Related

Job profiling pitfalls: How one vague verb can sabotage the integrity of job evaluations

Chimoné Zaayman 1 Jul 2025

Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

We have just completed the study across eight listed exchanges in which South Africa is the only emerging market exchange. South African listed companies can stand tall amongst the developed nations in our adoption and application of ESG metrics.

ESG metrics can be described as non-financial metrics and are about the sustainability of the world, the continents, countries, businesses and society. Society is becoming more vocal about government and business practice as the world moves from “Shareholderism” to “Stakeholderism”.

This trend has been catapulted forward due to the Covid-19 pandemic, which has highlighted the unsustainable business practices worldwide that are leading to the destruction of the environment and of society.

Our study also identified that a growing number of companies are starting to incorporate ESG metrics in executive long-term incentive plans and that the weighting is higher than in prior years - tying sustainable metrics to executive pay in the long term.

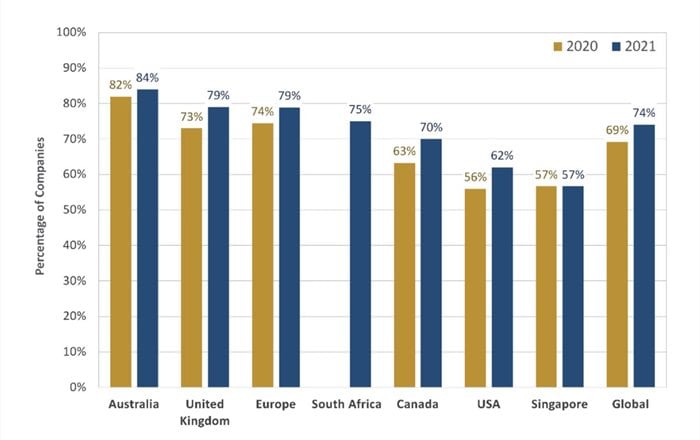

More than 74% of companies in all sectors reviewed use ESG metrics. South Africa ranks 4th in the world with 75% of companies using ESG metrics, whilst Australia leads (84%), followed by Continental Europe (79%).

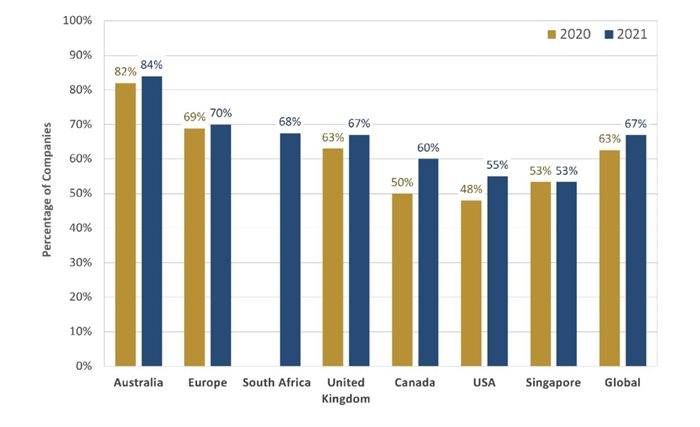

There has been a huge swing towards Social Metrics, catalysed by the pandemic which highlighted the inequity of pay and wealth around the world, particularly prevalent in South Africa, which has the highest Gini coefficient (measure of income inequality), and one of the highest unemployment rates in the world. South Africa moves to 3rd place for the use of Social Metrics (68%), behind Australia (84%) and Europe (70%).

