Sappi results third quarter ended June 2015

Summary for the quarter

Commenting on the result, Sappi Chief Executive Officer Steve Binnie said:

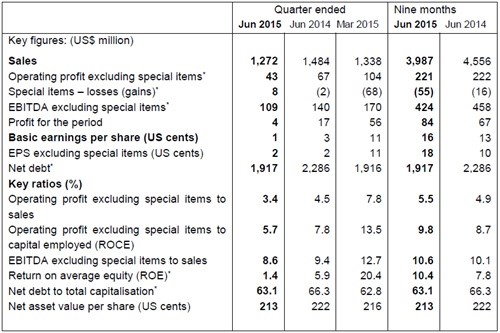

The third quarter is seasonally the weakest for Sappi. In addition, the pulp mill upgrade at Gratkorn and planned annual maintenance shuts in all three regions reduced profit by approximately US$27 million compared to the equivalent quarter last year. The group generated EBITDA, excluding special items, of US$109 million, operating profit excluding special items of US$43 million and profit for the period of US$4 million. Earnings per share excluding special items for the quarter was 2 US cents, as it was in the equivalent quarter last year.

The North American business experienced significant pressure as a result of the stronger US dollar, which led to increased imports of coated paper, lower coated paper sales volumes and lower margins for the release paper business. The domestic graphic paper market was also weaker than expected.

The performance of the European business was adversely impacted by the higher cost of raw materials due to the stronger US Dollar and additional pulp purchases during the upgrade of the recovery boiler at Gratkorn. The market for graphic paper continues to decline in Western Europe. However, the weaker Euro made exports more competitive and profitable.

In the South African paper business the virgin fibre packaging grades continue to show good demand growth. However, newsprint and recycled packaging paper demand were flat.

The Specialised Cellulose business continued to generate solid returns during the quarter, with EBITDA excluding special items, of US$56 million. The planned annual maintenance shuts at Saiccor and Ngodwana reduced margins relative to the prior quarter. US Dollar prices for dissolving wood pulp remained constant compared to the prior quarter, though the South African mills benefited from a weakening ZAR/USD exchange rate.

Net debt of US$1,917 million was flat compared to the prior quarter and US$369 million below that of the equivalent quarter last year as a result of cash generation from operations, debt repayments and favourable exchange rates on the translation of our debt.

* Refer to the published results for details on special items, the definition of the terms, the reconciliation of EBITDA excluding special items to profit/loss for the period as well as net debt to interest-bearing borrowings..

The table above has not been audited or reviewed.

The quarter under review

During this seasonally slow quarter, graphic paper sales volumes in Europe were 5% below those of the prior quarter and stable year-on-year. Overall sales volumes were 1% up on the equivalent quarter last year as a result of the continued growth in speciality packaging paper sales. The upgrade of the recovery boiler at Gratkorn had a once-off impact on operating profit of €10 million during the quarter.

In North America, dissolving wood pulp sales volumes were lower than both the prior quarter and the equivalent quarter last year as we maximised own-make fibre production for the paper machines at Cloquet in order to improve profitability. Variable costs were lower than the equivalent quarter last year as lower chemicals, fibre and energy prices more than offset higher wood prices. We also realised the benefit of our variable usage improvement programmes. Raw material costs remained flat and variable usage improved following difficult operating conditions in the prior quarter as a result of the extreme weather conditions experienced in the Northeast US

The Southern African business achieved higher average prices and volumes compared to both the equivalent quarter last year and the prior quarter. Operating profit for the quarter was impacted by ZAR204 million as a result of the planned annual maintenance shuts at Ngodwana and Saiccor. Post quarter-end, we announced the sales of our Enstra Mill's recycled packaging paper business and Cape Kraft paper mill. This is in line with our strategic focus on the virgin fibre packaging business in South Africa.

Net cash generation for the quarter was US$25 million, compared to US$44 million net cash utilised in the equivalent quarter last year. The improvement in cash generation was primarily due to lower working capital and interest costs during the quarter.

Capital expenditure in the quarter was US$49 million and mainly related to maintenance and efficiency improvement projects.

Outlook

Graphic paper markets remain challenging and currency movements are having a significant impact on trade flows. These negatively affected our US business while improving export margins for our European coated paper business. The European business continues to face pressure from higher pulp prices.

Dissolving wood pulp prices in China have risen steadily over the past four months and this should translate into higher short term fixed prices with our major customers. The weaker Rand/US Dollar exchange rate will support the profitability of this business in South Africa.

Capital expenditure in the last quarter of fiscal 2015 is expected to be approximately US$80 million (US$245 million for the full year) and is focused largely on maintenance projects and efficiency improvement investments.

We expect to reduce net debt levels during the fourth quarter. Any proceeds received from the sale of Cape Kraft, Enstra and/or the Twello forestry assets before year-end would further reduce net debt.

We expect that the regional operating performance for the year will be broadly similar to 2014 despite a number of significant once-off impacts from various capital projects. At current exchange rates, the translation of Euro and Rand results to US Dollar will adversely impact the group results. Nevertheless, due to lower interest costs, earnings per share excluding special items for the full year are expected to be substantially better than that of the prior year.

- Wits and Sappi renew forestry partnership to boost climate resilience08 Dec 15:54

- Sappi TuksRace - 90 days to the ultimate new year challenge19 Nov 15:49

- Sappi reports Q4 and full-year 2025 financial results10 Nov 13:29

- Sappi recognised in Forbes' World’s Best Employers and Top Companies for Women rankings for 202517 Oct 08:28

- Celebrating Arbor Month: Sappi’s commitment to indigenous forests08 Sep 14:40