The retail bonanza of Black Friday has traditionally been the start of the Christmas shopping season in the US. The day occurs on the fourth Friday of November following Thanksgiving Thursday. The 'black' refers to turning a profit, that is, retailers making profits as opposed to being in the 'red'.

Black Friday has been a North American shopping event since the middle of the previous century. Starting in Philadelphia in the 1950s, city authorities referred to Black Friday as the day that scores of shoppers swamped Philadelphia’s shops after Thanksgiving and ahead of the annual Army-Navy football game held during the subsequent weekend.

South African retailers Takealot and Checkers both claim to have debuted the concept of Black Friday in South Africa in 2012 and 2014, respectively. Takealot is generally regarded as the local pioneer of online Black Friday, with Checkers being the first to do so in brick-and-mortar format.

Irrespective of its domestic origins, Black Friday is a cash cow for local retailers. BankservAfrica (the continent’s largest automated payments clearing house) recorded R2.5 billion worth of transactions on Black Friday in 2o17. The 4.7 million card transactions that it cleared on the Friday were double the daily average.

In line with this data, Nielsen found that Black Friday resulted in a sales boost of more than R1.3 billion in the fast moving consumer goods (FMCG) sector. On a broader scale, data from Facebook indicates that Black Friday is the busiest online shopping day in South Africa. Survey data shows that nearly nine out of 10 South Africans know what Black Friday is.

Black Friday is different from other seasonal sales that aim to sell old stock: this promotion is about selling high volumes of in-demand products. As a result, market and consumer information company GfK South Africa again expects good growth in Black Friday retail sales this year.

As of Monday, 19 November, local digital marketing specialists Nichemarket were listing confirmed Black Friday promotions by 278 goods and services companies across 26 spending categories.

Internet and social media insights

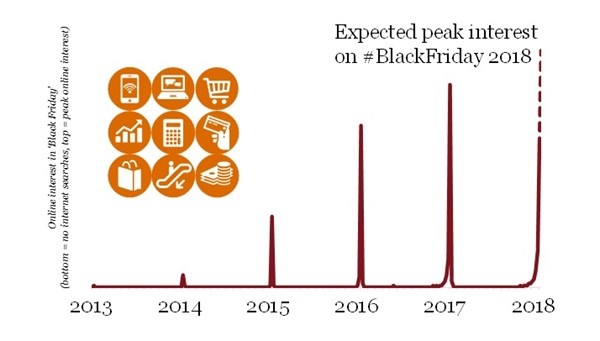

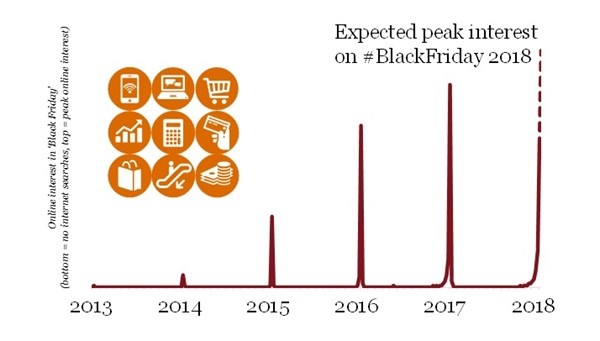

The accompanied graph indicates that online interest in Black Friday was still limited by 2014 before picking up notably in 2015. It has become a mega shopping phenomenon over the past two years and PwC Strategy& expects continued growth in interest during the week of Black Friday 2018.

Continued increase in online interest about Black Friday amongst South Africans. Source: PwC Strategy& calculations based on Google Trends data.

In order to understand the social media exposure and reach (also referred to as views) of the shopping bonanza, PwC Strategy& conducted a high-level analysis of tweets over the period 14 November to 20 November. The analysis of several hashtags related to Black Friday found that Twitter reach increased from 2.4 million views on November 12th to 47.2 million on the 20th of the month.

The trending themes are, unsurprisingly, captured in keywords such as “amazing deals”, “Black Friday tips”, “mall” and “surprises”. With these positive enforcements seeing as much combined exposure as the official #BlackFriday tag, the event could be interpreted as generating much anticipation and happiness amongst social media users and customers.

Social media analysis can look beyond the volume and themes of tweets and consider this sentiment. According to the tweet analysis, some 67% of Twitter sentiment towards Black Friday was positive over the period. This is in line with a survey by global discount website Picodi.com finding that nearly two out of three South Africans will be taking part in Black Friday this year.

Only 5% of tweets were negative, with the remaining 28% classified as neutral. An example of a more downbeat message – yet very valuable in the local context – was a tweet from the South African National Police Service (SAPS) indicating a higher threat of crime during the day. Indeed, many websites offering tips about how to make the most of Black Friday warns consumers about the risk of exploitation by criminals and unscrupulous retailers.

Black Friday will be different this year, morphing into Black November

Some 54.6% of South Africans took part in Black Friday last year, with the Picodi.com survey finding that 66.5% will be taking part this year. Respondents indicated that they are planning to spend on average R1,654 on their Black Friday purchases in 2018.

Some 64.4% of survey respondents indicated that they will be buying at both online and in brick-and-mortar stores this year, compared with just 39.6% in 2017. This reflects a diversification trend in client activity that has resulted in South African online retail growing by 25% in 2017 with a forecast rise of 25% in 2018 as well.

In order to benefit from changing buying patterns, retailers are extending their Black Friday offerings to a week or more leading up to the day and the days thereafter, including the ensuing weekend leading up to Cyber Monday.

Retailers are also responding to the fact that Black Friday generally occurs ahead of private sector payday on the 25th. While salaries are likely to be paid out on the 23rd this year due to the 25th falling on a Sunday, this is the exception. (Black Friday falls on the 23rd this year – the earliest since 2012.)

It has been suggested that South African retailers should collectively reschedule Black Friday to after the 25th. However, this is unlikely to happen, as local companies would risk losing business to international Black Friday promotions that would continue on the day after Thanksgiving.

The expanding of the day into a long weekend and, in some cases, weeks-long sales has seen Black Friday morph into what PwC consumer experts have referred to as ‘Black November’. Furthermore, a larger number of shopping days during the month has seen Black November shift holiday shopping earlier.

Nonetheless, Black Friday is also seen as an opportunity to stimulate sales in December. The November event drives visits and footfall at online and brick-and-mortar shops that exposes consumers to the products available in these facilities. Retailers have the opportunity to use this traffic for advertising and to keep consumer conversations going heading into the Christmas shopping season.

Black November – as opposed to a singular day – allows for improved logistics management as the demand for stocking and delivering products is spread over a longer period. Some retailers have been working since February this year to get their processes in order for Black Friday 2018.

There has also been an associated increase in port traffic as retailers increase their international purchases earlier in the calendar year. Container volumes, which previously peaked in November, is now expected to have peaked in September already.

For companies of all sizes, the risk of website downtime, stock shortages and a lack of capacity at call centres are real risks this week. Retailers are challenged by short-term needs – getting customers in and out – with long-term reputational challenges of service delivery falls short. This has seen companies step up their customer service activity leading up to Black Friday.

The earlier preparation and launch of Black Friday deals is also reflected in online interest. Google Trends data indicates that up until 2016, online searches in South Africa for “Black Friday” were limited to the month of November. There was increased interest from October 2017, while this year’s online interest started in September already.