Top stories

ESG & Sustainability#BudgetSpeech2026: SRD grant unchanged, other Sassa social grants see hike

8 hours

More news

ESG & Sustainability

South Africa’s carbon tax should stay: climate scientists explain why

Over the past 12 years managing ATI as a private training provider, I’ve observed the changing impact of market dynamics affecting the different approaches corporate companies have towards technical training. The key decisions to insource or outsource technical training needs to be reflected on, with a longitudinal view of the institutional relevance of corporate training centres. In this article, I argue that institutional relevance is linked to the commercial sustainability of a training institution, with the positive societal spin-off related to those centres’ ability to train artisans at a competitive cost.

Deciding whether to outsource technical training or not, requires a few key questions being answered. For example, understanding national and regional skills supply constraints, forecasting immediate and future industry skills demands, and weighing options for planned capacity building initiatives against provider capacity constraints. Unfortunately, the decision to build and manage training centres has often been taken during times of abundance, ignoring the time held predictability of market downturns, plus the questions raised above.

Unless business has no access to quality training providers, there is no commercial rationale for building corporate-owned training centres. This is especially relevant in South Africa, where there is a significant oversupply of underutilised training facilities. This is true for both company and private training providers. Critically, from a financial perspective, companies have to question the utility of carrying ongoing fixed costs that represent a weak balance sheet item, versus making technical skills training a variable cost. It is also prudent for them to question what business they are in: training or their core focus of mining or engineering, for example.

Illustrating, the financial decisions corporates need to consider, Andre Steyn, ATI’s Financial Director presents three comparisons:

Although the variable cost per learner for running an in-house facility is R12,629 versus R14,482 for an outsourced facility, in the unlikely representation where a training centre runs at full capacity, this monthly variable cost advantage is not sustainable. Most corporate training centres in South Africa today are operating far below 50% of their capacity.

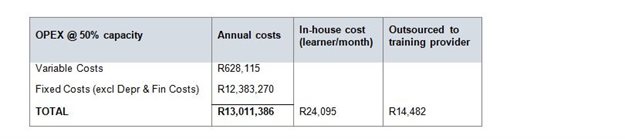

Table 2 highlights the drastic effect of the variable cost per month working at 50% of capacity. The nature of the cost structure drives the variable costs per learner to R24,095 versus R14,482.

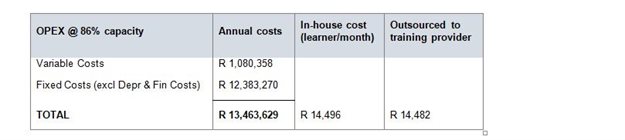

To achieve a break-even variable cost, a technical training centre must run at 86% capacity, which is difficult to achieve during market slumps.

The calculations show that a private provider’s variable cost to a company remains constant, which means capacity building costs are predictable regardless of market conditions. The graph below summarises the three scenarios and illustrates the predictable variable costs per learner instead of huge swings in operating costs per learner.

The decision to build and run in-house training centres means costs are no longer variable but more fixed.

During times of abundance, these in-house centres can play a key role in skills development; however, when revenues are constrained, the same in-house centres are seen as burdensome.

Looking to the future, companies need to carefully consider the deployment of capital in technical training initiatives to prevent the establishment of additional non-productive assets. We are also proposing a critical stocktake of existing facilities, assessing whether keeping them on the books are in the best interest of business and labour.

With more effective spending, there is the potential to allocate more purposeful funding toward training as opposed to funding capex or other fixed costs. This is more beneficial to South Africa’s labour economy over the long-term and as a business, you have the agility to scale training numbers up or down without the distraction of managing costly in-house facilities.