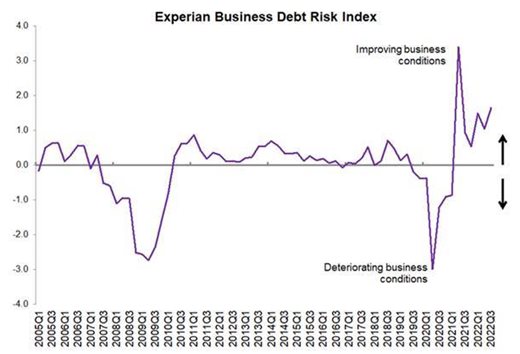

According to the Experian Business Debt Index (BDI), despite there having been a strong improvement in South African business debt conditions in the last quarter of 2022, business debt conditions look set to deteriorate in 2023.

This, in the face of an anticipated increase in the intensity of load-shedding in the upcoming year, which is bound to weigh negatively on economic growth.

The Experian Business Debt Index (BDI) increased in Q3 from Q2 2022, rising to 1,649, from an upwardly revised 1,044. The increase in the BDI in Q3 was much greater than had been anticipated.

Macroeconomic factors influencing Q3 2022

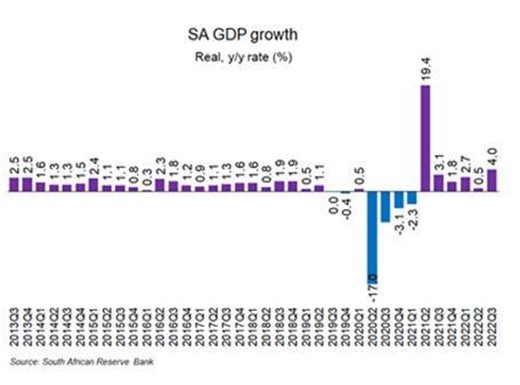

A major reason for the upward move in the index was that GDP growth domestically for Q3 was much stronger than had been anticipated.

The domestic GDP growth rate for Q3 came in at 1.6% quarter-on-quarter, compared with an expectation of a 0.4% increase from the 0.7% contraction experienced in Q2. On a year-on-year basis, GDP growth accelerated to 4.0% in Q3 from 0.5% in Q2.

Ans Gerber, head of data insights at Experian Africa said: “This better-than-expected outcome for Q3 domestic growth was superficially surprising, given the steep increase in inflation and substantial rise in interest rates, coupled with an increase in the intensity of load-shedding, which at one point reached Stage 5 in September.

"It would seem that the distortive statistical effects of the floods in Q2 in KwaZulu-Natal had also been underestimated. There were substantial improvements in GDP in Q3 in agriculture, mining, manufacturing, and construction, all sectors of which had been severely negatively affected by the effects of the floods.”

“Agriculture, in particular, saw its q-o-q growth shooting upwards from -11.1% in Q2 to 19.2% in Q3. Mining and manufacturing recovered after production had been badly disrupted in Q2, while construction activity picked up in Q3 partly to restore some of the infrastructure destroyed by the floods.

"There was also a huge build-up of inventories in Q3 of R63bn, presumably to make up for products lost in the floods and to support the restoration of infrastructure,” added Gerber.

Ironically, most of the other macroeconomic inputs into the compilation of the BDI were negative. Still, their impact was substantially outweighed by the dramatically improved statistical performance of the South African economy.

The only macro-economic component other than GDP that positively influenced the BDI was the differential between the PPI inflation rate and the CPI rate. This increased still further to 9.32% in Q3 from an already substantial 8.10% in Q2.

This is usually taken as a reflection of an enhancement of profit margins by producers who are able to pass on cost increases more aggressively than previously.

Business debt metrics in Q3 2022

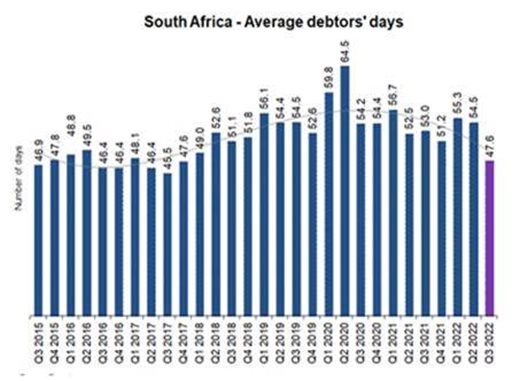

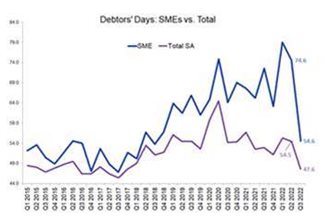

A marked improvement in Experian data on the outstanding debt age ratios also played an important role in pushing up the BDI beyond expectations in Q3. The average number of outstanding debtors’ days fell dramatically to 47.6 in Q3 from 54.5 in Q2.

“This was the lowest number of outstanding debtors’ days in almost five years. One can only think that the steepness of the rise in domestic short-term interest rates encouraged businesses to pay off their debts more rapidly,” said Gerber.

BDI by sector

There was a marked improvement in the economic situation experienced by most sectors of the economy following the devastation wrought by the KwaZulu-Natal floods.

Indeed, from a sectoral perspective, there was uniformity in improvements across these BDIs. Only in the case of electricity and community services were there marginal declines in the BDIs.

The improvements were exceptionally sharp in the case of agriculture, mining, manufacturing, transport, construction, and retail and wholesale trade and accommodation. Proportionately, the biggest improvement by far was that of agriculture. This reflected the devastation of crops by floods in Q2, followed by a sharp recovery subsequently.

BDI by company size

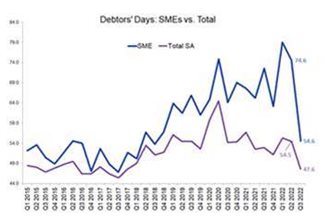

The improvement in the outstanding debtors’ days metrics was particularly marked in the case of small businesses. Outstanding debtors’ days of small businesses declined from 74.6 in Q2 to 54.6 in Q3. This was even more substantial than the corresponding decline in the overall outstanding debtors’ days from 54.5 to 47.6.

Source: Supplied.

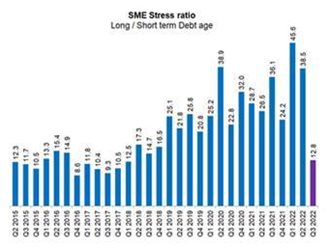

The long to short-term debt age ratio of SMEs, referred to as the SME stress ratio, plummeted to 12.8% in Q3, from 38.5% in Q2 and 45.6% in Q1. Clearly, the march to pay off debts as soon as possible and, therefore, not incur steeply higher short-term interest rates was most noticeable among SMEs.

Looking ahead

Gerber added that statistically, one will not see the same kind of recovery in economic activity reflected in the Q3 GDP figures. There is unlikely to be a repetition of the build-up of inventories witnessed during the third quarter.

Furthermore, with global economic growth slowing down in the face of sharply higher interest rates and interruptions to supply chains emanating from lockdowns imposed in China to quell the spread of Covid-19, exports from South Africa are likely to feel the pinch, she said.

"The remarkable recovery in exports experienced in Q3 is unlikely to be repeated in forthcoming quarters.

“Businesses are therefore urged to manage their debt responsibly, especially given that the upcoming quarters are predicted to be more challenging due to increased consumer distress, which will increase the stress levels associated with business debt.

"Innovative approaches are required to facilitate growth, in an environment where enterprises and consumers alike take caution in managing their risk as tightly as possible."