While the recent national lockdown announcement by President Cyril Ramaphosa has dramatically changed the lives and lifestyles of South Africans, time has proven that as a united country, and within our local communities, we have the ability to harness our indomitable spirit and overcome challenges and hardships.

From a residential property market perspective, historically, recent international experience reveals that global economic shocks of this nature inevitably cause property transactions to taper off, as other priorities take over.

However, within the property industry, and despite the lockdown, the rapid adoption of new technology is delivering the benefits of ensuring that the industry is already geared to largely operate and transact electronically, coupled with personal interaction – albeit at a distance at present.

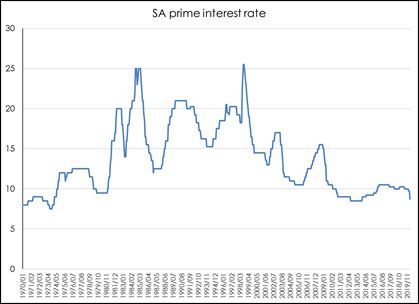

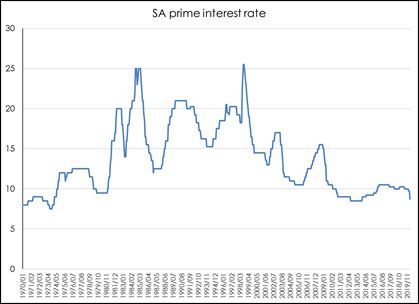

Interest rates close to historic lows

The fact that interest rates are close to historic lows following last week’s 100bps reduction in the repo rate, with the possibility of additional reductions in the months ahead, presents an opportunity for buyers, particularly in the price band below R3m where there remains a strong demand for accommodation to buy and rent. This is coupled with the benefit for buyers of properties valued up to R1m, where no transfer duty is payable, plus anticipated further reductions in the interest rate during the course of the year. And, being a buyers’ market, currently there is a good selection of properties across all price ranges available to view online and electronically via our agents.

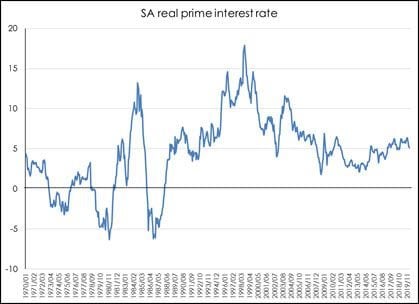

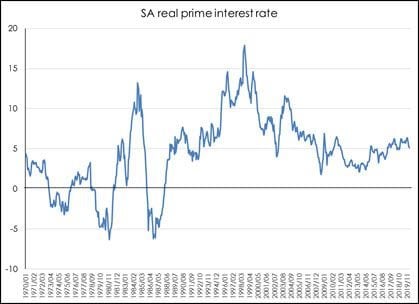

Notably, there have only been two previous occasions since 1970 when the prime interest rate has been cut this low (see chart below). Prime was at 8.5% between July 2012 and December 2013 and was below current levels in the early 1970s. However, real prime interest rates reveal that there is still room for further reductions (see second chart).

Graph 1: SA prime interest rate

Graph 2: SA prime interest rate

This is because, when adjusting for inflation, it is evident that real interest rates remain fairly high by historical standards. As March 2020 inflation has not yet been released, the most recent figure we have is for February (i.e. before the recent 100bps rate cut), when real prime interest rates were at 5.15%. Double digit inflation from the mid-1970s until the early 1990s saw real rates drop into negative territory on several occasions during this period.

Andrew Schaefer 25 Mar 2020 Property a solid asset class

With the extreme volatility currently being experienced in global stock markets, it is probable that, as has been seen over decades during times of great turmoil, we will see increased confidence among investors and home buyers in bricks and mortar as a resilient and solid asset class.

As property has over the longer term proven a sound investment, it stands to reason that many will regard the residential property market as a safe haven amid the current heightened economic uncertainty.