Top stories

Marketing & MediaWarner Bros. was “nice to have” but not at any price, says Netflix

Karabo Ledwaba 1 day

More news

Logistics & Transport

Maersk reroutes sailings around Africa amid Red Sea constraints

We experienced a sharp slowdown in applications at the end of March and part of April 2020, however, our year-on-year figures for May 2020 show only a 15 % reduction in volume compared to the same month in 2019. We started to see a small increase in registrations in the recent weeks as the Deeds Office reopened and attorneys could issue instructions.

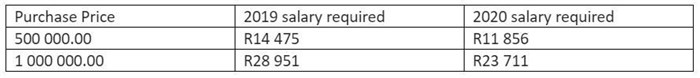

However, the recent interest rate cuts have stimulated interest among buyers, as revealed by an increase in ‘buy a home’ search terms since the rate cut announcement. In 2019, you would have needed to earn a household income of R28,951 to afford a R1m home, now that has significantly reduced to R23,711 - almost a 20% reduction in gross income. Even though the market is under pressure, we have unlocked a new buyer in the market, add to that the house prices will not be growing, it’s the best time to buy.

Customers’ income, current debt commitments and monthly household expenses are all considered to accurately determine an applicant’s affordability and, ultimately, their ability to take on additional debt. This principle has not changed as a result of Covid-19. Although it is expected that the income of some customers will be affected, which will impact their affordability, there are sectors that are seeing a boom, such as online services and tech businesses, resulting in a client base with the income to purchase homes.

Banks and lenders are processing applications now that they have the ability to verify employment. We anticipate an increase in home loan applications as the real estate industry resumes business.