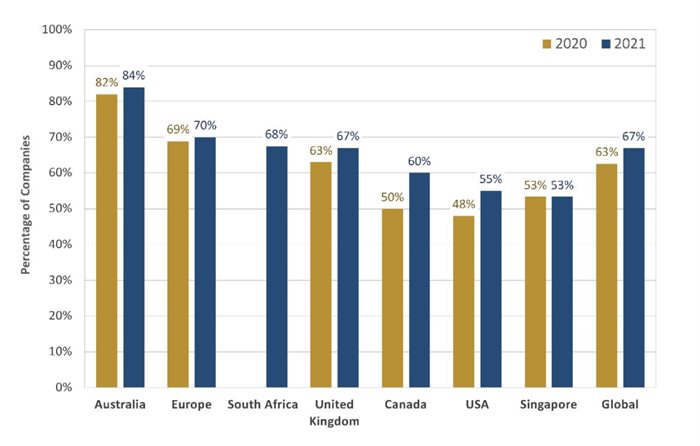

South Africa ties in 1st place with Australia, with 13% for the most important metric of ESG – the weighting of the executive maximum total remuneration linked to ESG metrics. The link between the executive key performance indicator (KPI) and executive pay is critical in incentivising the executive to “do the right thing”.

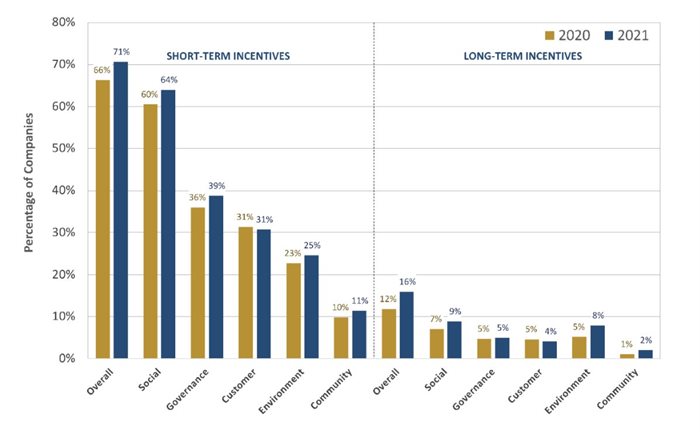

Figure 4 shows that using ESG metrics is much more prevalent in short-term incentives (71%) than in long-term incentives (only 16%). We can only hope that the move from short-term towards long-term incentives continues rapidly, as this is how ESG metrics will become sustainable.

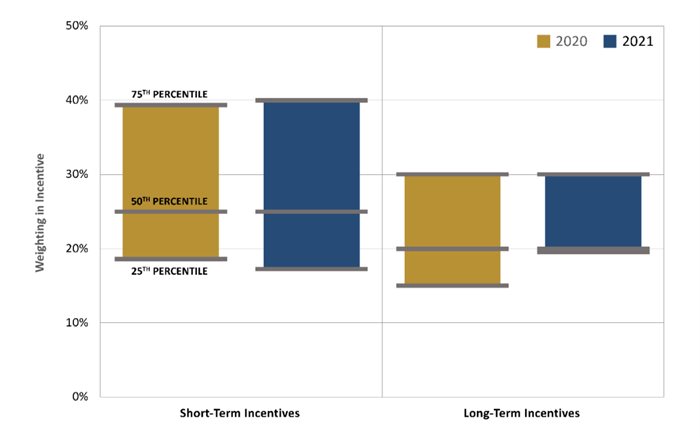

The prevalence does not, however, tell the full picture of the effectiveness of ESG metrics in short- and long-term incentives. It is rather the weighting of the metric that is important, as this incentivises the executive’s behaviour. The median weighting for ESG metrics in short-term incentives is 25% compared to 20% in long-term plans, and is significant for both.

The upper quartile, 25% of metrics or more have a weighting in short-term incentives of 40% and 30% for long-term incentives. This is encouraging for the future sustainability of ESG. Even at the lower quartile, 25% of metrics or less still have a weighting of 20% for long-term incentives.

The world is in urgent need of change in terms of its environment, climate change, social inequity and well-being. ESG metrics could be the silver bullet that brings this change about, but only if it is universally adopted and governed. South Africa sets an example that as an emerging market, we can contribute and stand tall amongst our world peers.