In our view, Finance Minister Nene produced a pragmatic budget for FY15/16 against the challenging backdrop of simultaneously having to contain government spending to protect the sovereign's credit status while at the same time being confronted with a weak revenue base resulting from a frail growth outlook.

As such, it is difficult to categorise the FY15/16 budget as being either unequivocally expansionary or contractionary for the SA economy.

Subdued global growth conditions and electricity supply concerns have prompted National Treasury to lower its real GDP growth forecasts from 2.5% to 2.0% in 2015 and from 2.8% to 2.4% in 2016. These revised figures are now more in line with the SA Reserve Bank's (SARB) latest forecasts of 2.2% and 2.4%, respectively and slightly higher than the corresponding Reuters consensus expectations of 2.3% and 2.6%.

With Brent oil prices currently c.30% lower than at the time of the Medium Term Budget Policy Statement (MTBPS) in October last year, it came as no surprise that National Treasury cut its 2015 headline consumer price inflation projection to 4.3% from 5.9% previously and raised its 2016 forecast from 5.6% to 5.9%. In our opinion, there could be slight downside risk to this year's forecast and upside risk to next year's.

Deficit slightly worse

Lower commodity prices have also had an effect on Treasury's current account projections which have narrowed from -5.4% to -4.5% in 2015 and from -5.2% to -4.9% in 2016.

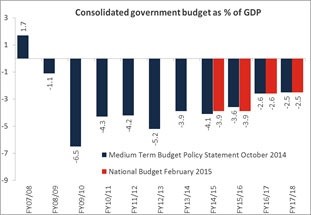

Chart 1: FY15/16 budget deficit now slightly worse than October projections

Source: National Treasury, MAM

Against this backdrop, government's consolidated budget deficit remained steady relative to FY13/14 at -3.9% of GDP, but projections over the rest of the medium-term framework deteriorated. The budget deficit is now expected to remain at 3.9% in FY15/16 instead of narrowing to 3.6% as outlined in the October 2014 MTBPS, before tapering to 2.5% by FY17/18 (see Chart 1).

Elements of the budget that can be described as stimulatory for the economy include:

- The absolute rise of the deficit in monetary terms (the FY15/16 deficit is R9.8 billion or 6.4% higher than the FY14/15 deficit).

- In addition, the budget implies strong real spending growth in FY15/16 (3.9% in total spending and 3.8% for non-interest spending), based on government's inflation (CPI) projection.

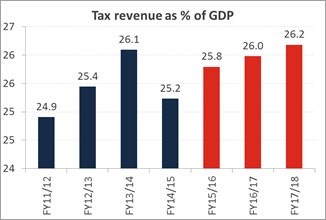

- In contrast, there are other aspects of the budget that can be construed as unsupportive for economic growth: The combination of a FY15/16 budget deficit-to-GDP ratio that remains flat at 3.9% while there is a 0.6% rise in the tax-to-GDP ratio to 25.8% (see Chart 2) implies that the budget is removing spending power from the economy on a net basis in FY15/16 and can thus be construed as contractionary for the economy.

Chart 2: Rising tax burden

Source: National Treasury, MAM

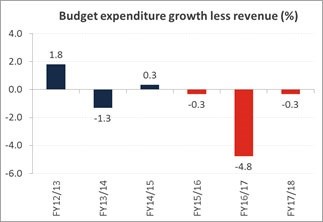

Furthermore, the fact that spending growth (8.7%) is expected to lag revenue growth (9.0%) over the next year, as well as over the full budget period to FY17/18, also implies a net drain on economic activity over the period (see Chart 3).

Tax proposals

With regards to the new tax proposals, the announcement on increases in personal income tax rates and the general fuel levy are anticipated to contribute an additional R16.8bn in gross tax revenue in FY15/16. Personal tax rates have been raised by 1% for all taxpayers earning in excess of R181,900. Tax brackets and rebates on medical scheme contributions are to be adjusted for inflation. This leaves those earning less than R450,000 a year with tax relief on a net basis, while those earning more will be paying additional taxes.

Chart 3: Revenue growth outstrips expenditure growth in the medium-term

Source: National Treasury, MAM

In addition, higher transfer duties on properties above the value of R2.3m have been implemented in an effort to tax the wealthy, while relief on tax duties have been targeted at low- to middle-income consumers.

The general fuel levy and Road Accident Fund (RAF) levy was increased by 30.5c/l and 50c/l respectively, partly offsetting the recent fuel price windfall to consumers following a steep decline in international oil prices.

