Top stories

More news

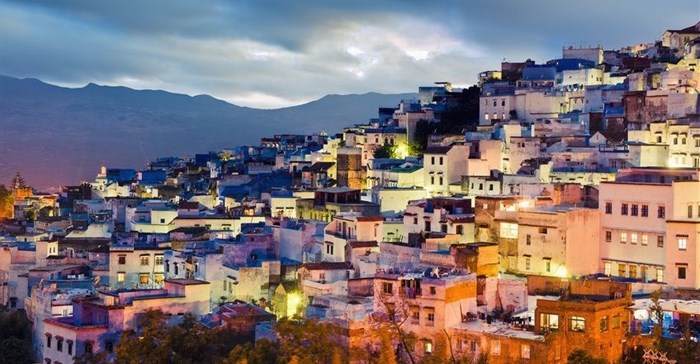

The pan-African property group wants its Moroccan assets to be managed in a separate unit in North Africa. Morocco is seen as being a widely separate market from other African markets by various global institutions.

"We have been aggressively pursuing the conversion of our Moroccan subsidiary for some time now," said Mara Delta CEO Bronwyn Corbett, speaking after the release of its full-year results to June.

"There are numerous direct and indirect benefits associated with a Reit structure, such as a more effective tax structure. Property Reits are well understood by the international market, which bodes well for our ability to attract additional investors," she said.

"Our strategy is to systematically expand across Morocco, and the Reit structure will allow for more cost-effective options ... Ultimately, we may list the structure on a recognised stock exchange to extract further value and opportunities for shareholders."

Moroccan Reit legislation requires an external asset manager to undertake the management of any Reit operating in the country.

"To address this, Mara Delta has formed an asset manager, Morocco Reit Management SA, as part of its conversion of the Moroccan Fund into a Moroccan Reit. Mara Delta will hold a 20% stake in the asset manager," the company said.

Grindrod Asset Management's chief investment officer, Ian Anderson, said creating the Reit structure for Mara's Moroccan assets would eliminate tax leakages from their income.

"One of the problems faced when acquiring properties in some non-SA jurisdictions is that taxes are usually paid before the income is remitted back to SA. That is currently the situation with Mara Delta's operations in Morocco," he said. "Creating a Reit which is exempted from paying taxes means there is no tax leakage to the Moroccan authorities before the net income is remitted to SA. At some point, Mara Delta could list the Moroccan Reit and raise capital from shareholders in other jurisdictions, including Europe."

Mara Delta declared a final dividend of 5.58 US cents per share for the year to June.

This represented distribution growth of 4.1%, in line with management's guidance of between 3% and 6% on the prior year's distribution.

Nesi Chetty, a fund manager at MMI Investments, said Mara Delta's performance had improved in the period.

"Things are looking slightly better now, and 4% plus growth is decent in the current environment. Still, it is tough to do deals in some of the African countries where they operate.

"Yields have come down on some of their office assets, but at least they are still raising capital at a slight premium to net asset value," he said.

Source: Business Day

For more than two decades, I-Net Bridge has been one of South Africa’s preferred electronic providers of innovative solutions, data of the highest calibre, reliable platforms and excellent supporting systems. Our products include workstations, web applications and data feeds packaged with in-depth news and powerful analytical tools empowering clients to make meaningful decisions.

We pride ourselves on our wide variety of in-house skills, encompassing multiple platforms and applications. These skills enable us to not only function as a first class facility, but also design, implement and support all our client needs at a level that confirms I-Net Bridge a leader in its field.

Go to: http://www.inet.co.za