue to apply a one-size-fits-all approach to credit risk assessment for business funding, much of which is designed for more established and medium size businesses and disadvantages micro and small businesses.

The most significant issue is the lack of SMME credit data in the country, which makes it difficult for funders to assess the SMME’s historical payment behaviours or to clarify if they have existing credit. The World Bank is conducting ground-breaking pilot projects to use alternative data to increase credit extension to SMMEs in South Africa.

Surprisingly, there is a lot of funding available for SMMEs in South Africa. Sadly, most businesses that apply for funding are not finance ready, meaning they can’t provide the information and documentation requested by funders when they apply for finance.

Many businesses that need finance do not have the finance record keeping side of their business in order and are behind on issues of compliance. Business owners are advised to focus on the business administration and financial management side of their business, to ensure they are ready to secure funding when needed.

For more, go to https://www.wesgro.co.za/invest/funding.