The government as part of its on-going retirement reform process continues to design policies aimed at encouraging South Africans to save and make adequate provision for their retirement.

Hugo Malherbe

In its latest effort, the regulator has changed the tax treatment of contributions to retirement funds and simplified its calculation. As of the beginning of the current tax year (1 March 2016), the maximum tax deduction for all cumulative annual retirement contributions (whether into a retirement annuity fund, a pension fund or a provident fund) has increased to 27.5% of remuneration or taxable income - up to an annual maximum tax deduction limit of R350,000.

Previously the tax deduction for contributions to retirement annuity funds was limited to 15% of non-retirement funding income, so now there is an excellent opportunity to claim a much higher tax deduction by contributing more to a retirement fund. Increasing your monthly contribution to your retirement fund, or alternatively topping up your retirement annuity (RA) to the maximum allowable limit before the end of each tax year can make a significant difference to your retirement savings and boost your tax savings.

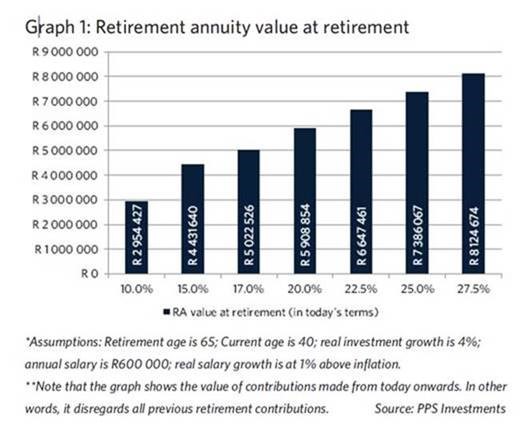

As Graph 1 illustrates, by increasing your total RA contributions from 15% to 27.5% per year, you have the potential to boost your retirement savings to R8.1 million instead of R4.4 million. This scenario is specific to the example provided and will change depending on how much you’re contributing and how long you have left to retirement.

Of course, you can decide whether to take the leap from investing 15% to 27.5%, or gradually increase your percentage from year to year. Additional contributions can be made monthly, and spread over the year, or annually when you have extra lump sums.

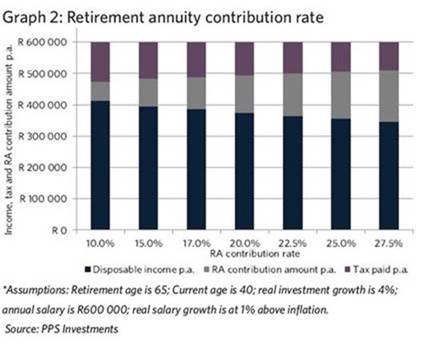

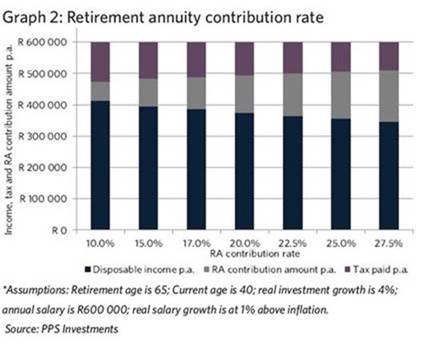

Due to the tax deductions on contributions, the impact on disposable income is much lower than expected. Graph 2 also illustrates that the greater the RA contribution, the less tax is paid. Investors that are concerned about the short-term impact of higher retirement savings contributions to disposable income, could consider smaller incremental increases. For example, a 2%, increase in retirement savings from 15% to 17% of disposable income, can make a significant difference to the growth of your retirement savings (e.g: R590,000 more by retirement, as illustrated by comparing Graphs 1 and 2).

Even though you may be contributing to an employee retirement fund, it doesn’t mean that you can’t benefit from the tax advantages of contributing to an additional retirement savings vehicle. Some individuals who already contribute to an employee retirement fund may have opted not to contribute to an additional retirement fund given the difficulty, under the previous regulation, to determine whether contributions to the additional retirement vehicle fund qualified for tax deductions. The new regulation removes this complexity, encouraging more investors to take control of their own retirement savings outside of employee schemes and invest additional amounts into retirement annuity funds.

Should you be investing more into your RA this tax year?

Now is an opportune time to determine how much you should be adding into your retirement annuity before the end of the tax year to take advantage of tax breaks. The 2016/17 tax year ends on 28 February 2017. This means you only have a very short while to maximise the contributions you make to your RA fund and use tax legislation to your advantage to boost your retirement savings. To calculate how much you can boost your tax return, go to the Investment Tools page on PPS Investments.