While the speech was an honest admittance of the challenges faced by the country, he also mentioned various positive measures that the government and civil society are taking to bring citizens’ lives back on track. However, it remains an unfortunate fact that the halt in economic growth will not be resolved overnight. And the sentiments of the people reflect this.

The impact on employment

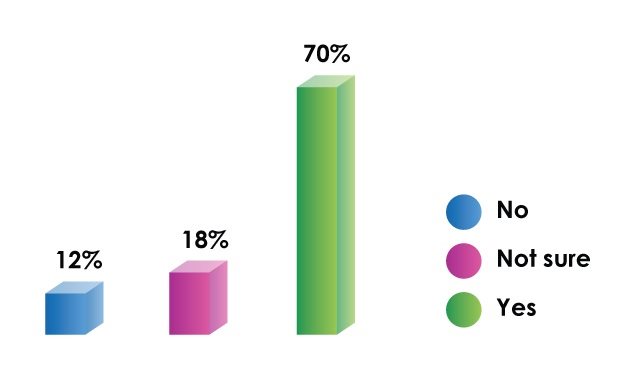

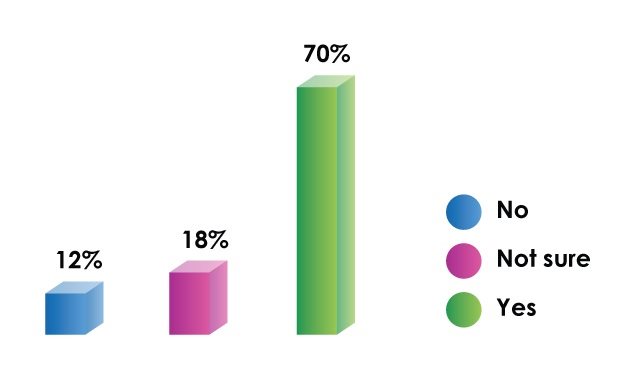

In order to understand the sentiments of South African consumers, professionals and business decision-makers about the economic scenario, Borderless Access recently conducted a study. It revealed that only 30% of the respondents had an optimistic view of the country’s economic situation taking a turn for the better within this year.

On the prospects of the economy getting back on track in 2020

Are citizens apprehensive about the economy?

Adding to this, the rate of unemployment is predicted to go up further. According to the government, two-thirds of the 1.2 million people entering the labour market each year do not find employment or receive further training.

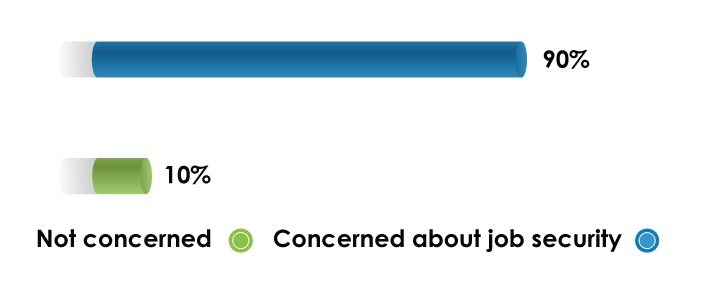

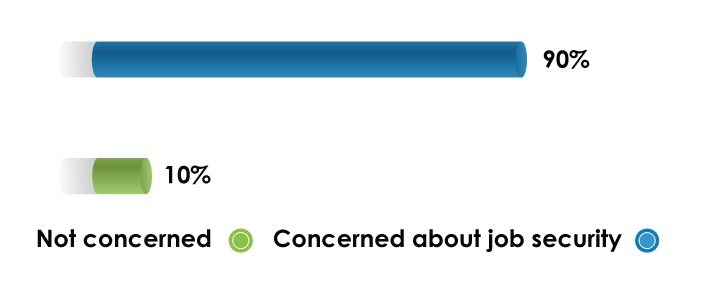

Our survey reveals concordant data: 90% of the respondents said they were worried about job security. In fact, over 50% of the respondents said they either plan to or are considering immigrating in search of better financial prospects. In a country that needs its skilled human resources more than ever, this is of particular significance.

Plans to immigrate for better financial prospects

Perception on job security

The power struggle

On the power front, Eskom has tripled the cost of electricity in the last decade to service its debts as well as maintain its infrastructure but continues to struggle financially and functionally. The resulting power cuts have taken a toll on people’s earnings.

