Related

South Africa as G20 leader can take action on Africa’s food supply: 4 ways to make a difference

Wandile Sihlobo 15 Apr 2025

Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

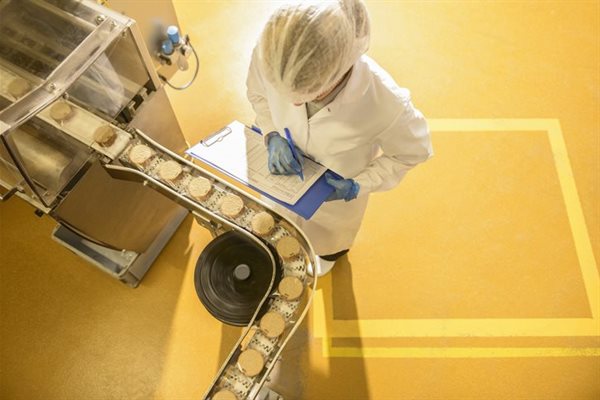

But how practical is this when some people have no way of practicing social distancing, when they have to travel in close proximity with other people in busses or taxis? Food manufacturers rely heavily on labour, and in South Africa, a lot of this labour uses public transport to get to and from work, making them more susceptible to infection.

Taking a look at Covid-19 and its effect on the fast-moving consumer goods (FMCG) industry, it is likely that losses could be made in one way or another. A labour force that is at high risk of contracting Covid-19 has a major impact on the food supply chain, which inevitably affects retailers.

Although manufacturers are doing the utmost to keep their workspaces hygienic and Covid-19 free, they have no control over what happens outside of the workplace with their workforce.

President Cyril Ramaphosa announced a nationwide lockdown, stating that only certain services may remain operational like the food industry. But how do these companies mitigate the risk of Covid-19?

Cutting down on labour through increased rotations or a decreased number of labourers working at a point in time means a shortage of supply, and this will, in turn, mean that food prices and supplies will be affected negatively. This will impact the mass market severely, with half the population (according to Stats SA 2019) living below the poverty line.

Rising food prices will likely knock more people below this line, and those who can afford food will be stretched thin, as those who can buy in bulk leave little for those who cannot. This will leave increasing numbers of South Africans with no choice but to go from shop to shop, risking exposure to Covid-19 so that they can feed their families.

That being said, food manufacturers who depend on suppliers for their raw materials may choose to stockpile in the event that their suppliers cannot food supply needs. In such instances, suppliers may require payment upfront, which affects the cash flow and working capital of food manufacturers.

The drastic decline of foot traffic in shopping malls following the lockdown inevitably means that stores will make losses. The consequence of this is that smaller retailers may not remain sustainable, leading to job losses and permanent closures.

Social distancing has encouraged online shopping as a means of mitigating contracting the virus. Although Covid-19 has its negative consequences, a positive consequence would be a boost for online retailers. Online shopping is convenient, open 24/7, and gives shoppers more time to engage in other activities.

According to Moneyweb, e-commerce in South Africa grows by 20% to 35% annually. With a pandemic on our hands, this will likely increase this year. Even with a lockdown in effect, some online stores remain fully operational.

As more people become attached to online shopping, brick and mortar stores will be placed under great pressure to compete.

Over and above this, the effect of empty stores in a shopping mall regrettably impacts the valuation of a property as one of the key inputs into valuing a property is the rental stream and the vacancy rates. It is unclear how valuations will look once people are allowed back in shopping malls. Retailers need to make contingencies for slow or no uptake once doors are open.

South Africa tends to be very resilient in times of crisis and tends to work together as a country to pull through it. We encourage our clients to be responsible and realise that their people are their most valuable assets.

This article is an excerpt from BDO South Africa's e-book The Clarity Report: Business Impacts of Covid-19.