Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

![Derek Engelbrecht, Partner: Consumer products & retail sector leader at EY.<p>Picture: [[https://www.linkedin.com/in/derek-engelbrecht-187a351 LinkedIn]](https://biz-file.com/c/1606/347941.jpg)

Derek Engelbrecht, consumer products & retail sector leader of EY, said: "An involuntary build-up of stock levels during the previous quarter and sustained weak volume growth in 2016Q2 prevented many retailers from hiking their selling prices in line with their earlier expectations. The subsequent erosion of profit margins - coupled with the sombre outlook for the domestic economy and retailers' expectations that sales growth will wane further in 2016Q3 - in all likelihood weighed heavily on retailer confidence."[1]

Retail sales data from Statistics South Africa show that the growth in retail sales volumes held up remarkably well during 2015 amid a confluence of adverse economic developments, including low business confidence levels, weakening employment growth, rising interest rates, tighter credit conditions and an increase in the household tax burden.

According to Statistics South Africa, the growth in retail sales volumes improved from 2.8% year on year (y-o-y) in 2015Q1 to a sturdy 3.8% y-o-y by 2015Q4. With average annual volume growth of more than 4% in 2015, hardware retailers - who benefitted from an increase in home renovations and load shedding-related sales - and clothing, textiles and footwear retailers fared particularly well last year. However, the growth in total retail sales volumes eased from 3.8% y-o-y in 2015Q4 to 3.5% in 2016Q1, with only 1.5% y-o-y recorded in April 2016.[2]

Results from the latest EY/BER Retail Survey suggest that the growth in retail sales volumes slowed further during 2016Q2, with durable goods (e.g. furniture, household appliances, hardware and electronics goods) in particular taking a knock. Engelbrecht pointed out that "Durable goods typically have a high import content and a greater sensitivity to changes in debt financing costs and consumer confidence levels. It was therefore to be expected that the dramatic depreciation in the rand exchange rate, rising interest rates and low consumer confidence levels would translate into weaker durable goods sales volumes. In addition, the DIY boom that started in 2014 now seems to be fading, and hardware retailers are no longer deriving support from sales of products used during times of load shedding."

Semi-durable goods retailers (e.g. clothing, footwear, toys and sporting equipment) also reported low sales growth during 2016Q2. "With the late start to winter compounding the adverse impact of tighter credit conditions and slowing disposable income growth on clothing and footwear sales volumes, it appears as though semi-durable goods retailers were forced to slash profit margins in order to prop up sales volumes," said Engelbrecht. In all, the business confidence index for semi-durable goods retailers plunged from 30 to 6 index points - the lowest level since the East Asian financial crisis of 1998/99 (when South Africa's prime interest rate spiked to 25%).

Non-durable goods[3] sales volumes, in turn, have been coming under pressure from soaring food prices on the back of the widespread drought and dramatic depreciation in the rand exchange rate. According to Statistics South Africa, food inflation surged from 4.3% y-o-y in September 2015 to a massive 12.8% in April 2016. While the purchasing prices of non-durable goods retailers continued to increase relentlessly during 2016Q2, most of the BER's survey respondents indicated that they too sacrificed profit margins by keeping their selling price hikes in check in order to bolster sales volumes.

In all, the vast majority of retailers surveyed by the BER indicated that business conditions worsened in 2016Q2, and they expect the rate of deterioration to escalate further during 2016Q3. Both the volume growth and the pricing power of retailers now seem to be coming under pressure, with the BER's index rating the overall profitability of retailers dropping to a three-year low in 2016Q2.

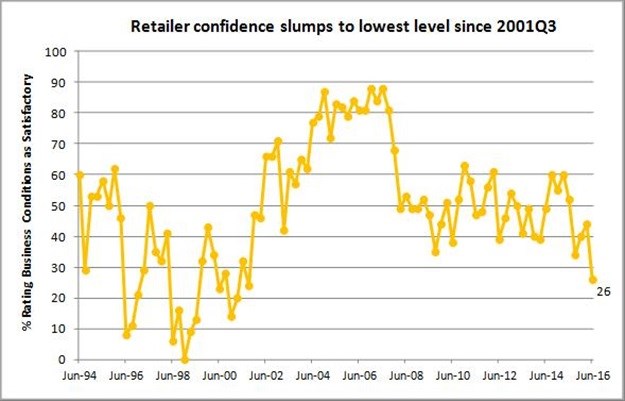

Combined with the rather dismal outlook for domestic economic growth - and particularly the strong headwinds that are still battering the South African consumer - it is not surprising that the business confidence levels of retailers dropped during 2016Q2. However, the 18 index point decline (from 44 to 26) was striking, and retailer confidence is now at the lowest level since 2001Q3 (i.e. even lower than during the 2008/9 global financial crisis and recession).

Engelbrecht said: "While retailers may be trimming their profit margins and trying to cut costs, we still expect consumer inflation to accelerate further during the second half of the year, as rising fuel prices and soaring food inflation continue to put upward pressure on the input costs of retailers. Given the underwhelming pace of economic growth amid low business confidence levels and the slowdown in government spending, most employers probably won't be able to hike wages in line with the acceleration in inflation. This will translate into a further deterioration in the real disposable income of households towards the end of the year, which does not bode well for the outlook for retail sales volumes in coming quarters."

[1] The fieldwork for the second quarter survey was conducted between 25 April and 30 May 2016.

[2] Although official retail sales data is not yet available from Statistics South Africa for the full second quarter, the significant slowdown in retail volume growth from 3.5% y-o-y in 2016Q1 to only 1.5% y-o-y in April 2016 is in line with the downbeat findings of the latest EY/BER survey covering the full second quarter.

[3] Food, beverages, tobacco, household cleaning products, cosmetics and pharmaceuticals.