Both globally and locally, there has been a steady increase in the number of influenza cases during flu seasons, which has been accelerated by the removal of Covid-19 lockdowns and restrictions, whilst flu seasons have also been starting earlier than usual across different regions. The expected strains of influenza are being considered a major public health concern, due to its severity, resulting in the launch of new cough, cold and flu products aimed at meeting the anticipated demand amongst consumers feeling under the weather.

Insight Survey’s latest South African Cough, Cold and Flu Remedies Industry Landscape Report 2023, carefully uncovers the global and local cough, cold and flu market, based on the latest intelligence and research. It describes the latest global and local market trends, innovation and technology, drivers, and challenges, to present an objective insight into the South African cough, cold and flu industry environment and its future.

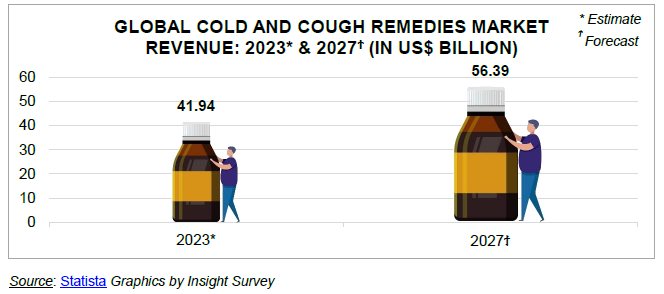

In 2023, the global cold and cough remedies market (also referred to as the cough, cold and flu market) is estimated to achieve a revenue of approximately $41.94bn. Furthermore, the market is forecast to increase at a compound annual growth rate (CAGR) of approximately 6.1%, to reach a value of approximately $56.39bn by 2027, as illustrated in the graph below.

This growth in the global market is also evidenced locally, with the South African cough, cold and flu market experiencing growth of 8.5% year-on-year, at current prices, between 2021 and 2022, as well as forecast compound annual growth of 8.0% for the forecast period 2023 to 2027, in retail value RSP terms. This strong current and predicted growth is being driven, in part, by unusually severe flu seasons, which is driving demand for cough, cold and flu products.

Globally, health experts have indicated that, following the pandemic, the 2023 flu season presents a major public health crisis, due to the collision of influenza, Covid-19, and RSV, which experts are calling the ‘tripledemic’. This resurgence and severity of cases has led to a trend towards anti-infectives and a resulting influx of innovative cough, cold and flu products, and research, to help consumers prevent and treat infection.

As an illustration, an innovative research trial began in the United Kingdom, which intends to use Covid-19 lessons to swiftly identify new and effective treatments for people who are being hospitalised with severe flu. There has also been a host of product launches, such as Haleon‘s Theraflu Max Strength product, Mucinex’s HBP Cough & Chest Congestion Liquid Gel, Marie Original’s Sinus Congestion spray, as well as Hylands Naturals’ Baby Cough & Immune Daytime syrup. These products are all targeted for cough, cold and flu symptoms and have been released ahead of the anticipated severe flu season.

In terms of the local market, in early June 2023, the South African Department of Health alerted the public of an increasing circulation of influenza around the country, which has been experienced since the beginning of May 2023. In particular, the department was notified of this rise in cases by the National Institute for Communicable Diseases (NICD), with reports of influenza clusters being increasingly received in schools and workplaces.

Amidst the rise in cold and flu cases, as well as the increased severity of these cases, there have been new product launches in the South African market, as industry players look to meet the expected strong demand for cough, cold and flu products.

For example, in September 2022, iNova Pharmaceuticals released an additional product to its Pholtex brand, namely its new Pholtex Mucus 200 effervescent tablet. This product assists with the relief of respiratory conditions associated with excessive mucus production. More specifically, this product contains 200mg of N-Acetylcysteine, which is used as a mucolytic to break down and thin mucus, making it easier to clear out the airways.

Additionally, in May 2023, Vicks South Africa introduced a new product to its Vicks Vapolozenges range, namely Vicks Vapolozenges + Immune Support. This product is available in two flavours, orange menthol and blackcurrant menthol, and is helpful in the temporary relief of a sore throat, cough, and blocked nose. Moreover, this product has the benefit of providing additional immune support, as it contains immune-boosting ingredients, such as vitamin C and Zinc.

Furthermore, to help meet the anticipated demand for products to treat flu symptoms, Dis-Chem introduced its new WhatsApp chat line service, which provides further convenience for customers to obtain their cough, cold and flu remedies. Specifically, this new offering allows Dis-Chem customers to access their required medication quickly and easily, among other services.

The South African Cough, Cold and Flu Remedies Industry Landscape Report 2023 (103 pages) provides a dynamic synthesis of industry research, examining the local and global cough, cold and flu remedies industry from a uniquely holistic perspective, with detailed insights into the entire value chain – market sizes and forecasts, industry trends, latest innovation and technology, key drivers and challenges, as well as a manufacturer and distributor overview, retail and pricing analysis.

Some key questions the report will help you to answer:

- What are the key market dynamics of the global and South African cough, cold and flu remedies industry?

- What are the latest global and South African cough, cold and flu remedies industry trends, innovation and technology, drivers, and challenges?

- What is the South African cough, cold and flu remedies market size value and volume trends (2017-2022), and forecasts (2023-2027), as well as channel distribution?

- Which are the key manufacturers, distributors and retailers in the South African cough, cold and flu remedies industry?

- What is the latest company news for key players in terms of products, new launches, and marketing initiatives?

- What are the prices of popular OTC cough, cold and flu remedy brands/products across South African retail pharmacies?

Please note that the 103-page full report is available for purchase for R35,000.00 (excluding VAT). Alternatively, individual sections can be purchased for R15,000.00 (excluding VAT). For more information, please email az.oc.yevrusthgisni@ofni, call our Cape Town office on (021) 045-0202 or Johannesburg office on (010) 140- 5756.

For a full brochure: South African Cough, Cold and Flu Remedies Industry Landscape Brochure 2023.