South Africa's residential property market is facing domestic and global headwinds, with rising interest rates, socio-political tensions and a limp economy bedevilled by intermittent power dampening consumer spirits, says Hayley Ivins-Downes, head of digital at Lightstone. While abroad, the Russian invasion of Ukraine and numerous other geo-political hotspots continue to unsettle global stability.

Source: Gallo/Getty

Despite all these factors, South Africa’s residential property is showing pockets of progress and opportunity.

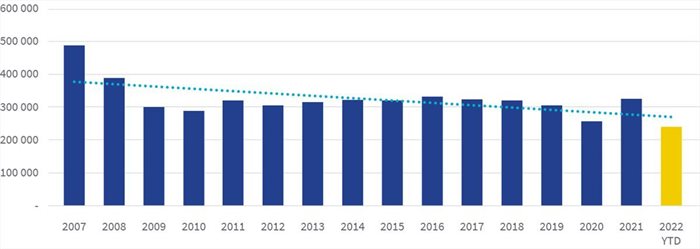

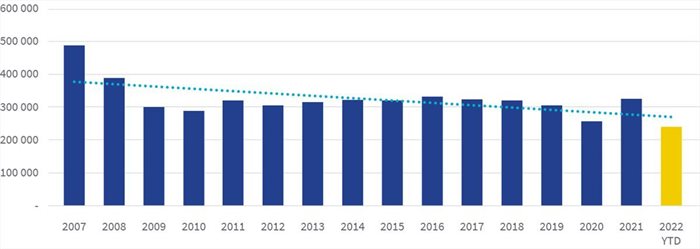

Overall transfer volumes were continuing their uneven trajectory, with 2022 anticipated to reach around 330,000, well down from the high of 493,000 recorded just prior to the 2008 crash.

However, if sales in 2022 hit 330,000, it would match the 2021 Covid-19 bounce-back from 263,000 and similar volumes last recorded in 2017 and 2018.

Source: Supplied

Who is buying?

If volumes are falling or flat, then who are the buyers?

As the graph below shows, Ivins-Downes said buyers were predominatly from the mid-value (37%) and high-value (32%) segments in 2021, a consistent trend for many years. In fact, the mid-value share of market was at its highest since 2009, and looks to be holding the same level in 2022.

Luxury category buyers were back to 12% in 2021, the highest recorded in this category and last matched in 2015, and buyers in the high category hit 32% in 2021, the highest score recorded in the past 14 years.

Unfortunately, low-value buyers dropped below 20% in 2021, suggesting perhaps less new entrants into the market – an unwelcome development given the country’s demographics – with market activity dominated by the mid and high values.

Source: Supplied

Property price inflation

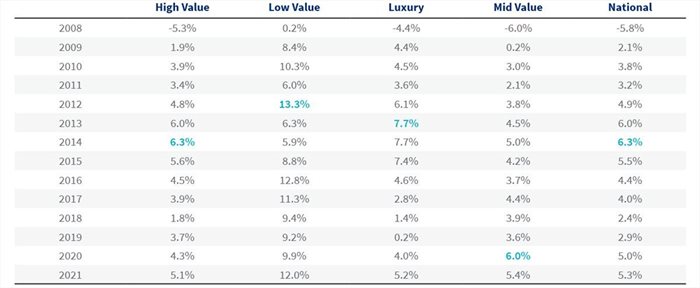

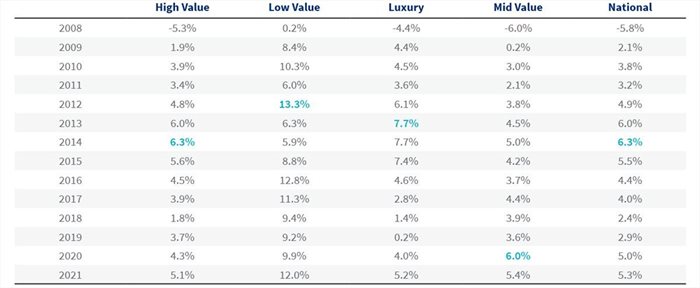

Ivins-Downes said despite sales in the low-value category trailing mid value and high value, property price inflation was most pronounced in this category, except for a dip in 2013 and 2014.

In fact, low-value property price inflation in 2021 was 12%, more than double high value (5.1%), luxury (5.2%) and mid value (5.4%), and more than double the national average of 5.3%. In fact, low-value property price inflation has been over 9% since 2016.

