Earlier this year, market research company Alpha-Diver and The Food Institute released the Snack 50 Psych Pulse report, the industry's measure of the psychological drivers of consumer decision-making when it comes to snacking.

Alpha-Diver has now conducted a deep dive into The Snack 50 findings, unpacking unique insights regarding Gen Z’s snacking preferences. This young consumer edition disrupts many of the assumptions and conventions upon which marketers and retailers base their strategies.

This chart describes the four emotional jobs different snacks do for consumers and shows the top two snacks for each “job.” The analysis studied 12 categories of snacks overall, with an emphasis on packaged snacks and sweets brands.

Image supplied

The report examines differences in preferences for snack “jobs” among Gen Z versus the overall population, revealing how this cohort differs and what it means for brands. The findings point to three macro differences for Gen Z regarding what categories and brands they decide to buy.

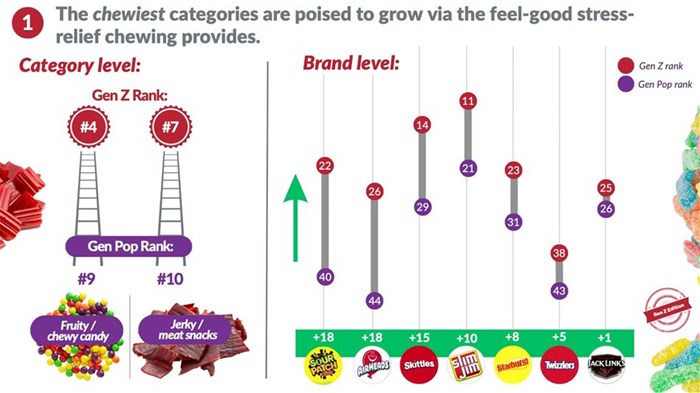

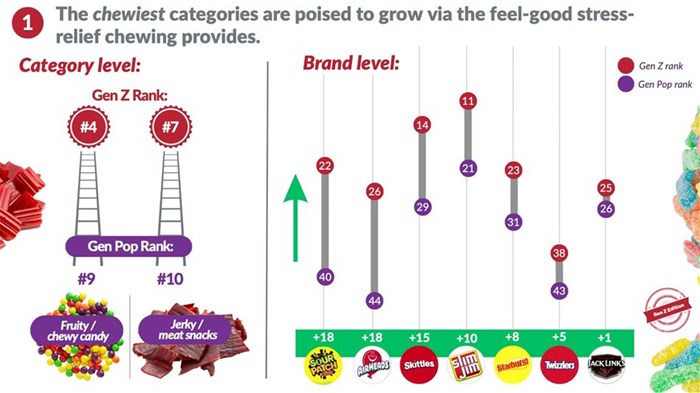

1. They choose the chews

Two categories increased most significantly in popularity among younger consumers: fruity/chewy candy and meat snacks / jerky. Corresponding brands within these categories jumped similarly in their emotional importance to this generation.

Image supplied

Further, behavioural science offers an interesting insight regarding these improvements: these are the chewiest snacks included in the study. It’s been widely reported that young consumers are experiencing potent levels of stress and anxiety. The field of psychology has found that the physical act of chewing contributes to stress reduction. So, it’s likely no coincidence that “the chews” are appealing to Gen Z.

This insight can be transformative in guiding innovation pipelines and corporate strategy.

2. ‘Better-for-you’ may not be better-for-business

Snack categories like nuts reside in the ‘functional’ space – meaning they make rational, practical sense. Typically, this is the domain of better-for-you, sensible options. (snack bars and pretzels also serve this emotional job).

With many headlines awash in the supposed importance of health and wellness for Gen Z, it’s surprising that snack nuts plummeted in popularity among this cohort, dropping to #11 out of 12 (and the #12 spot belongs to pretzels).

Image supplied

Why don’t sensible snacks create the emotional voltage of their fun-forward (and generally less “healthy”) alternatives? Because snacking decisions for Gen Z are primarily about feeling better emotionally. Snacks’ role is to provide mental escape via an interesting experience, or just some feel-good satisfaction (and stress relief) that comes with salt, fat, and carbs/sugar.

It’s not that sensible options are irrelevant to young consumers, but wise marketers will adapt their offerings to address not only better-for-you functionality but also a “better-to-you” emotional experience.

3. (Name) brands matter

With ongoing economic uncertainty, most marketers are concerned about shoppers “trading down” to store brands / private labels. However, the broader Snack 50 findings reveal that shoppers choose store brands not merely for prices, but because of social norms: shoppers perceive that other people like them agree Walmart’s Great Value, for example, is the best choice.

For Gen Z, however, the importance of social conformity drops considerably when it comes to snacking. Individual experiences drive decision-making much more. As a result, the rankings of store brands in our list drop across the board.

Image supplied

So, while the snacking decisions of Gen Z are often surprising, and counter to conventional assumptions, they are explainable. Experiences matter. Brands matter. And marketers have options beyond the price promotion race-to-the-bottom. Brands that heed these explanations, serving the core emotional needs of these consumers, will enjoy strong potential.

The complete report is available for download here.