When asked if the frequent power cuts had negatively impacted their earnings either directly or indirectly, about 57% answered that they had.

Impact of power cuts on income

The response to the spike in expenses

The financial impact of the power situation, combined with rising living costs resulting from the economic instability, has resulted in a shift in the spending pattern of the average person – also evident in our earlier study on consumer spending patterns of South Africa.

While the cost of electricity and fuel has seen the steepest hike, fruits (8.7% year-on-year, 2019–20) and bread and cereals (6% year-on-year, 2019–20) also show some of the highest inflation rates, according to Statistics South Africa (SSA).

As per our survey, the majority response (from approximately 81% of consumers) has been to either reduce spending on such essentials items or switch to more affordable brands or products.

Shift in consumer spending patterns on essentials

Shift in consumer spending patterns on non-essentials

Notably, consumer spending on non-essential items also shows a similar conservative trend, even though prices in this category have not increased significantly and have even dropped in quite a few instances, according to SSA. Once again, this trend on non-essential spending is consistent with the result of our earlier study on consumer spending patterns in South Africa.

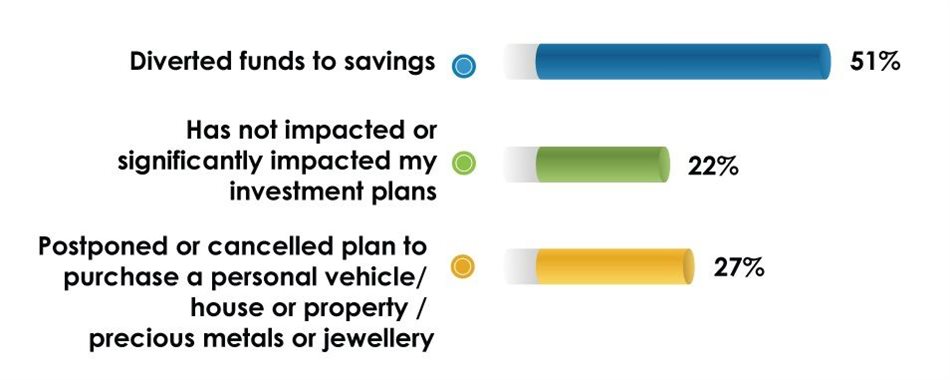

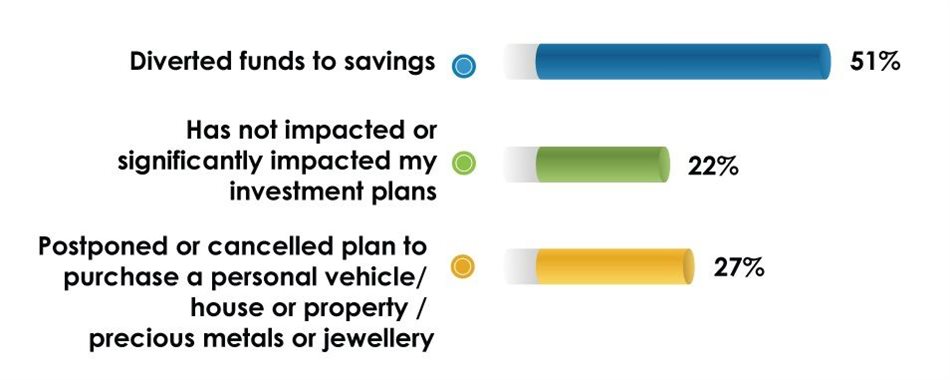

Economic uncertainty always tends to drive people to spend less. This trend was observed in our survey, which revealed around 51% of people had postponed or cancelled large spending plans such as buying a car, purchasing a house or spending on fine jewellery.

Changes in plans for large spending or major purchases

Apart from the financial impacts, the other significant hardship faced by some citizens is the shortage of drinking water. This peaked in 2018 due to a country-wide drought but is still occurring in certain isolated areas as a direct result of power shortages.

On hardships resulting from power cuts

Conclusion

On a positive note, the government is making a significant push towards alternative energy sources to compensate for the shortcomings in traditional energy production. This includes the development of additional grid capacity from coal as well as natural gas, hydropower and battery storage.

The government is also encouraging small-scale power generation for personal use, which is boosting the adoption of solar power panels by individuals. Energy utilisation from existing wind and solar plants is also set to get a significant boost.

How these measures pan out and help push South Africa back on the road to economic recovery still remains to be seen.