#BizTrends2017: Connecting Africa in 2017

Social platforms, chat apps and video content are now where the majority of people spend their time, because internet users primarily want one thing: to get their dose of content and people all in one place.

Hence why social apps like Facebook and Instant video have been so successful, they slot in a context where people can continue to access content and chat to their friends. Any 'interruption' that doesn't fit into this model is bound to annoy and dis-engage, unless the utility value brought is disproportionately high.

‘Digital is everything – not everything is digital?’ was the theme at dmexico, Europe’s biggest trade fair for digital marketing, which took place in Germany this past September. It resonated with me as I have seen this within the statistics across our SSA region.

The facts speak for themselves

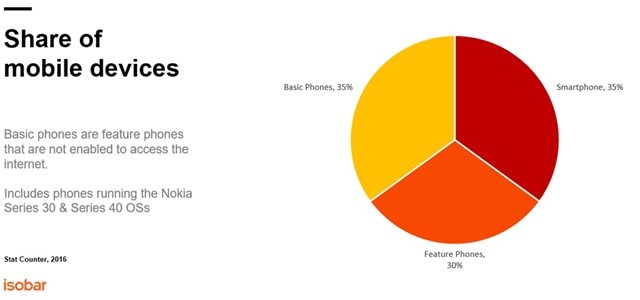

With reference to the graph below, the share of mobile devices is fairly evenly distributed, showcasing that 65% of the 186.9 million Nigerian population are interacting online. According to research conducted by the GSMA, “46% of the population in Africa subscribed to mobile services, equivalent to more than half a billion people. The region’s three dominant markets – Egypt, Nigeria and South Africa – together accounted for around a third of the regions total subscriber base.”

At Dentsu Aegis Network, we have been future proofing our business and pushing our vision of 100% digital by 2020. As mobile and internet adoption in Africa rises, the amount of mobile internet subscribers tripled in the last five years to 300 million by the end of 2015, with an additional 250 million expected by 2020 according to the GSMA. This is why our investments in digital and hiring the correct people are at the core of our plans for the future.

The increase in mobile subscriptions and number of feature phones and smartphones, is attributed to a number of factors. In certain regions the declining data cost - specifically in Nigeria, where they currently pay on average $1.65 for 1GB of data; with Tanzania having extremely affordable data costs of R14 per Gig; and the cost of data in Ghana, it is GHS0.0225 per megabyte. Due to the data cost becoming more affordable, the consumers’ online presence will escalate and opportunities for brands to interact with them will become more prevalent.

The average selling price of smartphones across Africa has dropped dramatically. Notably with low income groups, affordability has always been an obstacle which stops those in rural areas from owning and using internet devices and services. Telecommunication giants have dramatically reduced cost on smartphones, one example of this was MTN Nigeria, offering two smartphones for less than $50. The Orange Rise 31, includes a bundle with three months’ worth of voice minutes, SMS and data as stated by GSMA. These types of bundles and costs have taken strides in overcoming the affordability barrier.

Although voice and SMS still account for the major revenue and have continued to be resilient, the ever looming threat of IP-based services is changing at a rapid rate owing to the adaption of smartphones and access to mobile broadband being cheaper and accessible. With this being said, apps like WhatsApp, Viber and Skype are truly taking a prominent place in the communications landscape. This is why it is crucial for communications/media businesses to ensure their capabilities and tools are able to keep abreast with the changing African consumer.

The power of localisation: tech start-ups

Mobile is the go to platform for generating, distributing and consuming innovative digital solutions and services in Africa. There are many reasons for this which have been outlined, such as the growth of advanced mobile networks, the growth and adoption of smart devices, people seeking rich content whilst on the move, and the lack of any other alternative.

Even though global businesses such as Facebook and Google have tried to localise their offering to reach the tech generation consumer, the need for local solutions that speak and appeal to locals which address their unique needs, socially, and the economic difficulties the consumers face, can only be combated with a niche understanding of their landscape. Global businesses are increasingly challenged as agility can be more easily achieved by local businesses or small local tech start-ups.

Technology hubs and start-up investments in Africa have increased drastically, with the range of tech start-ups funded and sizing of deals showcasing the development of this growing ecosystem. The GSMA stats found that in 2015, 125 African tech start-ups raised approximately $185 million, with Kenya, Nigeria and South Africa gaining more than 80% of the funding. Even though this amount is miniscule in comparison to the 27.3 billion raised by start-ups globally in 2015, this has displayed the need for more investment to fund start-ups in Africa.

With the number of acquisitions in this past year alone, Africa is going to see a rise in investments, as we see more potential to grow our operating model in the region, through digital and creative hubs. Our business also sees the need to invest in start-ups. In September last year the decision was made to not acquire, but open Isobar, the global full service digital marketing agency in Kenya. Kenyan creativity was meeting high-tech and clients in Kenya were thirsty for award winning creativity and digital expertise. Making these critical decisions and seeing the need to invest at crucial times in a market, gives your business the ability to meet the need and truly innovate.