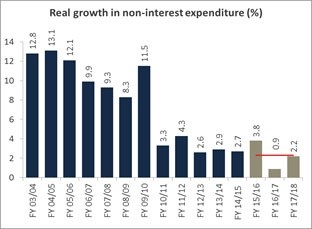

Non-interest expenditure has been revised higher by a nominal R637bn over the next three fiscal years, yet government maintains its commitment to the real expenditure ceiling of 2.3% on average over the medium term (see Chart 4). Cuts have largely come about in spend allocated to goods and services which are deemed as non-critical by government.

Social grants

Growth in social grants is expected to outstrip inflation over the medium term. Child support grants are likely to increase by over 2% per annum in real terms over the next three fiscal years, while old age grants could increase by close to 3.0% per annum over the corresponding period.

Chart 4: Government remains committed to expenditure ceiling

Source: National Treasury, MAM

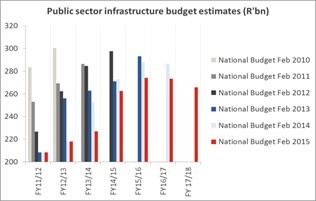

It looks like the trend of back-end loading of infrastructure spend continues. The allocated public sector infrastructure budget of R847.3bn for FY14/15 - FY16/17 has been slashed to R809.7bn between the February 2014 and February 2015 budgets, with an additional R265.8bn being earmarked for FY17/18 (see Chart 5). The Finance Minister highlighted that while there has been an agreement on the National Development Plan, there is still hard work ahead regarding its implementation. Without meaningful progress on the necessary structural reforms in SA in terms of goods and labour market efficiencies, as well as infrastructure building, the country's growth potential will continue to be under pressure, posing a risk to SA's sovereign credit rating beyond the near term.

Chart 5: Public sector infrastructure continues to be back-end loaded

Source: National Treasury, MAM

While government stuck to its average nominal 6.6% p.a. (real 1.2%) increase in employee compensation over the budget period, the nominal increase for FY15/16 remains high at 7.7% (real 2.9%). The public sector wage bill remained sticky at 35.8% of total expenditure for FY14/15 and is expected to drift only marginally lower to 34.5% by FY17/18. While government has suggested that bloated budgets for employee compensation have been curtailed and cost-containment measures have had positive results, delivery of infrastructure remains key in promoting trend growth and continues to pose a risk to medium-term fiscal sustainability.

The funding source of the R23bn allocation to Eskom remains unclear other than Treasury's confirmation that this will come from the sale of non-core government assets. They also announced that transfers to Eskom will be done in three tranches, with the first instalment due by June 2015. If further financial assistance is required,Treasury would consider an equity conversion of government's subordinated loan to Eskom.

Market reaction

- SA bond yields sold off marginally on the back of medium-term funding concerns and news of increased gross issuance of R7bn per year.

- The FTSE/JSE All-Share Index dipped by 0.4%, most likely on the news of the personal tax and general fuel levy increases.

- The rand remained steady, going into the speech at 11.46 to the US dollar and only weakening by 3 cents following the announcement.

The mixed signals given to the economic growth outlook from the FY15/16 budget, with some elements negative and others positive for economic activity, make the relative implications for SA bonds and equities somewhat dubious.

Government's relative control over the budget deficit, leading to an R11.6bn lower anticipated domestic long-term bond issuance in FY15/16 relative to the revised outcome for FY14/15, would seem positive for the bond market from a supply-side perspective at first glance. However, it needs to be recognised that the FY15/16 expected long bond issuance has actually been increased by R7.1bn relative to previous numbers provided in the October 2014 MTBPS which likely led to bond yields selling off marginally post the announcement.

Long-term growth

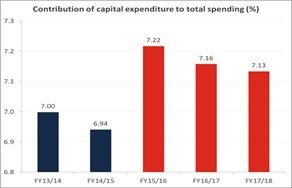

The strong 2.9% real increase in public sector employee compensation in FY15/16 could provide a near-term spending fillip for consumer-related companies which could partly offset the negative impact of the R8.3bn rise in indirect taxes. However, the redirection of expenditure from capital projects to current expenditure beyond FY15/16 (see Chart 6) has negative implications for the country's long-term growth potential and hence corporate revenue generation. It could also lead to eventual sovereign ratings downgrades in the medium term.

Chart 6: Capital spend as a share of total spend set to decline in the medium term

Source: National Treasury, MAM