Top stories

Energy & MiningGlencore's Astron Energy gears up with new tanker amidst Sars dispute

Wendell Roelf 10 hours

More news

Logistics & Transport

Uganda plans new rail link to Tanzania for mineral export boost

Insight Survey’s latest SA Bottled Water Landscape Report 2018 carefully unfolds the global and local bottled water markets based on the latest information and research. It examines the market drivers and restraints as well as global and local market trends to present an objective insight into the South African bottled water industry environment, market dynamics and its future.

Worldwide, the value of the bottled water market has shown meaningful growth over the last few years. Between 2014 and 2017 the market grew at a rate of 9% to reach over US$200 billion in 2017. The market is predicted to continue to grow at a CAGR of 10.7% for the period 2018 to 2023. Globally, the growth of the bottled water industry can be attributed to consumers’ increasing health concerns with regards to contaminated water, as well as rising levels of disposable incomes.

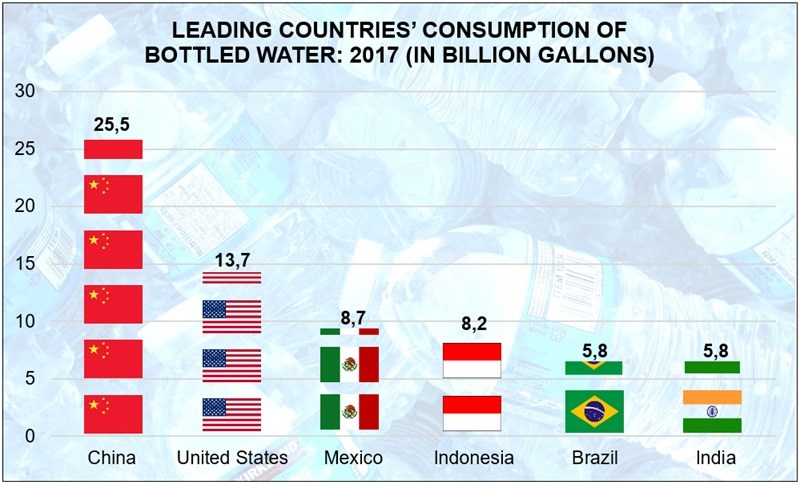

The leading countries in terms of bottled water consumption include China, the United States, Mexico, and Indonesia. In 2017, China had the highest bottled water consumption at 25.5 billion gallons.

In 2017, the value of the South African Bottled Water industry grew by 8.4% and growth in 2018 is expected to well over 10%, largely due to the water crisis in the Cape. Looking into the future, the Bottled Water market value is forecast to grow at an average compound annual growth rate (CAGR) of 8.3% from 2018 to 2022.

In South Africa, the demand for bottled water increased over the last few years as a result of municipal water quality decreasing, and the severe drought experienced in the Western Cape. After the announcement of Day Zero, there was a massive spike in bottled water sales and the December and January sales increased by 118%.

The sales of bottled water in the Western Cape have, however, since declined and return to normal. Consumers are no longer “panic buying” and many have become more water self-sufficient by installing rainwater tanks and sunk boreholes. According to Brian Austin, Pick n Pay’s head of groceries and perishables, although there was a significant increase in bottled water sales initially, the deferring of Day Zero and early stocking up of customers has resulted in the demand normalising.

The quality of municipal water in South Africa does, however, remain a concern and it is expected that certain consumers will continue to opt for bottled water in the future in order to avoid the health risks associated with contaminated water. In reality, however, most South African consumers simply cannot afford to buy bottled water regularly as it is still considered a luxury by many.

The South African Bottled Water Industry Landscape Report 2018 (111 pages) provides a dynamic synthesis of industry research, examining the local and global Bottled Water industry from a uniquely holistic perspective, with detailed insights into the entire value chain – from manufacturing and retailing to distribution, consumption, purchasing trends and pricing analysis.

Some key questions the report will help you to answer:

Please note that the 111-page report is available for purchase for R25,000 (excluding VAT). Alternatively, individual sections can be purchased for R9,000 (excluding VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (0)21 045-0202.

For a full brochure please go to: South African Bottled Water Landscape Report 2018

Insight Survey is a South African B2B market research company with almost 10 years of heritage, focusing on business-to-business (B2B) market research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B market research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.