While the low-value properties have seen prices rise, the luxury category has fallen the most, coming off a high in 2014 of 7.7% and dropping to 5.2% in 2021. High-value properties also peaked in 2014 at 6.3%, and in 2021 were 5.1%, while mid-value prices had their best year in 2020 (6.0%), dropping to 5.4% in 2021.

Property price inflation by value band

Source: Supplied

The years 2012 to 2014 (highlighted in the table above) were the best in terms of property price inflation since 2008, with high value (2014), low value (2012), luxury (2014) and the national average (2014) recording their 24-year highs. Ivins-Downes said only the mid-value band recorded its best year outside 2012-2014 – and that was in the Covid-19 bounce back year of 2020.

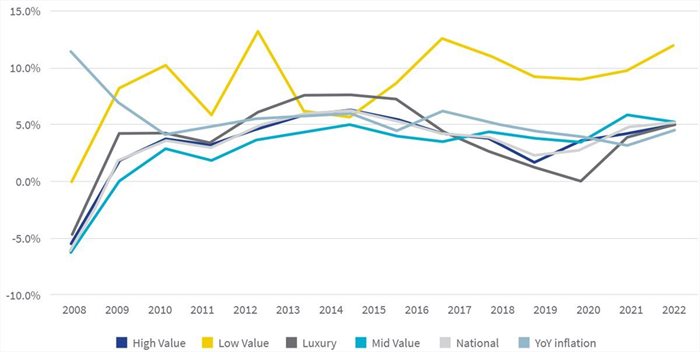

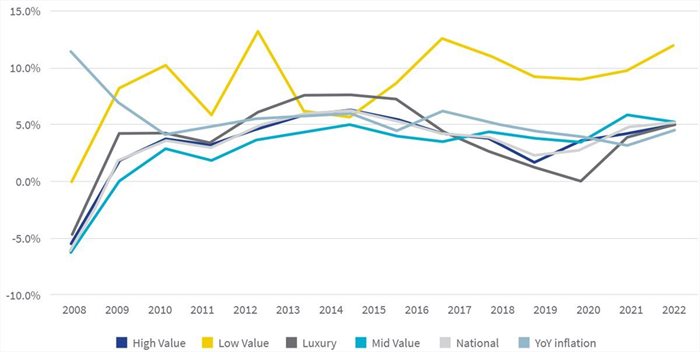

Other than 2014 being a “golden year” for rising property inflation, the table above and graph below indicated the hugely inconsistent movements in property price inflation, both within the property segments and collectively.

When property price inflation is superimposed on the CPI (see graph below) over the years 2008 to 2021, all of the property value bands have outperformed the CPI since 2020.

Source: Supplied

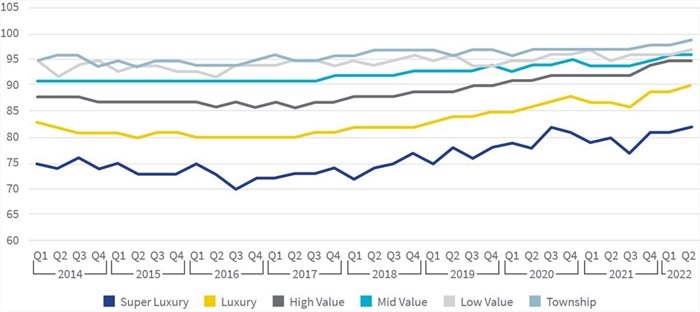

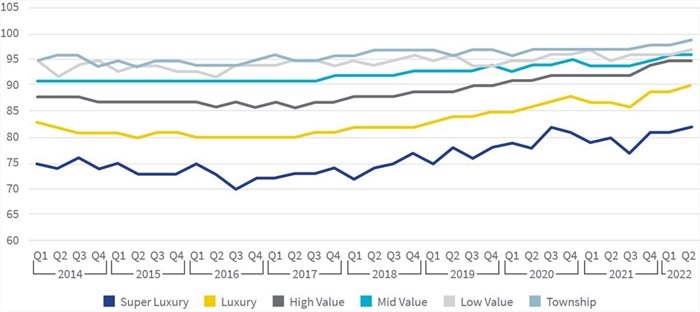

Loan-to-value increasing

Banks are offering higher loan-to-value (LTV), helping to stretch affordability of home ownership. “We can also see property owners holding onto their properties for longer. The LTV of all segments was rising as the graph below shows, but this was especially true of the high-value segment,” Ivins-Downes said.

Source: Supplied