Top stories

ESG & Sustainability#BudgetSpeech2026: SRD grant unchanged, other Sassa social grants see hike

7 hours

More news

ESG & Sustainability

South Africa’s carbon tax should stay: climate scientists explain why

This argument leans on investment in JSE food listed companies, which I believe would not be an ideal measure of observing investment in farming. Roughly speaking, the food share index is largely driven by short-term adjustments mainly from the consumption side. Knowing that food and beverages are price inelastic, it is often not surprising that one finds the food share index growing despite the uncertainty in policy.

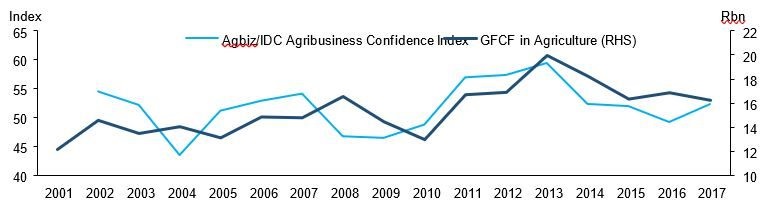

One data point that we observe closely, but also not a perfect indicator of measuring investment reaction to policy changes in the short term, is the Gross Fixed Capital Formation. This declined by 3% year-on-year to R16.2 billion in 2017. This decline is largely on the back of unfavourable weather conditions in some parts of the country, which somewhat constrained investment. Going forward, however, policy uncertainty could further weigh on investment. In the meantime, we look at agribusiness confidence levels as a guide of investment path for the year. Figure 1 below shows that there is a good correlation between Agbiz/IDC agribusiness confidence and investment in the sector.

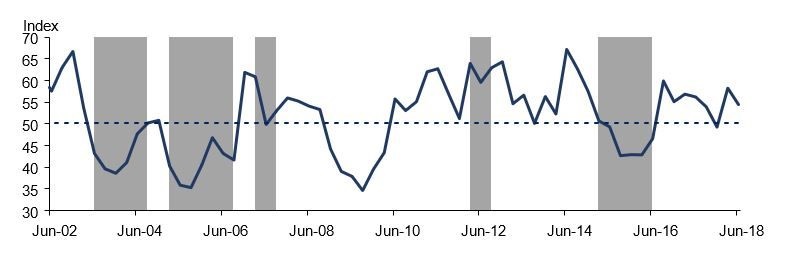

In the second quarter of this year, the Agbiz/IDC Agribusiness Confidence Index declined from 58 index points in the first quarter to 54 (see Figure 2). With the results still above the neutral 50-point mark, albeit having declined, this means that the agribusiness sector was still optimistic about business conditions in South Africa. Be that as it may, the decline in confidence is concerning, as we pointed out in the official statement of the second quarter index results that ‘the uncertainty around land reform policy, particularly expropriation without compensation, remains a key risk that could potentially undermine investment in the sector. At this point, however, farmers are somewhat in a wait-and-see mode. We have not seen a notable dent on investments in the sector yet’. Additionally, investment figures are not yet available for the period in which the debate escalated to be a major risk to the sector.

In closing, we believe the suggestions that the proposed expropriation without compensation policy have not affected investments in the sector and have actually led to an increase in investment, might be premature.

Given the data presented in the aforementioned figures, we are of the view that the deterioration in confidence could lead to a decline in investment in the sector if uncertainty continues for longer around the proposed land reform policy.

Read the original article via Agbiz.