Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

BankservAfrica is the appointed TCIB operator and scheme manager.

In September 2016, the Southern African Development Community (SADC) committee of central bank governors approved the development of a SADC low-value regional payments scheme in support of the acceleration of financial inclusion in all SADC member states.

Under this mandate, the SADC banking association designed the framework for the SADC low-value credit-transfer payment scheme and then worked closely with BankservAfrica to develop and bring into operation this framework into the formal low-value or retail payments scheme known today as TCIB (Transactions Cleared on an Immediate Basis).

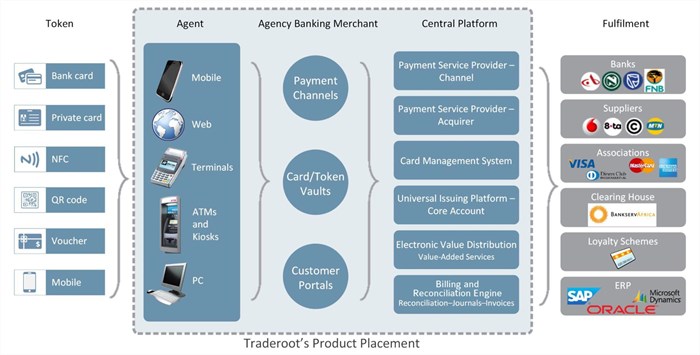

“This certification enables Traderoot Africa to add even more value to our clients’ businesses, as the TCIB integration capability extends to our core solutions,” says Traderoot Africa CEO, Craig Ireland. “Our fintech solutions already give our clients a competitive advantage, but the ability to leverage the power of TCIB is likely to make a major impact in the speed of transactions while also reducing overheads.”

TCIB has been created to facilitate and maximise trade between countries, businesses and individuals within the SADC region, removing many of the previous barriers and enabling instant cross-border payments. The scheme allows for immediate clearing of single-credit “push” transactions, settled on a deferred basis, and is available to a wide range of players in the financial sector. It is the first and only platform in the SADC that enables a scalable low-cost, interoperable and fully open-loop ecosystem for authorised financial institutions to transact seamlessly and effortlessly with each other.

“TCIB is a revolutionary payments reform initiative,” says Francois Roode, Traderoot Africa’s head of Business Development. “The fact that TCIB is fully interoperable and multi-currency enabled will empower authorised financial institutions in SADC to breach the many barriers preventing low-cost and fully interoperable remittance across all corridors in the SADC region.”

TCIB promises its scheme participants low-cost payments across the SADC region directly into the bank accounts and/or mobile wallets of their customers, hereby addressing the requirement for immediacy of payments, supporting financial-inclusion objectives and adding immense value to the economies of all SADC member states.

“Because TCIB is the formal SADC retail (low-value) credit transfer scheme,” Roode continues, “there is no requirement by participants – including banks, mobile-network providers, e-money providers, retailers, and money-transfer operators – to enter into separate closed-loop or bi-lateral agreements with any financial institutions within the participant community.”

“BankservAfrica has identified the enablement potential that certified TCIB integrators may offer,” says Ireland, "and we are delighted to have responded. Being the first business to secure this certification, highlights Traderoot Africa’s position as a market leader on the continent. I am thankful to our team for the work done to achieve this milestone and to BankservAfrica for its trust in us.”