Top stories

More news

Logistics & Transport

Uganda plans new rail link to Tanzania for mineral export boost

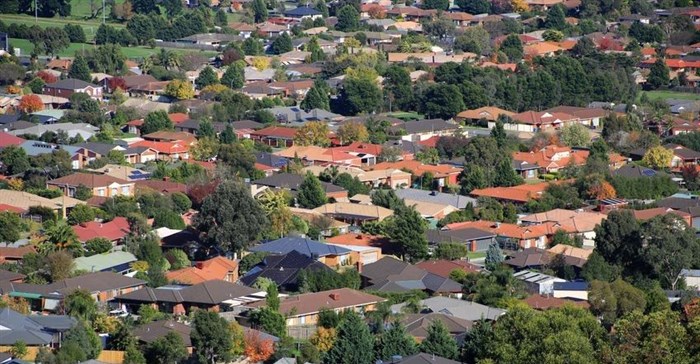

Sub-indices show that inflation of freestanding properties continued to slow, while that of flats/townhouses picked up marginally April. The median price of a freestanding house was R1,000,000, up only 2.8%y/y, slower than 3.7% y/y growth in March.

The median price of a flat/townhouse was R820,000 in April, 7.3% higher than in April 2016, and slightly above growth of 7.2% y/y in March 2017.

Household credit ticked up slightly in March. However, such growth levels continue to indicate subdued appetite by banks to lend to households because of their poor affordability. Household credit recorded nominal growth of 0.6% y/y in March, marginally higher than the 0.4% y/y in February. Likewise, mortgage advances ticked up marginally, recording 3.0% y/y, from 2.8% y/y in February. In real terms, growth in household credit remained in contraction (-5.5% y/y), indicating very tight domestic credit conditions.

From a housing supply perspective, monthly residential building statistics still show subdued building activity. The volume of residential building plans approved by larger municipalities contracted by 430 units. The decline was common across all property segments. The volume of residential units completed declined by 370, with freestanding units and flats/townhouses under pressure. In value terms, building plans approved (which is an indicator of future supply) amounted to R4.2bn (constant 2015 prices, seasonally adjusted), a decline of 8.5% compared to the same period last year. Value of residential houses constructed was R3bn, 14.8% higher than the same period last year.

The number of cash and mortgage transactions is converging. Data from the Deeds Office suggests that the share of cash transactions increased significantly from around 20% in 2006/07 (before the global financial crisis) to around 40% in 2009 (post-global financial crisis); and then fell to around 36% by Q3:11 before rising again. By Q4:16, we estimate that cash transactions had risen to 46% of residential property transactions, their highest proportion since Q3:02.

The sharp increase in the share of cash purchases in 2008 and 2009 was a function of mortgage transactions declining sharply, rather than the amount of cash transactions increasing. Likewise, mortgage transactions have fallen faster than cash transactions between Q4:15 and Q4:16, with mortgage transactions declining by 24.5% versus a 20% decline in cash transactions in the same period. This reflects the impact of adverse labour market conditions and the tightening of credit conditions, which limits the number of people able to buy with a mortgage, while fewer such constraints apply to cash purchasers. This situation is very similar to that during the financial crisis.

Looking ahead, the SARB’s leading indicator came in at 6.4% y/y, predicting a more buoyant growth in the months ahead. Notwithstanding, SBR expects that the heightened uncertainty via political risk will negatively impact confidence, leading to continued contraction in investment and job creation, and lower GDP growth. In addition to lower growth, higher borrowing costs associated with sub-investment grade may result in tax increases, which seemed on the cards even prior to the downgrade. The consequent deterioration in disposable income growth should impact the potential for a more meaningful recovery in the household credit cycle, which would delay recovery in purchasing activity. We note that the number of property transactions in Q4:16 was at its lowest level since Q1:10, and remains significantly (48%) below its peak of Q1:07.