What can a marketing or communications worker expect to earn in Malta? New figures released in April by Eurostat give broad sectoral outlines across five areas of economic activity providing an indication of wages across the EU in general and the Maltese islands in particular.

Creative shopping for talent

The Eurostat statistics have actually been compiled the other way around – to indicate the comparative cost of labour for employers across Europe – so making broad inferences about salary expectations is reverse engineering. The better matched question would be: ‘What can an agency owner expect to pay staff if he/she opened an office or started a creative shop in Europe?’

The sector to which I am ascribing the marketing function is services, as distinct from the other four areas of Eurostat economic activity: business economy, industry, construction and mainly non-business (excluding public administration). On an assumed exchange rate of 15:1, the average communications worker could expect to earn R32,400 per month (€2,160). If that sounds very low, it probably is as Malta’s average 2017 salary is R33,120 (€2,208). Outside of the public service (which employs Maltese-speakers in general and Labour Party supporters in particular) Malta’s three biggest employers are tourism, i-gaming and financial services. A starting salary in banking would be R22,500 (€1,500) but it’s double that in i-gaming: R43,500 (€2,900).

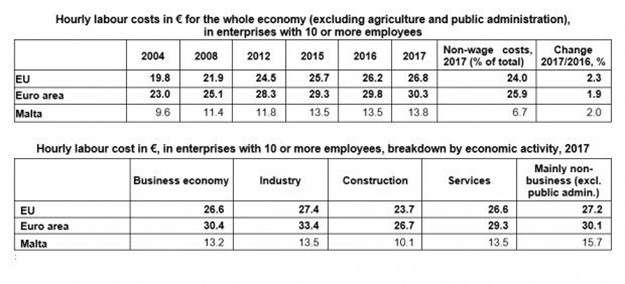

Apart from wages, the costs that employers in Malta have to pay for labour are the lowest in the EU, according to Eurostat. (Non-wage costs include the employers’ social contributions plus any employment taxes regarded as labour costs – adjusted for government subsidies). In Malta, these amounted to just 6.7% of the total cost of labour in 2017, compared to 24% in the EU. France was at the highest end of the scale, with 32.8%.

In 2017, average hourly labour costs in the whole economy (excluding agriculture and public administration) were estimated to be €26.8 in the European Union (EU) and €30.3 in the eurozone. Malta’s average hourly labour cost (€13.8) was less than half that.

Wages: Bulgaria low, Denmark high

However, this average masks significant variances between EU member states: the lowest hourly labour costs are Bulgaria (€4.9) and the highest Denmark (€42.5). Malta’s costs were €13.8 an hour, 2% higher than a year before.

If there is a learning, it's this:

Set up the office in Malta where the cost of living and labour is low but source your clients from the higher paying/earning countries.

As i-gaming has done…

I-gaming impact

iGaming has had a particularly transformative effect on the economy and the typical Maltese way of life. For starters, it’s an international industry with most of the companies choosing to register themselves in Malta during the past five years for notable tax efficiencies. The sector accounts for 11% of the Maltese economy and has added 9,000 mostly foreign employees to the workforce out of an expat community of 40,000.

In keeping with the young status of the industry itself, most workers are bright young things from elsewhere in the EU. Because those 9,000 Generation Y (Gen Y) staffers are largely under 30, their lifestyle preferences have created a noticeable imprint in everything from nightlife culture to property development.

If you accept the generalisation that many millennial employees prefer a transient job path to lifetime employment and enjoy a less traditional approach to conventional norms around property ownership since paying a mortgage presupposes job security, you can understand why there has been a perfect storm here on the archipelago regarding buy-to-let property investing.

The need to accommodate 9,000 Gen Y workers has bred a rush of apartment dwellings (studio, one and two bedroomed) which were never part of the island’s housing stock and certainly not typical of its architecture. The bulk of this property development is in the areas where i-gaming companies have their offices: the neighbouring localites of Sliema, St Julian’s, Paceville (clubland), Msida and Gzira. These areas are being transformed at a rapid pace and the traditional streetscape of double-storey terraced houses (here called townhouses when they have the architectural vernacular Maltese balcony) either being demolished or getting permits to add additional storeys to the building’s footprint.

Because of planning permission regulations requiring a set-back from the building line at roof level, every development now sells a penthouse which is simply a slightly smaller top floor apartment with an outdoor terrace the size of the regulatory set-back.

Rising rentals, a function of supply and demand, have meant that buy-to-let properties have become – due to the i-gaming industry – the island’s surest bet!