Top stories

Energy & MiningGlencore's Astron Energy gears up with new tanker amidst Sars dispute

Wendell Roelf 10 hours

More news

Logistics & Transport

Uganda plans new rail link to Tanzania for mineral export boost

Insight Survey’s latest South African Carbonated Soft Drinks (CSD) Industry Landscape Report 2023, carefully uncovers the global and local Carbonated Soft Drinks market, based on the latest intelligence and research. It describes the latest global and local market trends, innovation and technology, drivers, and challenges, to present an objective insight into the South African Carbonated Soft Drinks industry environment and its future.

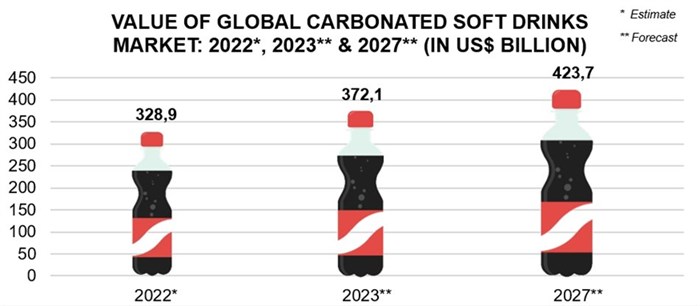

In 2022, the global Carbonated Soft Drinks market was estimated to have generated approximately $328.9bn in revenue and is forecast to reach approximately $372.1bn in 2023, growing by 11.6% year-on-year. Furthermore, as per the graph below, the global CSD market is forecast to increase by a compound annual growth rate (CAGR) of 3.3% between 2023 and 2027, to reach approximately $423.7bn by 2027.

In terms of South Africa, the local Carbonated Soft Drinks market achieved very strong growth of 15.1% year-on-year, at current prices, between 2021 and 2022. Tellingly, the Reduced Sugar Carbonates market has witnessed significant growth in the country since 2017, with a CAGR of 9.4% between 2017 and 2022, compared to 7.3% for Regular Carbonates.

The current and expected growth of both the global and local Carbonated Soft Drinks market can be attributed, in part, to the introduction of healthier CSD products, specifically those lower in, or without, sugar and caffeine. These new products and formulations are being released by market players to meet prominent consumer health trends and concerns.

For example, in the global market, in line with the recent trend towards sugar-free products and variations, The Coca-Cola Company introduced four limited-edition zero-sugar CSD products. These products were released as part of the company’s new Coca-Cola Creations global innovation platform, with each product being made available in regular and zero-sugar variants.

Furthermore, PepsiCo launched its new caffeine-free, lemon-lime flavoured CSD product, Starry Lemon Lime. In addition to being caffeine-free, this product was also made available in a zero-sugar variant. The company also released a reformulated version of its Pepsi Zero Sugar product, in order to provide consumers with an enhanced flavour for this sugar-free product.

This trend has also gained traction in the local market, with more South African brands introducing low sugar, sugar-free, and caffeine-free CSD products. Notably, the introduction of zero-sugar formulations has been identified as a key driving force for sales in the local CSD market, as consumers struggle with health concerns and players combat the local ‘sugar-tax’, with sugar-free variations.

As an example of this, Coca-Cola South Africa, which already has a number of sugar-free and low sugar CSD products available throughout the country, announced the launch of its new Coca-Cola No Sugar No Caffeine soft drink. Marketed as an ‘epic caffeine-free replacement’ for its discontinued TaB product, this product was launched as part of the company’s ‘refreshed’ portfolio.

In addition, South African Rooibos beverage brand, BOS, announced its plans to enter the local CSD market, with its new sparkling iced tea range. This range was made available in three flavours that are all caffeine-free and low in sugar, responding to consumer demands for healthier alternatives.

Additionally, PepsiCo tested its Pepsi MAX zero-sugar product, through an international 'Taste Challenge' in South Africa. In particular, the company held a blind taste test, where participants would taste two zero-sugar CSD products and identify their favourite, with Pepsi MAX zero-sugar showing strong results across the country. According to the company, the results of this challenge demonstrate its confidence in this being the ideal zero-sugar cola product.

The South African Carbonated Soft Drinks (CSD) Industry Landscape Report 2023 (111 pages) provides a dynamic synthesis of industry research, examining the local and global Carbonated Soft Drinks industry from a uniquely holistic perspective, with detailed insights into the entire value chain – market sizes and forecasts, industry trends, latest innovation and technology, key drivers and challenges, manufacturer overview, distributor overview, retail and pricing analysis.

Please note that the 111-page report is available for purchase for R35,000.00 (excluding VAT). Alternatively, individual sections can be purchased for R15,000.00 (excluding VAT). For more information, please email az.oc.yevrusthgisni@ofni, call our Cape Town office on (021) 045-0202 or Johannesburg office on (010) 140- 5756.

For a full brochure: SA Carbonated Soft Drinks (CSD) Industry Landscape Brochure 2023.

Insight Survey is a South African B2B market research company with more than 15 years of heritage, focusing on business-to-business (B2B) and industry research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer market research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.