Recent statistics say that there are approximately 310 active tech hubs across Africa, with 180 accelerators or incubators, according to the GSMA. The diversity in the tech start-ups that were given funding and the size of the deals showcase the huge developments of this network. The attraction to Africa for its wealth of opportunities to innovate without stringent rules and regulations, as opposed to other first world countries makes Africa open to creating and innovating on an astronomical level.

The major players and kingpins

Operating in a globalised world, we cannot ignore that the majority of spend from brands for digital advertising is with Google and Facebook. They both have identified that Africa still has a large proportion of untapped internet users and with advertising budgets moving to digital marketing, their presence will continue to rise. The majority of spending by brands on digital advertising is going to Google and Facebook and together, they accounted for 75% of all new online ad spending in 2015, according to the Internet Trends report published this month by Mary Meeker of Kleiner Perkins Caufield & Byers, the US venture capital fund. In the US, 85 cents of every new dollar spent on digital went to the two companies in the first quarter of 2016.

Digital is rapidly becoming advertising’s biggest source of revenue. Although television still holds a large portion of the pie in Africa, in the US, digital spend will soon overshadow television in the US come 2017, according to eMarketer.

The explosion of video

Going hand in hand with the increase of mobile sales and internet adoption rates, is the ever growing video consumption across the SSA region. The media world has changed drastically; it is now convergent, interconnected and fully transparent to technology and is therefore measurable. This shift in media has caused everyone to re-evaluate and think beyond initiated transactions, emails, push notifications and traditional advertising. Rather, businesses need to be thinking about live connections, coherent ecosystems, emotions translated into data, people and dynamics.

The proliferation of smart devices across all markets has seen a change in how content is consumed and how attention shifts throughout the day. When we look at video consumption across the major online networks (Google, YouTube, Facebook, Twitter etc.) the stats are frightening.

This is driven largely by internet enabled devices, compounded by Generation Y and Generation Z, who are making sure that this trend accelerates. The explosion of screens has resulted in the fact that consumers are always on, 24/7. It is a reflection of how consumers’ media behaviour has changed, since the paradigm shift of internet-enabled communication.

The new consumer is converged, fully-integrated through multi-media and multi-screen. From the below visual on the Nigerian consumer it is evident that the combination of Live TV and smartphones, delivers 64% share of time spent on video content consumption. Leveraging a combination of broadcast content and smartphone content will deliver highest impact for video content.

In Ghana video content is equally consumed from traditional and online sources, with the majority online being those aged 16-24. 48% of Ghanaians consume TV whilst 52% consume online videos. Average time on TV is 1.5hrs/day and average time on online video 1.65hrs/day, according to TNS Connected Life Research.

Programmatic media buying will be an even bigger player come 2017, as it is about leveraging technology that can assist marketers in reaching the most relevant audiences for a specific product or service. Analysing video consumption rates such as the above give marketers a well-rounded insight into when campaigns need to go live.

This allows the planning, execution or buying and optimising of advertising campaigns to be done in the most effective ways using real time data to guide the next decision in a campaign, e.g. indicate which creatives are working the best, or easily refine a media plan to only target the top five placements that delivered the best results over the past 24 hours.

Millennials are video crazy, no longer is the brand the hero of the marketing narrative. Continuing into 2017, one needs to make young people the heroes of the brand story. This means giving them the tools to tell their own story, with 38% of Kenyan ‘how-to’ videos created by 18-21 year olds. Brands need to understand this shift and how to adapt their strategies accordingly.

Video will continue to rise in 2017. Having more affordable smart, cheaper data cost, simplicity of content creation and video technology all aid the era of video playing an even larger role in marketing than ever before. Traditional TVC’s are broadening their spectrum to online and the competition between traditional TV and online will continue to escalate. The likes of Netflix and Showmax are still trying to gain traction in Africa, but improved infrastructure and connectivity will certainly increase going into 2017.

With the explosion of meme’s, images, videos, civilian journalism, ‘how-to videos’ generated by the consumer themselves, it is going to be tough for brands to get the attention and engagement of the consumer. If your business or brand wants to play in the video space, it will have to be something completely different and better, to go up against the rest.

Science in the art of data and analytics

Marketers and creatives can no longer create beautifully created PPT’s and creative presentations without solid data and the science of analytics. Having a fleet of tech tools will optimise your digital technology to track user behaviour, engagement across multiple channels and recognise purchase intent. Consumer data is priceless in making the best decisions for any brand. Having access to the best tools in analytics will be a matter of necessity going into 2017.

The digital economy is the economy

The pace of change is relentless, customers don’t buy brands anymore, they join brands, and those which embrace it the most within their industry are the ones that are going to survive. Digital transformation means that we can change the way that people experience our brands like never before. The next five years are going to be a constant state of change, data is becoming a new currency and if a company cannot adopt to test and learn to quickly launch products to the market, those companies will be left behind.