Top stories

Marketing & MediaAds are coming to AI. Does that really have to be such a bad thing?

Ilayaraja Subramanian 16 hours

More news

Here the main themes of industrial property in 2020 and how the year ahead will play out:

The global economy will remain weak in 2021, however, due to vaccine roll-outs, developed economies will recover fastest towards the end of 2021. Developing countries will likely only see their economies improve in 2022.

The industrial property sector in South Africa will remain tough, but better than the retail, office and leisure sectors - the speed of recovery will depend on the speed of the vaccine roll-out.

Companies utilising industrial property will continue to push for enhanced efficiencies, while modernisation across all business processes will be a continued theme. This includes further mechanisation of processes, where possible. Also, far greater utilisation of computerisation and cloud-based solutions. Along with better computerisation, access to buildings with fibre/ 5G will be critical.

Along with greater computerisation, the ratio of offices to warehouses and factories will continue to decrease (i.e., less office space in demand) and demand for environmentally friendly buildings will increase.

Hopefully, Eskom will not impose too much load shedding in the year ahead. However, as the economy picks up and the utilisation of power increases, Eskom’s ability to cope with the increased demand remains an ongoing concern.

Certain businesses will try to keep leases short until a greater amount of certainty returns, and landlords will demand higher rentals for the luxury of a shorter lease in the industrial property market. In general, industrial rentals will remain under pressure during 2021.

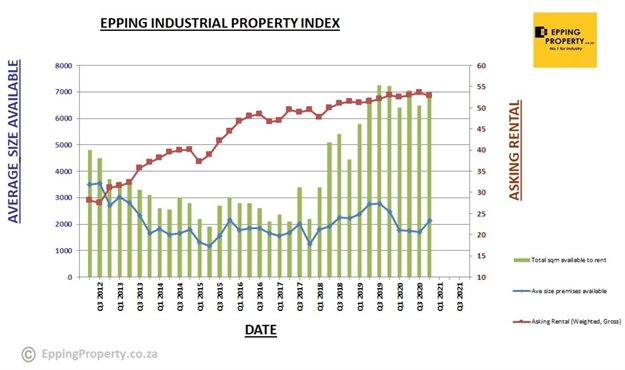

Asking rentals in the last quarter of 2020 were lower than at the same time in 2019 and in addition, achievable rentals are now roughly 10% lower than asking rentals, whereas a year ago achievable rentals were only 5% lower than asking rentals. This will be due in part to the weak economy and the competitiveness of landlords to secure tenants for their vacant buildings.

The industrial property sector in South Africa should, once again, be the best performing property sector in 2021. Recovery at the end of 2021 and into 2022 (of all business sectors) is likely to be heavily reliant on the manner in which South Africa deals with Covid-19 and the speed and efficiency at which it can roll out a successful vaccination programme.