While the State of the Nation Adress (SONA) offered little new detail, next week's Budget Speech will have more substance and is of far more interest to market watchers.

Political and policy uncertainty remain high in South Africa, but this is also the case globally. The Global Economic Policy Uncertainty Index is at all-time highs, following last year’s Brexit vote in the UK and the surprise victory of Donald Trump in the US presidential election. Unfortunately, the surprise did not end there, as the first three weeks of his term in office have been contentious. Amidst all the fights he has picked - from clashes with judges and the Australian Prime Minister to swipes at retailers no longer stocking his daughter’s clothing line - he has not announced any detail of the expected tax cuts and infrastructure spending plans that got the equity market excited in the first place.

Global Economic Policy Uncertainty Index

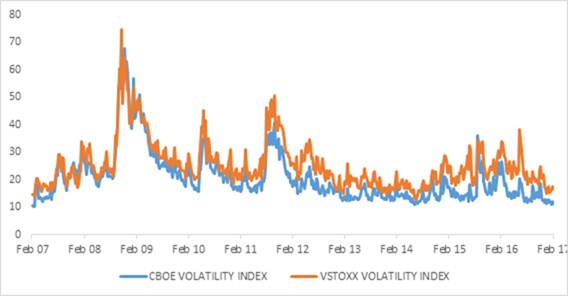

Strangely enough, traditional measures of uncertainty on financial markets show contradictory signals. The CBOE Volatility Index (the VIX), Wall Street’s so-called fear gauge, remains close to the lowest levels since 2007, implying that traders are not buying much protection on the S&P500. Similarly for the European version, the VSTOXX. On the other hand, gold, the traditional safe-haven investment, has rallied by around $100 per ounce since mid-December. Other precious metals such as platinum and silver have also done well.

Equity implied volatility indices

Economic growth improving

How does one square that circle? Despite political uncertainty, economic growth appears to be improving. The US added 227,000 jobs in January, which is much more than expected. Trump’s anti-trade rhetoric comes at a time when US exports are growing steadily for the first time since 2014 (before the collapse in the oil price and stronger dollar).

Elsewhere, export numbers are also improving and global trade appears to be picking up after a prolonged slump. Reported annual earnings growth turned positive in the fourth quarter for US, Japan, and Europe, even excluding the energy sector (which took a beating due to the lower oil price). There are also early indications that companies will start spending more on capital expansion, which in turn could boost productivity and lift growth rates over the longer run.

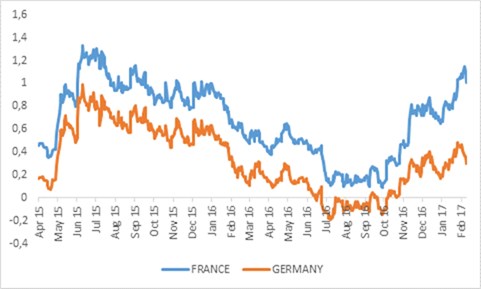

There is further room for political surprises this year as France, Germany and the Netherlands go to the polls. In France, the right-wing and anti-euro Marine Le Pen pulled ahead in opinion polls. This has seen French bonds yields rising relative to benchmark German yields (spreads have widened), signalling increased risk but not panic. The advantage of the French electoral system is that there are two rounds and even if Le Pen wins the first round, she is unlikely to win in the second. Germany and Netherlands have for a long time relied on coalition governments that tend to keep extremism at bay. Despite Brexit and Trump, one shouldn’t overestimate the rise of populism. At least the weaker euro – under pressure partly due to the political fear - supports European exporters.

10-year government bond yields

Greece in the spotlight again

It would be ironic for European voters to choose anti-establishment candidates when economic conditions on the ground are actually also improving. European growth has finally caught up with the US, unemployment has declined and leading indicators point to continued reason for optimism. But anything could happen as parties gain ground.

The one European country where things remain depressed is, of course, Greece. Investors are worried about Greece again as it is struggling to stick to the terms of the $92 billion 2015 bailout package. But a standoff is also developing between the International Monetary Fund (IMF) and the European Union. The former rightly believes that Greece’s debt burden (175% of GDP) is unsustainable and some of it will have to be written off for the IMF to continue participating in the bailout programme, while Greece will have to do more to overhaul its tax and pension system.

The IMF also wants to reduce the onerous budget surplus requirement. But with the elections in Germany and elsewhere this year, the country’s European creditors are not in a very accommodating mood. Austerity has worsened the economic situation, not improved it, which in turn makes implementing reforms harder.

There is an important lesson for South Africa – reform the economy to increase competitiveness when times are good, not when the IMF forces you to. But of course, the Greek situation is very different due to the straitjacket of the single currency. Our freely traded rand has acted as a shock absorber over the past few years, the sharp depreciation between 2011 and 2015 offset some of the declines in commodity prices.

However, the rand has strengthened over the past year, partly due to rising commodity prices and improved sentiment toward emerging markets. This was despite political uncertainty at home and abroad, and the threat of ratings downgrades (and brawls in the National Assembly). The firmer rand together with the end of the disastrous drought means that the outlook for inflation and interest rates has improved.

The maize crop is expected to be 30% larger than last year if the alien armyworm pest is contained – and this has already seen traded maize prices decline. The oil price may be the dark horse for investors. OPEC members have shown record compliance with the agreed output cuts (so far), supporting the price. But at the same time, American producers are ramping up activity again, so an oil shock seems unlikely.

Lower inflation, especially food inflation, should help to raise consumer confidence, especially for lower income earners who spend larger portions of their income on food. This, together with a better global growth outlook, surely means the worst is over for the battered local economy, even if the Finance Minister decides to increase tax rates next week.

Investing with uncertainty

Against this backdrop of global political uncertainty, how are we investing? Clearly, diversification is important and is embedded in our investment philosophy. Our Strategy Funds are designed with specific real return outcomes in mind. They are diversified across managers, asset classes and regions and are actively managed. Also important is trying to sift the signal from the noise. The things that dominate news headlines are not necessarily what will influence long-term returns.

Valuation provides an anchor when times are uncertain. What matters is not how bad the news is, but how much of the bad news is priced in. Sometimes, asset prices reflect too much bad news, presenting a buying opportunity. For instance, in 2009, the economy was still in recession but markets were priced as if we were in a depression, presenting a once-in-a-generation opportunity. Valuations are not as enticing, but still holds the prospect of real returns over the respective Strategy Funds’ investment horizons.