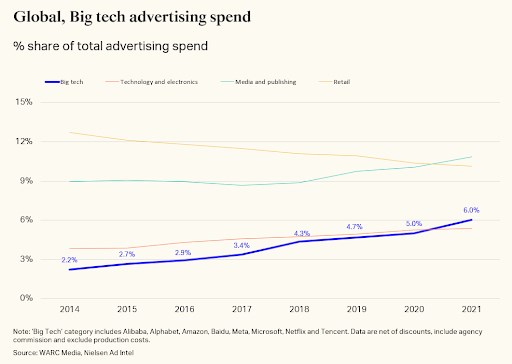

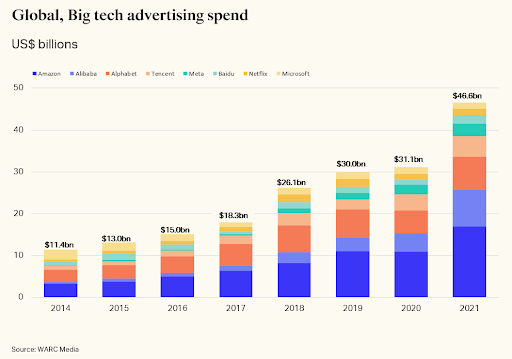

In 2021 advertising spend by Big Tech reached $46.6bn in 2021, accounting for 6% of all ad investment globally setting the eight Big Tech platforms (Alibaba, Alphabet, Amazon, Baidu, Meta, Microsoft, Netflix and Tencent) on course to account for 10% of all worldwide ad investment by 2030.

These findings, published by Warc, the international marketing intelligence service, as part of its Warc Media suite, underlines the importance of ‘Big Tech’ to the health of the global ad economy.

Big Tech spending growing faster

Big Tech’s spend on advertising is also growing faster (+49.4%) than categories such as media and publishing (+34%), technology and electronics (+26%) and retail (+21%).

Analysis by Warc found that Big Tech contributed more than a tenth (10.4%) of all global ad spend growth in 2021.

Big Tech among the biggest advertisers in the world

“Big Tech businesses have come a long way from being ad investment sceptics, to ranking among the biggest-spending advertisers in the world. As their dominance of the mobile-first digital commerce marketplace increases, so too their share of total global ad spend is likely to grow,” says Alex Brownsell, Head of Content, Warc Media, and author of the report.

“It underscores that, while digitally-native brands can succeed in the short-term without the support of ad spend, long-term success often depends upon a willingness to invest in performance-enhancing and brand-building advertising,” he adds.

Amazon: world’s biggest-spending advertiser

In 2009, Amazon founder Jeff Bezos infamously asserted that “advertising is the price you pay for having an unremarkable product or service.”

Fast-forward to 2021 and Amazon invested $16.9bn in ads (+55.0% year-on-year), the most ever spent by a single company within a 12-month period.

However, Amazon’s expenditure model appears to be self-funding: investment in advertising helps Amazon to draw shoppers to its e-commerce platform, which in turn increases the revenue it gains from retail media ads – as well as ad spend on products like Twitch and Freevee.

Alibaba - second largest advertiser

The second-largest advertiser within Big Tech is Alibaba, which invested $8.8bn (+84.4%) in 2021.

Fuelled by China’s flourishing e-commerce market, Alibaba has grown its share of total spend in the Big Tech category from 2.9% in 2014 to 19% in 2021 – exceeding Google-owner Alphabet in total ad investment ($7.9bn, +47.0%) for the first time.

Microsoft – lowest commitment to advertising

Among the companies analysed by Warc, Microsoft shows the lowest commitment to advertising. It invested $1.5bn in 2021, a sum that has remained stable since 2016.

However, this may change in light of the prospective acquisition of gaming company Activision Blizzard and Microsoft’s growing ambitions in the metaverse space.

Growing revenues at a remarkable rate

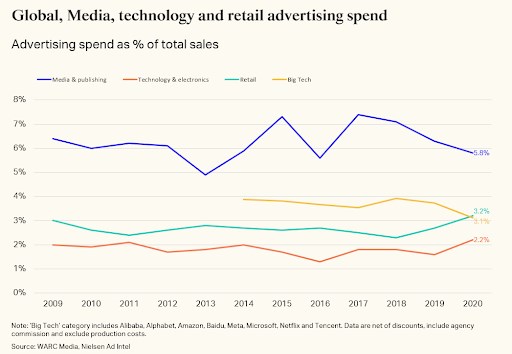

While Big Tech companies are investing vast sums on advertising in absolute terms, these platforms are also growing revenues at a remarkable rate.

In many cases, Big Tech brands are investing a lower percentage of total sales in advertising. These businesses do not feel bound by rules to maintain levels of ad spend relative to total sales, as one might find in categories such as CPG or automotive.

The notable exception is Facebook-owner Meta, which has accelerated its ad investment. Meta’s ad spend as a percentage of sales has grown from a mere 0.8% in 2017 to 2.5% in 2021.