Related

Top stories

Marketing & MediaWarner Bros. was “nice to have” but not at any price, says Netflix

Karabo Ledwaba 23 hours

Logistics & TransportMaersk reroutes sailings around Africa amid Red Sea constraints

Louise Rasmussen 16 hours

More news

While the excessive rains across South Africa present risks for agricultural production this year, the overall impact on crop prices remains uncertain. First, there have admittedly been delays in crop plantings and damages in some areas due to flooding.

Still, the scale of this disruption will only be precise after the release of the preliminary summer crop planting data on January 27 and production estimates data at the end of February. Only then could we formulate a reliable view on the possible size of imports need if the damage is extensive, and impact after that on prices.

Second, the increases in domestic agricultural commodity prices have primarily been underpinned by global prices over the past two years. The size of the domestic harvest mattered less than the crop conditions in South America or grains oilseeds demand in China and India, which were primary drivers of the global market. These factors provided upward pressure on global grains and oilseeds prices.

South Africa, a relatively small player in global agriculture, is linked to the global market. Thus, the general rise in global prices overshadowed the improved domestic crop supply in the 2020/21 production season. These conditions remain the dominant feature in the global agricultural market, although the prices softened somewhat in December 2020.

Importantly, with global grains production estimates relatively optimistic in 2021/22 compared to the previous season, despite the La Niña induced dryness in parts of South America, and as a consequence, the stocks set to improve slightly; it is plausible that prices could move sideways. To an extent, this will bode well with the domestic consumer food price inflation path.

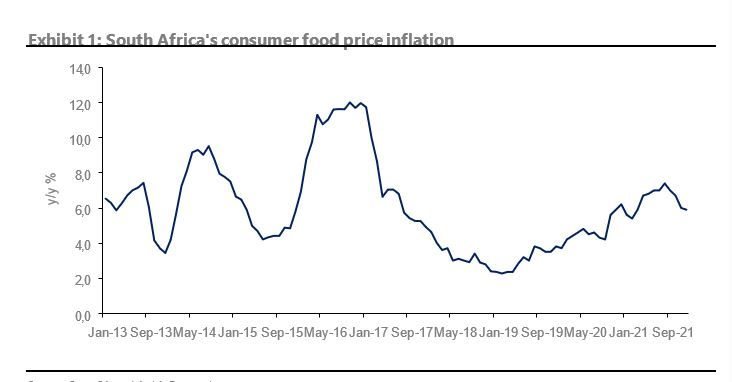

Lastly, if we account for the base effects and the above points, it is possible that consumer food price inflation could be somewhat moderate this year compared to 2021.

The essential data to watch domestically, which could present upside risks to consumer food price inflation, is meat. South Africa's cattle slaughtering activity was relatively lower in 2021 than in 2020. The continuous rebuilding of the cattle herd since the 2016 drought, combined with foot and mouth disease last year, were amongst the factors that contributed to modest slaughtering activity. The direction slaughtering will take this year will matter for meat prices.

Another vital issue to remember is poultry import tariffs that came on last year; this year's base effects will likely positively affect the consumer price inflation moderation path.