Questions are being asked about how the confidentiality provisions of the Tax Administration Act are aligned with legislation providing for whistle-blowers and freedom of expression.

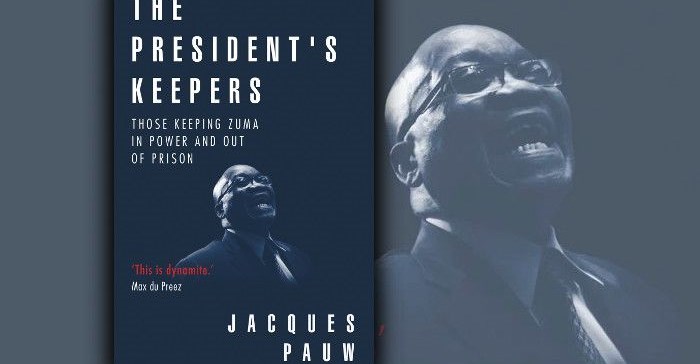

Photo: The Book List

The questions arise in relation to the legal action launched by South African Revenue Service (Sars) commissioner Tom Moyane against author Jacques Pauw on the grounds that he unlawfully divulged information about the tax affairs of individuals including President Jacob Zuma.

A tax law academic - who did not want to be named - was emphatic that the act not only prohibited the disclosure of information about taxpayers by the tax authority, but also prohibited individuals from doing so when they came into possession of information about the tax affairs of others.

The secrecy provisions of the act were stringent and applied to Sars officials and all other individuals, he said.

If Sars wanted to report a crime to another authority, it would have to go through prescribed processes.

However, what makes the current situation tricky is that the whistle has been blown about lack of action by Sars over the tax obligations of the president.

Cannot answer questions

It might be that this information would have to be channelled through the tax ombud.

However, the office of the ombud says it cannot answer questions on the matter as it is before the court.

South African Federation of Trade Unions (Saftu) general secretary Zwelinzima Vavi said the law should not be used to hide a crime. If Pauw had contravened a clause of the act by revealing that crimes had been committed, then, said Vavi, the act must be urgently amended to bring it in line with the Constitution, which provided for freedom of expression.

"We are sure that this legal action is not just an attack on Pauw, but an attempt to intimidate the media and whistleblowers and is an assault on the constitutional right to freedom of speech," he said.

Clear and compelling public interest

"This action is a clear attempt to punish Pauw for publishing damning evidence including that president Zuma was paid a R1m a month salary by one of his cronies for at least four months after he became president in 2009," he said.

By bringing the legal action, Moyane had conceded that what Pauw had written in his book The President's Keeper was true, Vavi said. This meant that Zuma had broken the law.

Saftu agreed with the author's publishers that there was clear and compelling public interest in his book that revealed that Zuma had perverted SA's law enforcement agencies to hide the fact that he was not tax compliant and that he had received a salary from a business of his backer Roy Moodley while in office, Vavi said.

DA deputy finance spokesman Alf Lees said that in taking court action against Pauw, Moyane was trying to execute the messenger, instead of dealing with the substance of the disclosures in Pauw's book.

Intended to intimidate

"The Sars court application, under the hand of Tom Moyane, is clearly intended to intimidate any other South Africans from exposing matters of public interest," Lees said.

"There is nothing confidential about the massive R145.2m estimate of taxable fringe benefit that accrued to President Zuma when the state rebuilt his Nkandla residence," he said.

"Unless SARS deals with this revelation as well as the many other revelations publicly and transparently, the reputation of senior Sars executives and consequently SARS itself will not be restored.

"This reputational damage will continue to have a negative impact on taxpayer morality and the consequent resistance of taxpayers to pay taxes due," Lees said.

Business Day