Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

Today, diversification includes property investments across various global markets, including Europe, United Kingdom and Africa, as well as exposure to Australian real estate through shareholdings in offshore property companies.

Investors face a new reality when buying SA listed property shares. Investments in locally listed property offer investors exposure to property investments outside of South Africa (SA). On average, SA-listed property portfolios have diversified so much so, that more than 25% of investments in the sector are situated beyond SA's borders.

Property companies such as New Europe Property Investments (NEPI) and Rockcastle have portfolios that are entirely invested outside of SA, while the local diversified portfolios of Growthpoint and Redefine have 25% and 16% invested offshore exposure respectively.

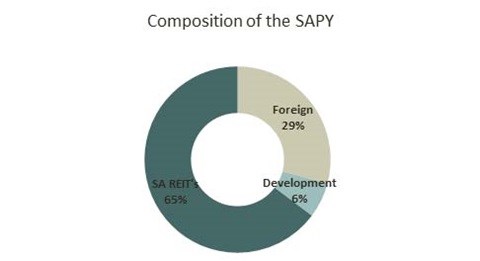

Of the 20 companies in the FTSE/JSE SA Listed Property Index (SAPY), 12 have diversified into offshore property investments with eight of the largest ten companies by market capitalisation offering at least some offshore exposure. The biggest currency exposure is to the euro, thanks in part to NEPI's investments in Eastern Europe.

Diversification of this nature appeals to SA investors, as it provides a currency hedge against the rand. While the net income yield on offshore investments is generally lower than in SA, favourable low funding rates can provide yield enhancement on equity. However, the growth potential of these investments is generally lower than in SA, given the very low inflation environment.

A further diversification to the SAPY is the inclusion of development companies, Attacq and Pivotal, which now make up 6% of the index. These companies earn development profits, as well as rental income on their portfolios. However, they do not distribute income to investors, but reinvest the income into new developments, boosting capital growth. The effect on the SAPY is an unwitting reduction in the overall income yield.

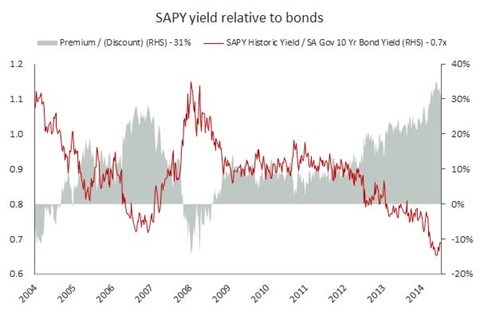

There has been much debate in recent weeks over current pricing of the listed property sector, with critics citing the premium to bonds as evidence that the sector has become too expensive. When comparing the SAPY historic yield of 5.6% with the SA 10-year government bond of 8.2% (at 30 June 2015), the listed property market does appear expensive, as per the graph below. (Note: The distribution yield is calculated as the ratio of the annual distribution over the last 12 months to the price per share, so that as the distribution yield falls, the sector is deemed to be more expensive.)

In the past two years, listed property has become more expensive relative to long bonds for a number of reasons. The search for yield with good growth gives listed property a material advantage over bonds, and the effect of quantitative easing on the local property yields as cheap money floods the market has been evident. Given that the local property market is relatively well hedged in terms of debt over the medium-term, a sovereign rating downgrade would affect the bond market more significantly.

However, the current premium of 31% that listed property trades over long bonds has sounded alarm bells with market commentators decrying listed property valuations. The increasing weighting of foreign property investments and new development companies in the SAPY requires a reconstitution of the composition of the index when comparing historical perspectives.

When offshore and development holdings are excluded from the SAPY, the net result provides a clearer understanding of the actual yield being achieved on local property. The forward yield on the property sector increases from 6.1% to 7.1%, resulting in a 1.1% spread (or a 13% premium) to the bond yield. This means investors are paying for 24 months additional income growth upfront, which seems reasonable in an investment world searching for income yield and growth in income.

SA faces a number of headwinds and economic growth is likely to continue to disappoint in the short-term. In this environment, the opportunity to access growth via offshore diversification, yield accretive transactions and management expertise in sweating assets is valuable and demands a premium. Few other investments, whether locally or globally, offer the attractive combination of a high initial yield, as well as income and capital growth that property does.

While growth is expected to taper from recent levels in the medium term, Metope maintains that the sector's premium to bonds is justified at current levels.