Related

Top stories

More news

Logistics & Transport

Maersk reroutes sailings around Africa amid Red Sea constraints

Despite this steep price hike, South African consumers’ perceptions of grocery costs have improved over time, suggesting that consumer sentiment is driven by more than just price. This is according to Shannon Temple, lead retail analyst at DataEQ, who recently presented on consumer trends in retail at the 2022 edition of E-commerce Live.

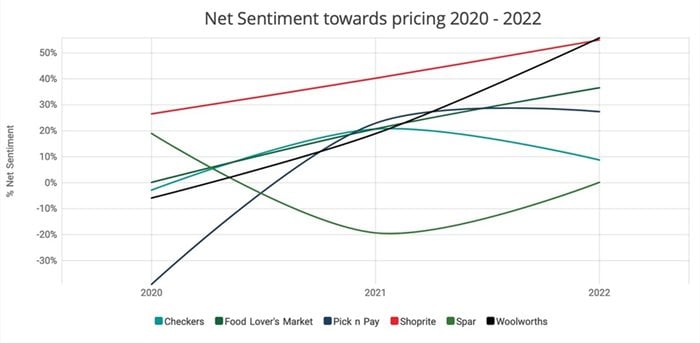

“Looking at net sentiment* on social media towards grocery retailers’ pricing since 2020, there is an upward trajectory, indicating that conversation is becoming gradually more positive,” explains Temple.

“Notably, we see Woolworths with the steepest incline here, while Checkers and Pick n Pay experienced slight declines since last year,” she adds.

Having analysed over 1 million social media posts from consumers talking about South Africa’s major grocery retailers, Temple goes on to unpack three major trends that are shaping the local retail e-commerce landscape.

Despite the prevalence of pricing and affordability in conversation, social media data indicates that consumers are speaking less and less about it since 2020.

Attention has moved away from price comparisons and towards special offers, with the online narrative shifting to which brand is offering the best value for money.

Driving a sense of savings is going to be critical for the industry going forward.

Consumers want to feel like they’re saving when using a premium service, and well-executed specials are key to achieving this.

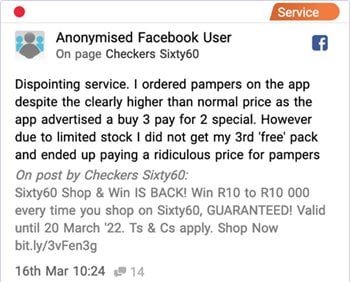

While special offers allow retailers to drive perceptions about price, they can be a major point of contention if not implemented correctly across all channels.

In this sense, creating an omnichannel shopping experience is critical for retailers and there needs to be parity between specials offered in-store versus what is offered on the app.

Digital platforms do not remove the risk of operational issues arising.

If anything, there is an even higher expectation from digital customers for operational ease.

For example, the issue of items being out of stock is typically met with high criticism – especially when said item is linked to a special offer.

There are also logistical issues that are inherent to the e-commerce model, such as delayed delivery times or cancelled orders.

This is where expectation management and clear communication becomes vital, setting apart the retailers who excel in digital customer service, from those who don’t.

*Net Sentiment is a single score calculated by deducting the percentage of negative conversation from the percentage of positive conversation.