Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

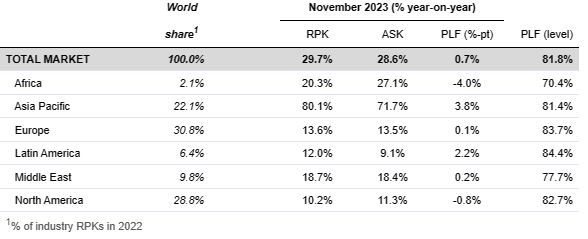

The report reveals a 29.7% rise in total air traffic for November 2023, measured in revenue passenger kilometres (RPKs), when compared to the same period in the previous year. At a global scale, air traffic has now reached 99.1% of the figures recorded in November 2019.

International travel experienced an upswing, showing a 26.4% increase compared to November 2022. The Asia-Pacific region emerged as a standout performer, boasting an impressive year-over-year growth of +63.8%. Across all regions, there is a positive trajectory, with November 2023 international RPKs reaching 94.5% of the pre-pandemic levels in November 2019.

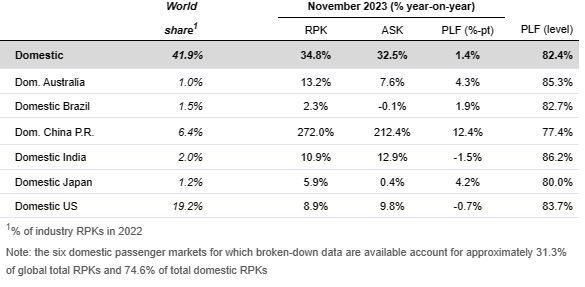

Domestic travel exhibited robust growth in November 2023, witnessing a substantial 34.8% increase compared to the same month in the previous year. Notably, the total domestic traffic for November 2023 surpassed the November 2019 levels by 6.7%.

The recovery was particularly remarkable in China, which reported a staggering +272% growth, rebounding from the Covid-related travel restrictions in place a year earlier. Additionally, the United States experienced a surge in domestic travel, reaching new heights with a +9.1% expansion over November 2019, fueled by strong Thanksgiving holiday demand.

"We are moving ever closer to surpassing the 2019 peak year for air travel. Economic headwinds are not deterring people from taking to the skies. International travel remains 5.5% below pre-pandemic levels but that gap is rapidly closing. And domestic markets have been above their pre-pandemic levels continuously since April," says Willie Walsh, Iata’s director general.

African airlines had a 22.1% rise in November RPKs versus a year ago. November 2023 capacity was up 29.6% and load factor fell 4.3 percentage points to 69.7%, the lowest among regions.

Asia-Pacific airlines' had a 63.8% rise in November traffic compared to November 2022, which was the strongest year-over-year rate among the regions. Capacity rose 58.0% and the load factor was up 2.9 percentage points to 82.6%.

European carriers’ November traffic climbed 14.8% versus November 2022. Capacity increased by 15.2%, and load factor declined by 0.3 percentage points to 83.3%.

Middle Eastern airlines saw an 18.6% traffic rise in November compared to November 2022. November capacity increased 19.0% versus the year-ago period, and the load factor fell 0.2 percentage points to 77.4%.

North American carriers experienced a 14.3% traffic rise in November versus the 2022 period. Capacity increased by 16.3%, and load factor fell 1.4 percentage points to 80.0%.

Latin American airlines’ November traffic rose 20.0% compared to the same month in 2022. November capacity climbed 17.7% and the load factor increased 1.7 percentage points to 84.9%, the highest of any region.

"Aviation’s rapid recovery from Covid demonstrates just how important flying is to people and businesses. In parallel with aviation’s recovery, governments recognised the urgency of transitioning from jet fuel to Sustainable Aviation Fuel (SAF) for aviation’s decarbonisation. The Third Conference on Aviation Alternative Fuels (CAAF/3) in November saw governments agree that we should see 5% carbon savings by 2030 from SAF.

"This was followed up at COP28 in December where governments agreed that we need a broad transition from fossil fuels to avoid the worst effects of climate change. Airlines don’t need convincing. They agreed to achieve net zero carbon emissions by 2050 and every drop of SAF ever made in that effort has been bought and used.

"There simply is not enough SAF being produced. So we look to 2024 to be the year when governments follow up on their declarations and finally deliver comprehensive policy measures to incentivise the rapid scaling-up of SAF production," said Walsh.